Financial Worksheet Usmc

Mastering Your Finances: A Comprehensive Financial Worksheet for USMC Members

As a member of the United States Marine Corps (USMC), managing your finances effectively is crucial to achieving financial stability and security. A well-planned financial strategy can help you navigate the unique challenges of military life, from deployments to relocations. In this article, we will provide a comprehensive financial worksheet specifically designed for USMC members, covering essential aspects of personal finance.

Section 1: Income and Benefits

To create a realistic financial plan, you need to understand your income and benefits. Start by calculating your:

- Base Pay: Your monthly basic pay, excluding allowances and special pays.

- Allowances: Include Basic Allowance for Subsistence (BAS) and Basic Allowance for Housing (BAH).

- Special Pays: Add any special pays you receive, such as hazardous duty pay or diving pay.

- Combat Pay: If applicable, include combat pay or imminent danger pay.

- Other Income: List any additional income sources, such as investments or a spouse’s income.

| Income Source | Monthly Amount |

|---|---|

| Base Pay | $_____ |

| Allowances (BAS/BAH) | $_____ |

| Special Pays | $_____ |

| Combat Pay | $_____ |

| Other Income | $_____ |

| Total Income | $_____ |

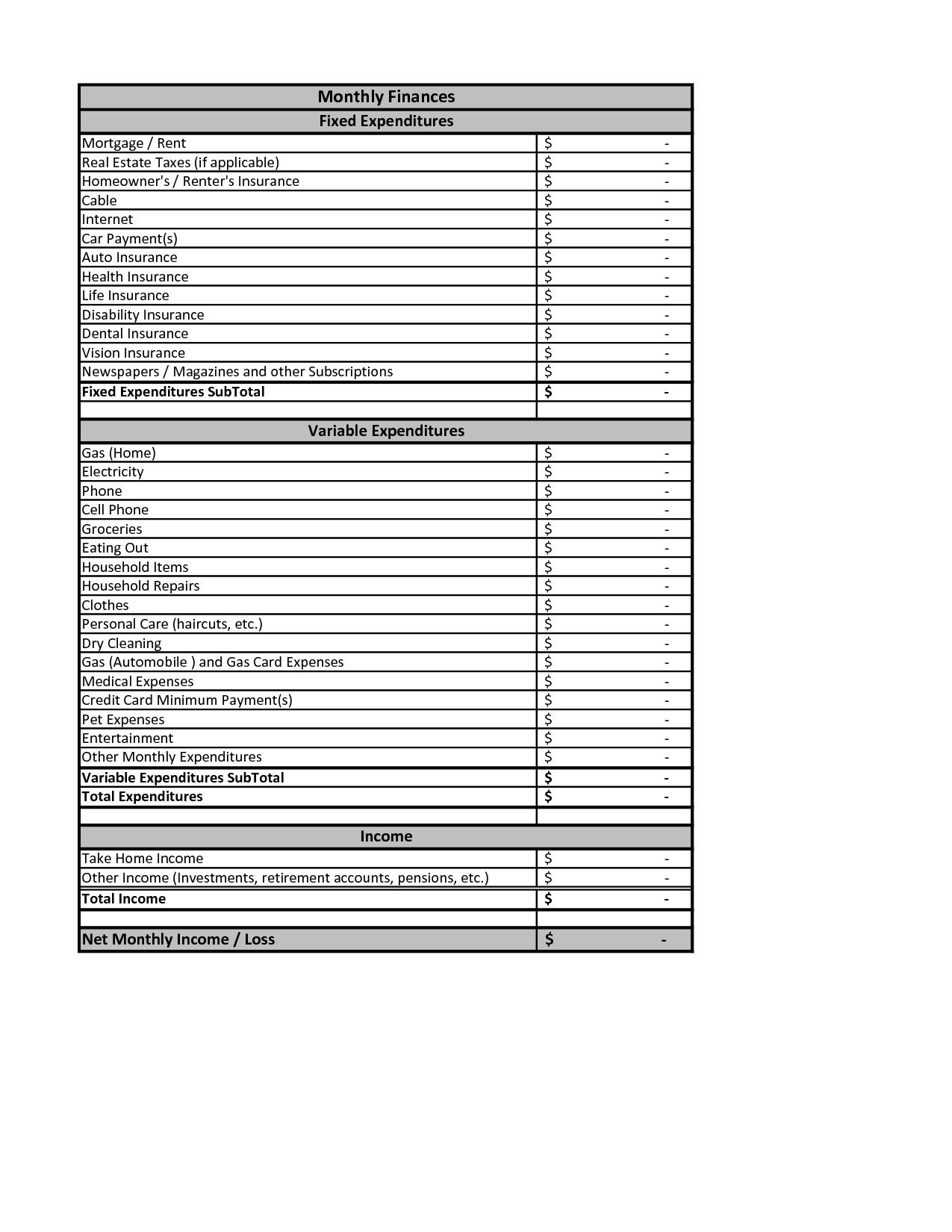

Section 2: Fixed Expenses

Next, calculate your fixed expenses, including:

- Housing: Rent or mortgage, including utilities and maintenance.

- Food: Groceries and dining out.

- Transportation: Car loan or lease, insurance, gas, and maintenance.

- Insurance: Health, life, and disability insurance.

- Debt Repayment: Minimum payments on loans and credit cards.

- Other Fixed Expenses: Include any other regular expenses, such as phone bills or subscription services.

| Fixed Expense | Monthly Amount |

|---|---|

| Housing | $_____ |

| Food | $_____ |

| Transportation | $_____ |

| Insurance | $_____ |

| Debt Repayment | $_____ |

| Other Fixed Expenses | $_____ |

| Total Fixed Expenses | $_____ |

Section 3: Savings and Emergency Fund

Adequate savings and an emergency fund are crucial for financial stability. Consider the following:

