State Tax Refund Worksheet Item B Explained Simply

Understanding State Tax Refund Worksheet Item B

The State Tax Refund Worksheet is a crucial document used by the IRS to calculate the taxable amount of state tax refunds. Among the various items on the worksheet, Item B is a critical component that requires attention. In this blog post, we will break down Item B of the State Tax Refund Worksheet in simple terms, helping you navigate the complexities of tax refunds.

What is Item B on the State Tax Refund Worksheet?

Item B on the State Tax Refund Worksheet refers to the refund you received from your state or local government for overpaid state or local income taxes. This includes refunds received from the prior year’s taxes. The IRS requires you to report this amount to determine if it’s taxable.

Types of State Tax Refunds Included in Item B

When reporting state tax refunds on Item B, consider the following types:

• State income tax refunds: This is the most common type of refund included in Item B. It’s the amount you received from your state government for overpaying state income taxes.

• Local income tax refunds: Some states have local income taxes. If you received a refund for overpaid local income taxes, you should include it in Item B.

• Prior year’s tax refunds: If you received a refund for taxes paid in a prior year, you must report it on Item B for the current tax year.

How to Calculate Item B

Calculating Item B is relatively straightforward. Follow these steps:

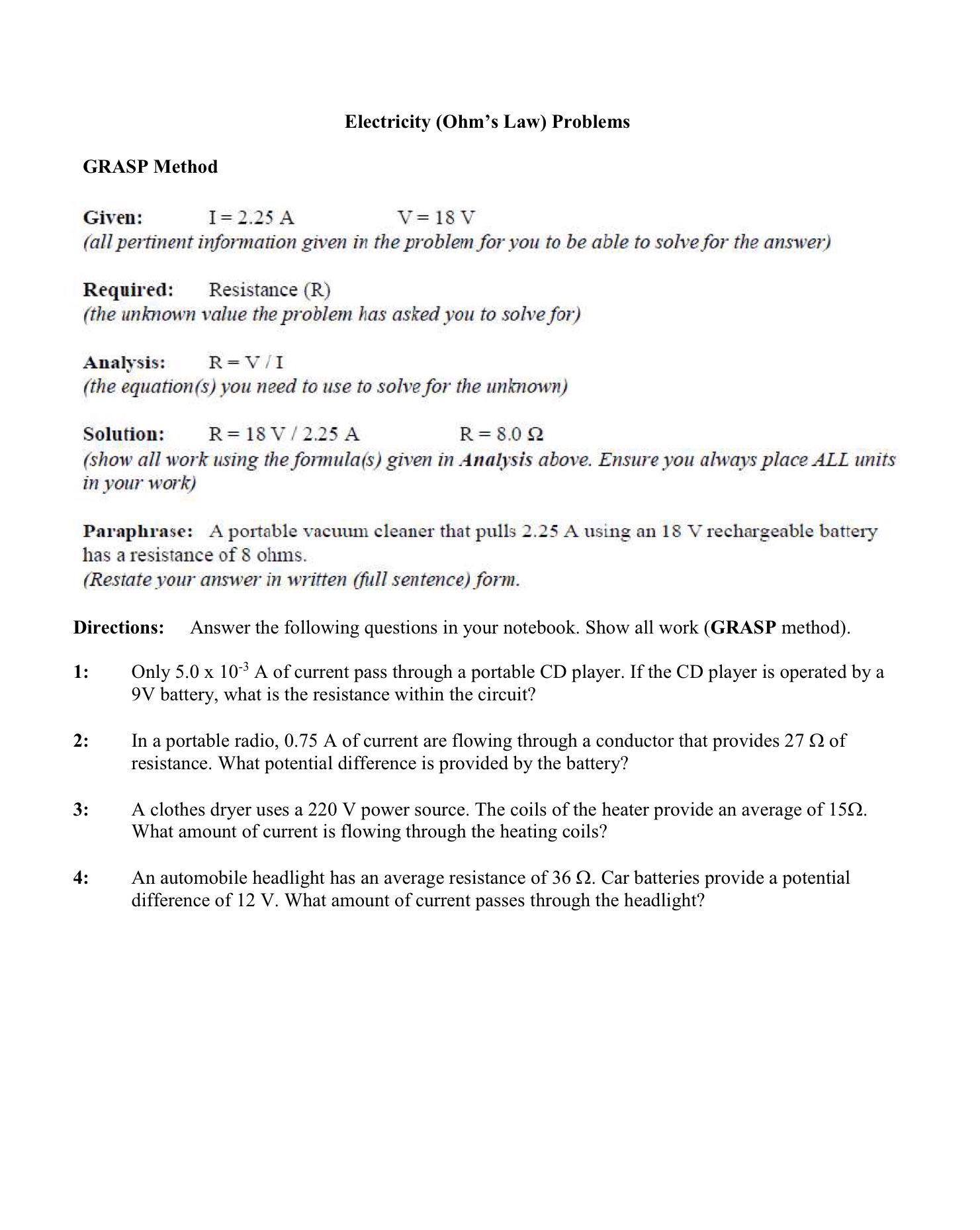

- Gather your state tax refund statements or Form 1099-G, which shows the amount of state tax refunds you received.

- Identify the type of refund you received (state income tax, local income tax, or prior year’s tax refund).

- Report the total amount of state tax refunds received on Item B of the State Tax Refund Worksheet.

Example: You received a 500 state income tax refund for the prior year's taxes. On Item B, you would report the entire 500 as the amount of state tax refund received.

📝 Note: If you received multiple refunds, add them together and report the total amount on Item B.

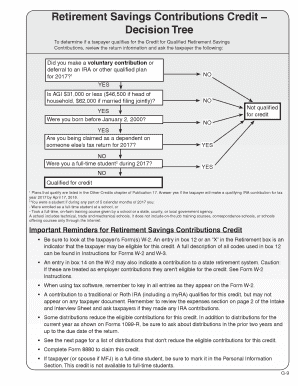

Is My State Tax Refund Taxable?

Not all state tax refunds are taxable. The IRS only taxes state tax refunds if you claimed the standard deduction on your previous year’s tax return. If you itemized deductions, your state tax refund is generally not taxable.

Item B and the Standard Deduction

If you claimed the standard deduction on your previous year’s tax return, your state tax refund is subject to federal income tax. In this case, you must report the refund on Item B and pay taxes on it.

Example: You claimed the standard deduction on your previous year’s tax return and received a 500 state income tax refund. On Item B, you would report the 500 as taxable income.

Conclusion

Item B on the State Tax Refund Worksheet is a crucial component of calculating the taxable amount of state tax refunds. By understanding what types of refunds are included in Item B and how to calculate it, you can accurately report your state tax refunds and avoid any potential tax issues. Remember, not all state tax refunds are taxable, so be sure to review your specific situation before reporting it on Item B.

What is Item B on the State Tax Refund Worksheet?

+Item B on the State Tax Refund Worksheet refers to the refund you received from your state or local government for overpaid state or local income taxes.

Is my state tax refund taxable?

+Not all state tax refunds are taxable. The IRS only taxes state tax refunds if you claimed the standard deduction on your previous year’s tax return.

How do I calculate Item B on the State Tax Refund Worksheet?

+Gather your state tax refund statements or Form 1099-G, identify the type of refund, and report the total amount on Item B.

Related Terms:

- IRS state tax refund Worksheet