Enact Rental Income Worksheet Made Easy

Rental Income Worksheet Made Easy: A Step-by-Step Guide

As a landlord, managing your rental income can be a daunting task, especially when it comes to tracking expenses, calculating profits, and preparing for tax season. A rental income worksheet can help simplify the process, ensuring you stay organized and make informed decisions about your rental properties. In this post, we’ll walk you through creating a rental income worksheet from scratch, making it easy to manage your rental income.

Understanding the Importance of a Rental Income Worksheet

A rental income worksheet is a vital tool for landlords, as it helps:

- Track income and expenses

- Calculate profits and losses

- Identify areas for improvement

- Prepare for tax season

- Make informed decisions about rental properties

Step 1: Gather Essential Information

Before creating your rental income worksheet, gather the following information:

- Rental income (monthly and annual)

- Fixed expenses (mortgage, insurance, property taxes, etc.)

- Variable expenses (maintenance, repairs, utilities, etc.)

- Depreciation and amortization

- Interest income (if applicable)

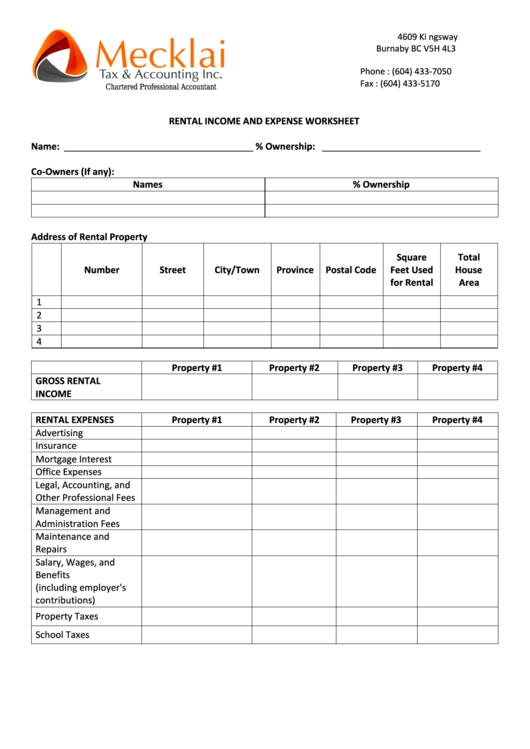

Step 2: Choose a Worksheet Template

You can use a spreadsheet software like Microsoft Excel or Google Sheets to create your rental income worksheet. Choose a template that suits your needs, or start from scratch. If you’re not familiar with spreadsheet software, consider using a pre-made template.

Step 3: Set Up Your Worksheet

Set up your worksheet with the following columns:

- Income: List all rental income sources, including monthly and annual totals.

- Fixed Expenses: List all fixed expenses, such as mortgage, insurance, and property taxes.

- Variable Expenses: List all variable expenses, such as maintenance, repairs, and utilities.

- Depreciation and Amortization: Calculate depreciation and amortization for your rental properties.

- Interest Income: List any interest income earned from rental properties.

- Net Operating Income (NOI): Calculate NOI by subtracting total expenses from total income.

- Cash Flow: Calculate cash flow by subtracting mortgage payments and other debt obligations from NOI.

Step 4: Calculate Net Operating Income (NOI)

NOI is a critical metric for landlords, as it represents the income earned from rental properties after deducting operating expenses. To calculate NOI:

- Total income: $____________

- Total fixed expenses: $____________

- Total variable expenses: $____________

- Depreciation and amortization: $____________

- Interest income: $____________

- NOI: $____________ (Total income - Total fixed expenses - Total variable expenses - Depreciation and amortization + Interest income)

Step 5: Calculate Cash Flow

Cash flow is the amount of money left over after deducting mortgage payments and other debt obligations from NOI. To calculate cash flow:

- NOI: $____________

- Mortgage payments: $____________

- Other debt obligations: $____________

- Cash flow: $____________ (NOI - Mortgage payments - Other debt obligations)

Example Rental Income Worksheet

| Income | Fixed Expenses | Variable Expenses | Depreciation and Amortization | Interest Income | NOI | Cash Flow |

|---|---|---|---|---|---|---|

| $1,500 (monthly) | $800 (mortgage) | $300 (maintenance) | $100 (depreciation) | $50 (interest income) | $900 (NOI) | $600 (cash flow) |

Notes

- Keep accurate records: Regularly update your rental income worksheet to ensure accuracy and make informed decisions.

- Review and adjust: Regularly review your worksheet to identify areas for improvement and adjust your strategy accordingly.

- Consult a professional: If you’re unsure about creating a rental income worksheet or need personalized advice, consult a financial advisor or accountant.

Key Takeaways

- A rental income worksheet helps track income and expenses, calculate profits and losses, and prepare for tax season.

- Gather essential information, choose a worksheet template, and set up your worksheet with necessary columns.

- Calculate NOI and cash flow to make informed decisions about your rental properties.

FAQ Section

What is a rental income worksheet?

+A rental income worksheet is a tool used to track income and expenses, calculate profits and losses, and prepare for tax season.

Why is a rental income worksheet important?

+A rental income worksheet helps track income and expenses, calculate profits and losses, and prepare for tax season, making it easier to manage rental properties.

How do I calculate Net Operating Income (NOI)?

+NOI is calculated by subtracting total expenses from total income.

Recap

Creating a rental income worksheet can seem daunting, but by following these steps, you’ll be well on your way to managing your rental income with ease. Remember to regularly review and update your worksheet to ensure accuracy and make informed decisions about your rental properties.

Related Terms:

- Enact income calculator

- Rental income Calculation Worksheet Excel

- Rental income Worksheet PDF

- Self-employed income worksheet

- Income Calculation Worksheet PDF

- self-employed income calculation worksheet excel