State Tax Refund Worksheet: Maximize Your Return

Understanding Your State Tax Refund

As the tax season approaches, many of us look forward to receiving our state tax refunds. A tax refund is essentially the amount of money that you have overpaid in taxes throughout the year, and it’s returned to you by the state government. To maximize your state tax refund, it’s essential to understand the process and what you can do to get the most out of it. In this article, we’ll guide you through a step-by-step worksheet to help you navigate the state tax refund process and potentially increase your return.

Step 1: Gather Your Documents

To begin, you’ll need to gather all the necessary documents to file your state tax return. These may include:

- Your W-2 forms from your employer(s)

- Your 1099 forms for any freelance work or self-employment income

- Your interest statements from banks and investments

- Your property tax statements (if applicable)

- Your medical expense receipts (if applicable)

💡 Note: Make sure to check with your state's tax authority for specific documentation requirements.

Step 2: Determine Your Filing Status

Your filing status affects the amount of taxes you owe and the amount of your refund. You can file as:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

📝 Note: If you're unsure about your filing status, consult with a tax professional or check with your state's tax authority.

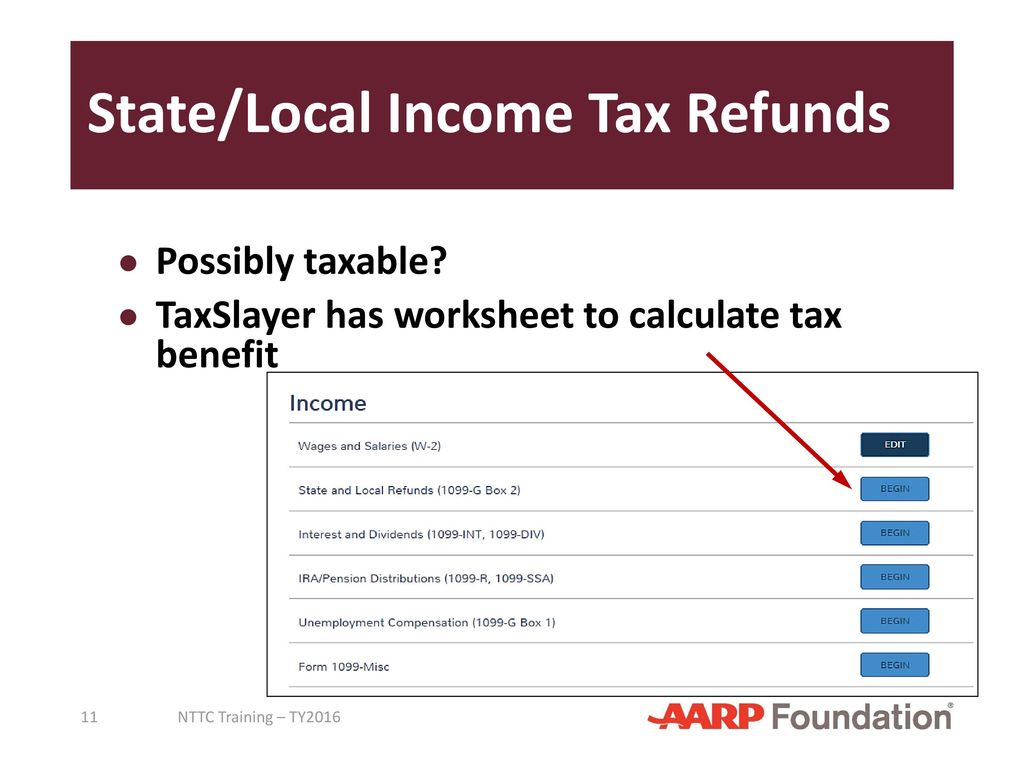

Step 3: Calculate Your Income

Next, calculate your total income from all sources, including:

- W-2 income

- 1099 income

- Interest income

- Dividend income

- Capital gains income

| Income Type | Amount |

|---|---|

| W-2 Income | $___________ |

| 1099 Income | $___________ |

| Interest Income | $___________ |

| Dividend Income | $___________ |

| Capital Gains Income | $___________ |

| Total Income | $___________ |

Step 4: Calculate Your Deductions and Credits

Deductions and credits can significantly impact your state tax refund. Consider the following:

- Standard deduction

- Itemized deductions (e.g., mortgage interest, charitable donations)

- Child tax credit

- Education credits

- Other state-specific credits

📝 Note: Consult with a tax professional or check with your state's tax authority for specific deductions and credits available.

Step 5: Calculate Your Tax Liability

Using your income, deductions, and credits, calculate your total tax liability. You can use tax software or consult with a tax professional to help with this step.

Step 6: Determine Your Refund Amount

Finally, subtract your tax liability from your total payments (including withholdings and estimated tax payments) to determine your refund amount.

📈 Note: If you owe taxes, you'll need to pay the amount due by the tax filing deadline to avoid penalties and interest.

Maximizing Your State Tax Refund: Tips and Strategies

- Keep accurate records: Keep all tax-related documents and receipts to ensure you don’t miss any deductions or credits.

- Take advantage of state-specific credits: Many states offer credits for things like education expenses, child care, and energy-efficient home improvements.

- Itemize deductions: If you have significant itemized deductions, it may be beneficial to itemize rather than taking the standard deduction.

- Consult with a tax professional: A tax professional can help you navigate the tax laws and ensure you’re taking advantage of all available deductions and credits.

By following these steps and tips, you can maximize your state tax refund and get the most out of your tax return. Remember to stay organized, take advantage of available credits and deductions, and consult with a tax professional if needed.

As the tax season comes to a close, take a moment to reflect on your financial situation and plan for the upcoming year. By being proactive and taking advantage of available tax savings, you can set yourself up for financial success.

What is the deadline for filing my state tax return?

+

The deadline for filing your state tax return varies by state. Check with your state’s tax authority for specific deadlines and requirements.

Can I file my state tax return electronically?

+

Yes, most states offer electronic filing options. Check with your state’s tax authority for specific requirements and instructions.

What if I owe taxes? Can I still file my state tax return?

+

Yes, you can still file your state tax return if you owe taxes. However, you’ll need to pay the amount due by the tax filing deadline to avoid penalties and interest.