5 Ways to Ace Fannie Mae Income Calculation

Understanding Fannie Mae Income Calculation

When it comes to mortgage lending, Fannie Mae plays a significant role in providing guidelines for lenders to follow. One crucial aspect of the mortgage application process is income calculation. Accurate income calculation is essential to determine a borrower’s ability to repay the loan. In this article, we will explore five ways to ace Fannie Mae income calculation.

1. Gather All Necessary Documents

To accurately calculate a borrower’s income, lenders need to gather all necessary documents. These documents may include:

- Pay stubs

- W-2 forms

- Tax returns (personal and business)

- Self-employment documentation (e.g., business financial statements)

- Social Security benefits documentation

- Alimony or child support documentation

📝 Note: Lenders should ensure they have all relevant documentation to avoid delays in the mortgage application process.

2. Calculate Gross Income

Fannie Mae requires lenders to calculate a borrower’s gross income from all sources. This includes:

- Salary and wages

- Self-employment income

- Social Security benefits

- Alimony or child support

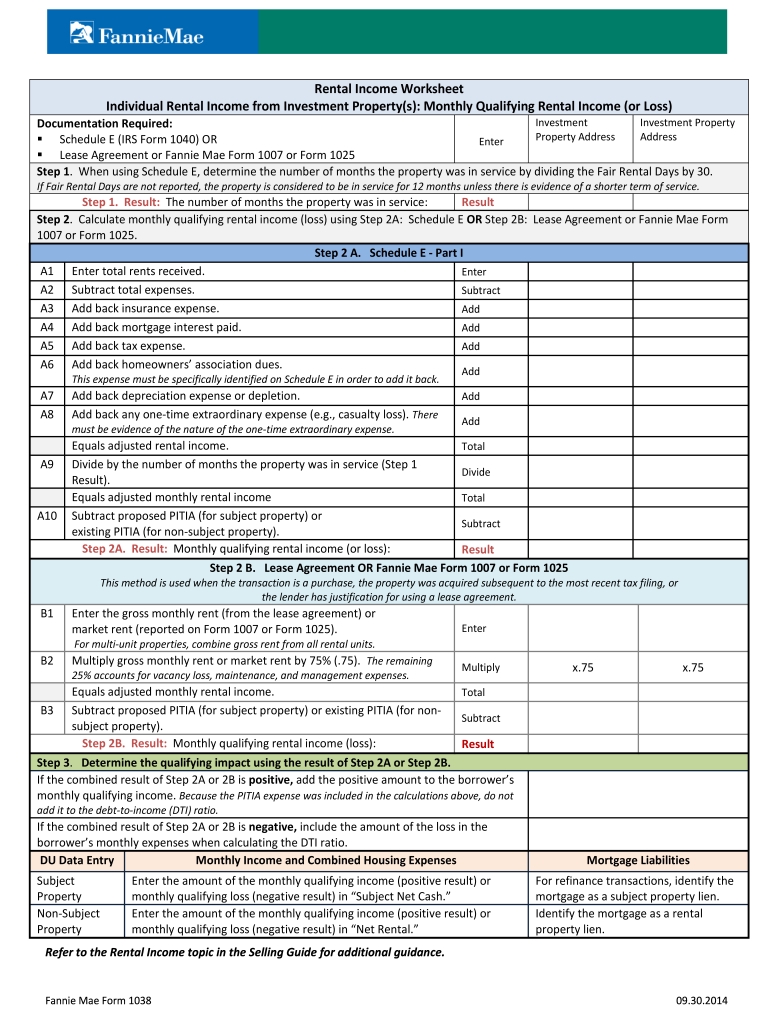

- Rental income

- Investment income

To calculate gross income, lenders should use the following steps:

- Add up all income from various sources

- Exclude any non-taxable income (e.g., tax-free scholarships)

- Include all income reported on tax returns

3. Apply Income Stability Requirements

Fannie Mae has specific requirements for income stability. Lenders must ensure that a borrower’s income is stable and likely to continue. This includes:

- Verifying a borrower’s employment history

- Analyzing a borrower’s income trend (increasing or decreasing)

- Considering any income gaps or fluctuations

📊 Note: Lenders should carefully evaluate a borrower's income stability to determine their creditworthiness.

4. Calculate Qualifying Income

Qualifying income is the income used to qualify a borrower for a mortgage. Fannie Mae requires lenders to calculate qualifying income by:

- Using the lesser of the borrower’s gross income or the income reported on their tax returns

- Excluding any non-qualifying income (e.g., income from a part-time job that is not likely to continue)

- Including all qualifying income from various sources

5. Analyze Income Trends and Gaps

Fannie Mae requires lenders to analyze a borrower’s income trends and gaps. This includes:

- Evaluating a borrower’s income trend over time

- Considering any income gaps or fluctuations

- Verifying a borrower’s employment history

| Income Trend | Fannie Mae Requirements |

|---|---|

| Increasing | Must be stable and likely to continue |

| Decreasing | Must be evaluated carefully to determine creditworthiness |

| Fluctuating | Must be analyzed to determine stability and likelihood of continuation |

📈 Note: Lenders should carefully evaluate a borrower's income trend and gaps to determine their creditworthiness.

By following these five ways to ace Fannie Mae income calculation, lenders can ensure accurate income calculation and make informed decisions about a borrower’s creditworthiness.

In summary, accurate income calculation is crucial in determining a borrower’s ability to repay a mortgage. By gathering all necessary documents, calculating gross income, applying income stability requirements, calculating qualifying income, and analyzing income trends and gaps, lenders can ensure compliance with Fannie Mae guidelines and make informed decisions about a borrower’s creditworthiness.

What documents are required for Fannie Mae income calculation?

+Pay stubs, W-2 forms, tax returns, self-employment documentation, Social Security benefits documentation, and alimony or child support documentation.

How does Fannie Mae calculate qualifying income?

+Fannie Mae calculates qualifying income by using the lesser of the borrower’s gross income or the income reported on their tax returns, and excluding any non-qualifying income.

What is the importance of income stability in Fannie Mae income calculation?

+Income stability is crucial in determining a borrower’s creditworthiness and ability to repay the mortgage.