5 Simple Debt Snowball Worksheets to Get You Started

Understanding the Debt Snowball Method

Are you tired of living paycheck to paycheck, with debt weighing you down? The debt snowball method, popularized by financial expert Dave Ramsey, is a simple yet effective way to pay off your debts and start building wealth. In this article, we’ll explore the basics of the debt snowball method and provide you with five simple worksheets to get you started on your debt-free journey.

What is the Debt Snowball Method?

The debt snowball method involves listing all your debts, from smallest to largest, and paying them off one by one. You start by paying the minimum on all debts except the smallest one, which you pay off as aggressively as possible. Once you’ve cleared the smallest debt, you use the money to attack the next smallest debt, and so on.

This method is based on the psychological principle of quick wins, which helps to build momentum and motivation as you see your debts disappear one by one.

Benefits of the Debt Snowball Method

The debt snowball method has several benefits, including:

- Quick wins: Paying off smaller debts first provides a sense of accomplishment and motivation to keep going.

- Simplified budgeting: Focusing on one debt at a time makes it easier to manage your finances.

- Builds momentum: As you pay off each debt, you’ll have more money to tackle the next one.

Creating a Debt Snowball Worksheet

To get started with the debt snowball method, you’ll need to create a worksheet that lists all your debts, including the balance, interest rate, and minimum payment. Here are five simple worksheets you can use:

Worksheet 1: Basic Debt Snowball Template

| Debt | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Debt 1 | $_____ | _____% | $_____ |

| Debt 2 | $_____ | _____% | $_____ |

| ... | $_____ | _____% | $_____ |

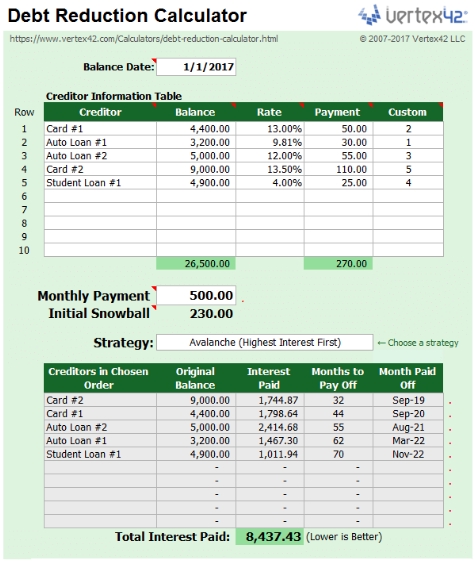

Worksheet 2: Debt Snowball Calculator

| Debt | Balance | Interest Rate | Minimum Payment | Monthly Payment |

|---|---|---|---|---|

| Debt 1 | $_____ | _____% | $_____ | $_____ |

| Debt 2 | $_____ | _____% | $_____ | $_____ |

| ... | $_____ | _____% | $_____ | $_____ |

Worksheet 3: Debt Snowball Tracker

| Debt | Original Balance | Current Balance | Payment Date |

|---|---|---|---|

| Debt 1 | $_____ | $_____ | _____/_____/_____ |

| Debt 2 | $_____ | $_____ | _____/_____/_____ |

| ... | $_____ | $_____ | _____/_____/_____ |

Worksheet 4: Debt Snowball Budget

| Category | Budgeted Amount | Actual Spend |

|---|---|---|

| Debt Payments | $_____ | $_____ |

| Living Expenses | $_____ | $_____ |

| ... | $_____ | $_____ |

Worksheet 5: Debt Snowball Progress Chart

| Debt | Original Balance | Current Balance | Progress (%) |

|---|---|---|---|

| Debt 1 | $_____ | $_____ | _____% |

| Debt 2 | $_____ | $_____ | _____% |

| ... | $_____ | $_____ | _____% |

Getting Started with Your Debt Snowball

Now that you have your worksheets, it’s time to get started with your debt snowball. Here are the steps to follow:

- Gather your debt information: Collect all your debt statements and information, including balances, interest rates, and minimum payments.

- List your debts: Use one of the worksheets above to list all your debts, from smallest to largest.

- Create a budget: Use Worksheet 4 to create a budget that prioritizes your debt payments.

- Start making payments: Begin making payments on your smallest debt, while paying the minimum on all other debts.

- Track your progress: Use Worksheet 3 or 5 to track your progress and stay motivated.

📝 Note: Remember to review and adjust your budget and debt snowball plan regularly to ensure you're on track to achieving your financial goals.

Conclusion

The debt snowball method is a simple yet effective way to pay off your debts and start building wealth. By using one of the five worksheets provided, you can create a personalized plan to tackle your debts and achieve financial freedom. Remember to stay motivated, track your progress, and adjust your plan as needed to ensure success.

Related Terms:

- Debt snowball worksheet PDF

- Debt snowball spreadsheet free download

- Debt Snowball tracker