- Emergency Fund: Aim to save 3-6 months’ worth of expenses in an easily accessible savings account.

- Retirement Savings: Contribute to the Thrift Savings Plan (TSP) or other retirement accounts.

- Other Savings Goals: Allocate funds for specific goals, such as a down payment on a house or a car.

| Savings Goal | Monthly Contribution |

|---|---|

| Emergency Fund | $_____ |

| Retirement Savings | $_____ |

| Other Savings Goals | $_____ |

| Total Savings | $_____ |

Section 4: Debt and Credit

Manage your debt and credit by:

- Listing Debts: Include credit cards, personal loans, and other debts.

- Credit Score: Check your credit score and work to improve it.

- Debt Repayment Strategy: Focus on paying off high-interest debts first.

| Debt | Balance | Interest Rate |

|---|---|---|

| Credit Card 1 | $_____ | _____ % |

| Credit Card 2 | $_____ | _____ % |

| Personal Loan | $_____ | _____ % |

| Total Debt | $_____ |

Conclusion

Creating a comprehensive financial plan as a USMC member requires careful consideration of your income, expenses, savings, and debt. By using this financial worksheet, you’ll be better equipped to navigate the challenges of military life and achieve long-term financial stability. Remember to regularly review and update your plan to ensure you’re on track to meet your financial goals.

📝 Note: Review and update your financial plan every 6-12 months to ensure you're on track to meet your financial goals.

What is the most important aspect of financial planning for USMC members?

+The most important aspect of financial planning for USMC members is creating a comprehensive plan that accounts for the unique challenges of military life, including deployments, relocations, and variable income.

How can I improve my credit score as a USMC member?

+Improving your credit score as a USMC member requires making on-time payments, keeping credit utilization low, and monitoring your credit report for errors.

What is the Thrift Savings Plan (TSP), and how can I contribute to it?

+The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees, including USMC members. You can contribute to the TSP through payroll deductions or by making lump-sum contributions.