Magic Income Calculation Worksheet: Simplify Your Financial Planning

Magic Income Calculation Worksheet: Simplify Your Financial Planning

Creating a personal budget can be a daunting task, especially when it comes to calculating your income. A Magic Income Calculation Worksheet can be a useful tool to simplify your financial planning. In this post, we will discuss the importance of calculating your income, how to create a Magic Income Calculation Worksheet, and provide a step-by-step guide on how to use it.

Why is Calculating Your Income Important?

Calculating your income is crucial in creating a realistic and effective personal budget. It helps you understand how much money you have available to spend, save, and invest. Without an accurate income calculation, you may end up overspending or underspending, which can lead to financial difficulties.

Benefits of Calculating Your Income:

- Helps you create a realistic budget

- Enables you to prioritize your expenses

- Allows you to make informed financial decisions

- Helps you identify areas for cost-cutting

What is a Magic Income Calculation Worksheet?

A Magic Income Calculation Worksheet is a simple and effective tool that helps you calculate your income. It takes into account various sources of income, including your salary, investments, and any side hustles. The worksheet provides a clear and concise format for calculating your income, making it easier to create a personal budget.

How to Create a Magic Income Calculation Worksheet

Creating a Magic Income Calculation Worksheet is easy. Here’s a step-by-step guide:

Step 1: Identify Your Income Sources

- List all your sources of income, including:

- Salary

- Investments

- Side hustles

- Freelance work

- Any other regular income

Step 2: Calculate Your Gross Income

- Calculate your gross income from each source

- Add up the total gross income from all sources

Step 3: Calculate Your Net Income

- Calculate your net income by subtracting taxes and other deductions from your gross income

- Use a tax calculator or consult with a tax professional to determine your tax rate

Step 4: Calculate Your Disposable Income

- Calculate your disposable income by subtracting essential expenses from your net income

- Essential expenses include:

- Rent/Mortgage

- Utilities

- Groceries

- Transportation

- Minimum debt payments

Step 5: Review and Adjust

- Review your Magic Income Calculation Worksheet regularly

- Adjust your income calculation as needed to reflect changes in your income or expenses

💡 Note: You can create a Magic Income Calculation Worksheet using a spreadsheet or a budgeting app. Alternatively, you can use a pre-made template or worksheet.

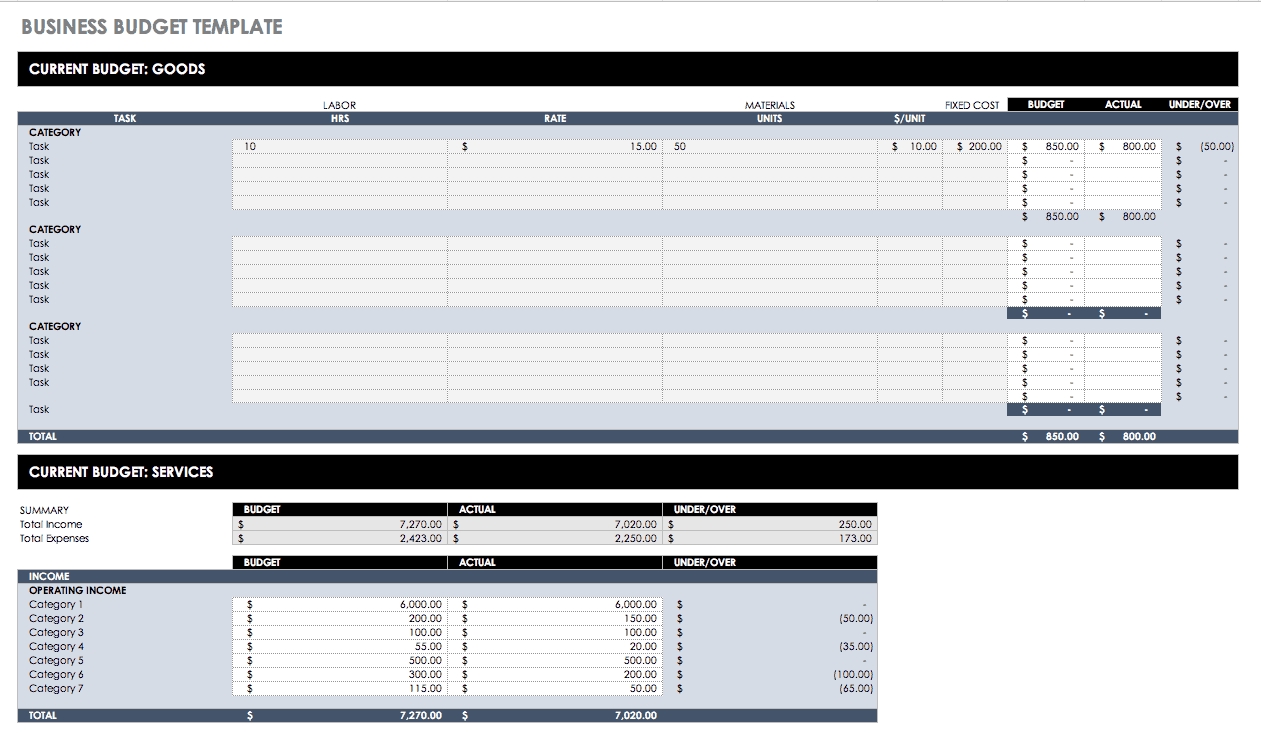

Example of a Magic Income Calculation Worksheet

Here’s an example of a Magic Income Calculation Worksheet:

| Income Source | Gross Income | Tax Rate | Net Income |

|---|---|---|---|

| Salary | $50,000 | 25% | $37,500 |

| Investments | $10,000 | 10% | $9,000 |

| Side Hustle | $5,000 | 15% | $4,250 |

| Total Gross Income | $65,000 | ||

| Total Net Income | $50,750 |

Using Your Magic Income Calculation Worksheet

Once you have created your Magic Income Calculation Worksheet, you can use it to:

- Create a personal budget

- Prioritize your expenses

- Make informed financial decisions

- Identify areas for cost-cutting

By using a Magic Income Calculation Worksheet, you can simplify your financial planning and make more informed decisions about your money.

It’s time to take control of your finances and start creating a brighter financial future. By using a Magic Income Calculation Worksheet, you can simplify your financial planning and make more informed decisions about your money. Remember to review and adjust your worksheet regularly to ensure you’re on track with your financial goals.

What is the purpose of a Magic Income Calculation Worksheet?

+The purpose of a Magic Income Calculation Worksheet is to help you calculate your income and create a realistic personal budget.

How often should I review my Magic Income Calculation Worksheet?

+You should review your Magic Income Calculation Worksheet regularly, ideally every 3-6 months, to ensure you’re on track with your financial goals.

Can I use a pre-made Magic Income Calculation Worksheet template?

+Yes, you can use a pre-made Magic Income Calculation Worksheet template. There are many free templates available online that you can customize to suit your needs.

Related Terms:

- Income Calculation Worksheet PDF

- Income calculation worksheet Excel

- MGIC income Worksheet pdf

- Essent income worksheet

- self-employed income calculation worksheet excel

- MGIC income worksheet w2