Schedule D Tax Worksheet Made Easy

Understanding the Schedule D Tax Worksheet

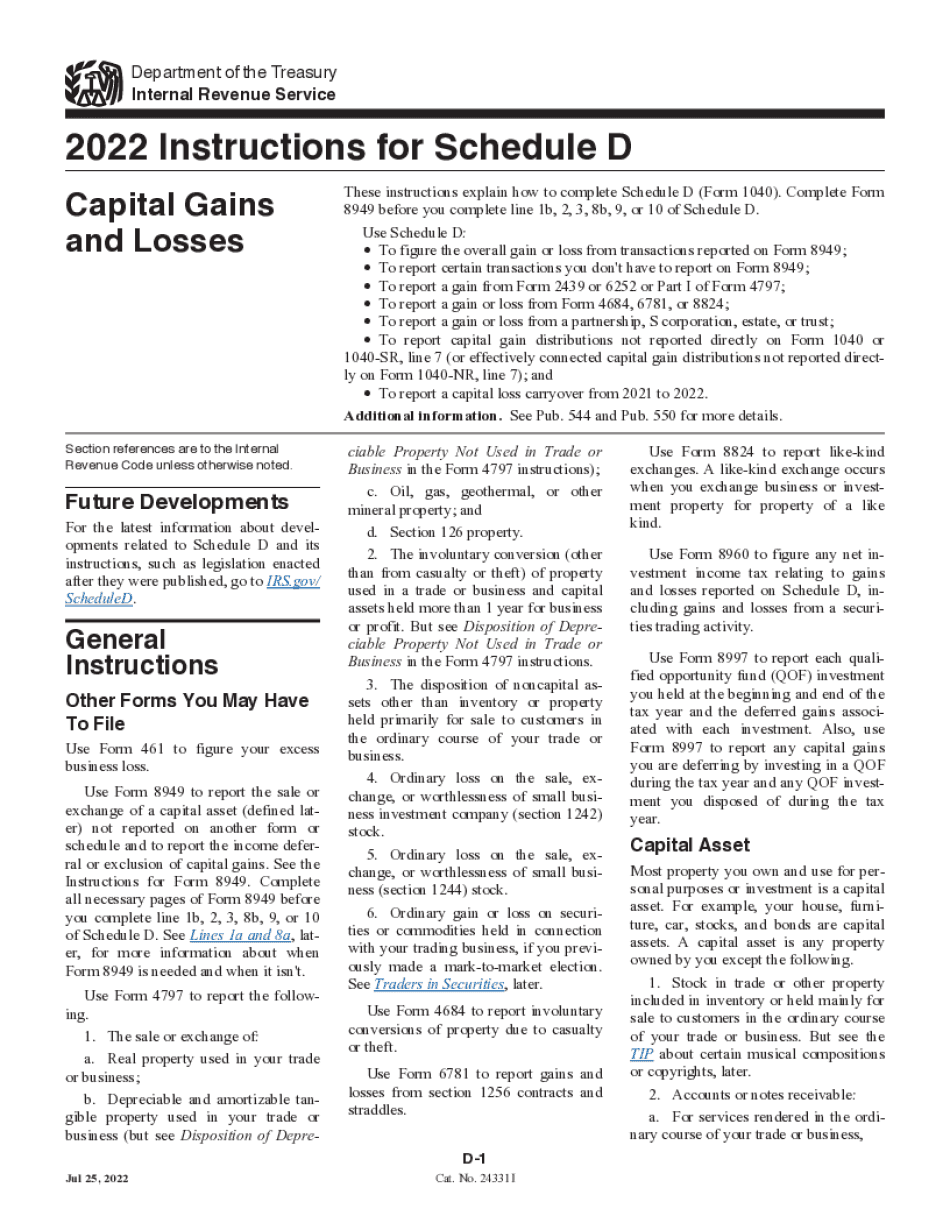

The Schedule D tax worksheet is a crucial document for taxpayers who need to report their capital gains and losses from the sale of investments, such as stocks, bonds, and real estate. Completing this worksheet accurately is essential to ensure that you are reporting your income correctly and taking advantage of any available deductions. In this article, we will break down the Schedule D tax worksheet and provide a step-by-step guide on how to complete it.

