7 Steps to Calculate Your IRS Credit Limit

Calculating your IRS credit limit can be a daunting task, especially with the ever-changing tax laws and regulations. However, understanding how to calculate your credit limit is crucial in managing your taxes and avoiding any potential penalties. In this article, we will walk you through the 7 steps to calculate your IRS credit limit.

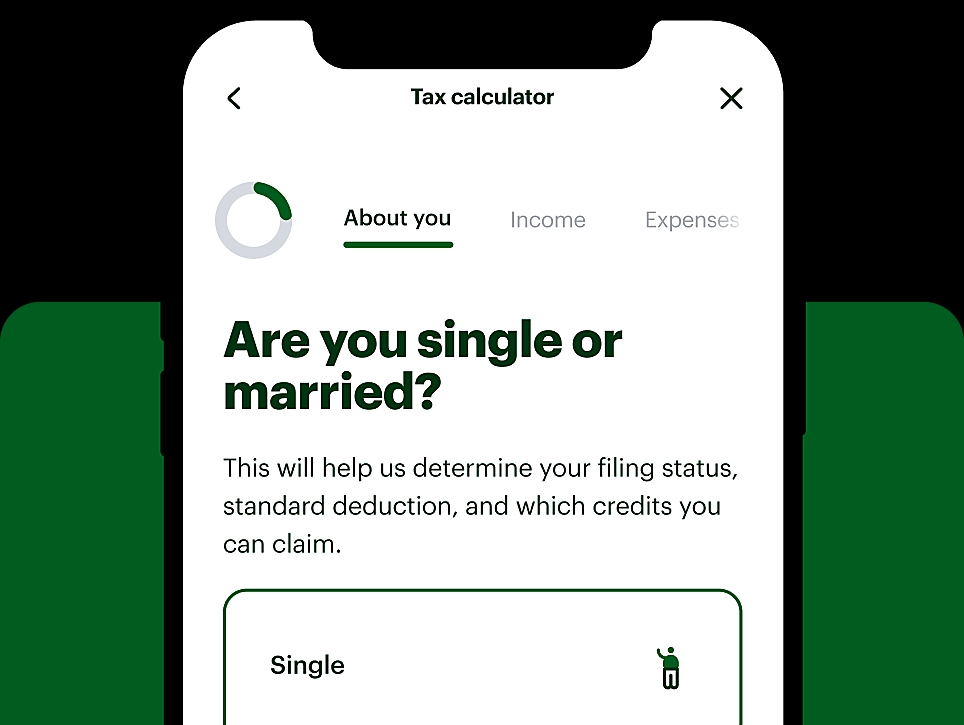

Step 1: Determine Your Filing Status

Your filing status plays a significant role in determining your IRS credit limit. The IRS recognizes five filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Each filing status has its own set of tax brackets and credit limits. You can determine your filing status by considering your marital status, dependents, and other factors.

Step 2: Calculate Your Total Income

Your total income is the sum of all your earnings, including wages, salaries, tips, and self-employment income. You can find your total income on your W-2 form or 1099 form. Make sure to include all sources of income, including interest, dividends, and capital gains.

Step 3: Calculate Your Taxable Income

Your taxable income is the amount of income that is subject to taxation. To calculate your taxable income, you need to subtract your deductions and exemptions from your total income. You can claim standard deductions or itemize your deductions, depending on your situation.

Step 4: Determine Your Tax Bracket

The IRS has a progressive tax system, which means that different levels of income are taxed at different rates. There are seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Your tax bracket is determined by your taxable income and filing status. You can use the IRS tax tables or consult with a tax professional to determine your tax bracket.

Step 5: Calculate Your Total Tax Liability

Your total tax liability is the amount of taxes you owe to the IRS. To calculate your total tax liability, you need to multiply your taxable income by your tax bracket. You can also use the IRS tax tables to estimate your total tax liability.

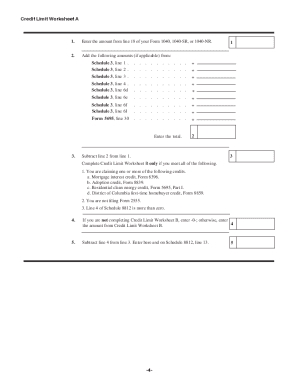

Step 6: Calculate Your Credit Limit

Your credit limit is the amount of taxes you can claim as a credit against your total tax liability. The IRS offers various tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. To calculate your credit limit, you need to determine which credits you are eligible for and calculate the amount of each credit.

Step 7: Apply for the Credit

Once you have calculated your credit limit, you can apply for the credit by filing Form 1040 and attaching the relevant schedules and forms. You can also use tax software or consult with a tax professional to help you with the application process.

💡 Note: The IRS has a statute of limitations for claiming tax credits. Make sure to file your tax return on time to avoid missing out on your credit limit.

To illustrate the calculation process, let’s consider an example.

| Filing Status | Total Income | Taxable Income | Tax Bracket | Total Tax Liability | Credit Limit |

|---|---|---|---|---|---|

| Single | $50,000 | $30,000 | 24% | $7,200 | $1,000 (EITC) |

In this example, the taxpayer has a total income of 50,000 and a taxable income of 30,000. Their tax bracket is 24%, and their total tax liability is 7,200. They are eligible for the EITC, which has a credit limit of 1,000.

After following these 7 steps, you can determine your IRS credit limit and apply for the credit. Remember to consult with a tax professional or use tax software to ensure accuracy and avoid any potential penalties.

In a nutshell, calculating your IRS credit limit requires careful consideration of your filing status, total income, taxable income, tax bracket, total tax liability, and credit eligibility. By following these steps, you can ensure that you receive the maximum credit limit available to you.

What is the difference between a tax deduction and a tax credit?

+A tax deduction reduces your taxable income, while a tax credit reduces your total tax liability. Tax credits are generally more valuable than tax deductions.

How do I know which tax credits I am eligible for?

+You can use the IRS website or consult with a tax professional to determine which tax credits you are eligible for. They can help you navigate the tax laws and regulations.

Can I claim tax credits if I owe back taxes?

+It depends on the type of tax credit and your individual situation. You may be able to claim tax credits, but you will need to pay any outstanding tax liabilities first.

Related Terms:

- Credit Limit Worksheet a PDF

- Credit Limit Worksheet A 8812

- Credit Limit Worksheet 8863

- Earned Income Worksheet

- IRS Form 8812 instructions

- IRS Schedule 3