What is the Schedule D Tax Worksheet?

The Schedule D tax worksheet, also known as the Capital Gains and Losses worksheet, is a supplemental form that accompanies your tax return (Form 1040). It is used to calculate your net capital gain or loss from the sale of investments, which is then reported on your tax return.

Who Needs to Complete the Schedule D Tax Worksheet?

You will need to complete the Schedule D tax worksheet if you:

- Sold or exchanged investments, such as stocks, bonds, or real estate, during the tax year

- Received a Schedule K-1 (Form 1065) or Schedule K-1 (Form 1120S) that reports your share of capital gains or losses from a partnership or S corporation

- Have a gain or loss from the sale of a primary residence that exceeds the exclusion amount (250,000 for single filers or 500,000 for joint filers)

Step-by-Step Guide to Completing the Schedule D Tax Worksheet

To complete the Schedule D tax worksheet, follow these steps:

Step 1: Gather Your Information

- Collect all relevant documents, including:

- Forms 1099-B (Proceeds from Broker and Barter Exchange Transactions)

- Schedule K-1 (Form 1065) or Schedule K-1 (Form 1120S)

- Records of your investments, including purchase and sale dates, and proceeds from sales

- Records of any capital losses from previous years

Step 2: Complete Part I (Lines 1-5)

- List all your long-term capital gains and losses from the sale of investments on Lines 1-5

- Report the date of sale, description of property sold, and proceeds from sale

- Calculate the gain or loss for each transaction using the following formula:

Gain/Loss = Proceeds from Sale - Basis (Adjusted Cost Basis)

Step 3: Complete Part II (Lines 6-10)

- List all your short-term capital gains and losses from the sale of investments on Lines 6-10

- Report the date of sale, description of property sold, and proceeds from sale

- Calculate the gain or loss for each transaction using the same formula as above

Step 4: Complete Part III (Lines 11-17)

- Calculate your net long-term capital gain or loss by combining the results from Part I

- Calculate your net short-term capital gain or loss by combining the results from Part II

- Report any capital losses from previous years on Line 15

Step 5: Complete Part IV (Lines 18-22)

- Calculate your net capital gain or loss by combining the results from Part III

- Report any adjustments to your net capital gain or loss on Lines 20-22

Step 6: Report Your Net Capital Gain or Loss on Your Tax Return

- Report your net capital gain or loss from the Schedule D tax worksheet on Line 13 of your Form 1040

📝 Note: This is a general guide and may not cover all specific situations. It is recommended that you consult the IRS instructions or seek professional tax advice if you are unsure about completing the Schedule D tax worksheet.

Tips and Tricks for Completing the Schedule D Tax Worksheet

- Keep accurate records of your investments, including purchase and sale dates, and proceeds from sales

- Consider consulting with a tax professional if you have complex investment transactions or multiple investments

- Use the IRS Free File program or tax software to help guide you through the process

Common Mistakes to Avoid

- Failing to report all capital gains and losses

- Incorrectly calculating the basis of your investments

- Not reporting capital losses from previous years

Conclusion

Completing the Schedule D tax worksheet can seem daunting, but by following these steps and tips, you can ensure that you are accurately reporting your capital gains and losses. Remember to keep accurate records and consider seeking professional tax advice if you are unsure about any aspect of the process.

What is the purpose of the Schedule D tax worksheet?

+The Schedule D tax worksheet is used to calculate your net capital gain or loss from the sale of investments, which is then reported on your tax return.

Who needs to complete the Schedule D tax worksheet?

+You will need to complete the Schedule D tax worksheet if you sold or exchanged investments during the tax year, or if you received a Schedule K-1 (Form 1065) or Schedule K-1 (Form 1120S) that reports your share of capital gains or losses.

How do I calculate my net capital gain or loss?

+Calculate your net capital gain or loss by combining the results from Part I (long-term capital gains and losses) and Part II (short-term capital gains and losses) of the Schedule D tax worksheet.

Related Terms:

- File schedule

- IRS Schedule D instructions

- Schedule c pdf

- Form 8949 and Schedule D

- IRS Schedule D 2023

- IRS Form 1041