Isabella's Combined Credit Report Worksheet Answers

Understanding Credit Reports: A Comprehensive Guide

Credit reports play a crucial role in determining an individual’s creditworthiness. It’s essential to understand the components of a credit report and how to analyze the information to make informed financial decisions. In this article, we’ll delve into the world of credit reports, exploring the key elements, and providing a worksheet to help you better comprehend your own credit report.

Components of a Credit Report

A typical credit report contains the following sections:

- Personal Information: This section includes your name, address, Social Security number, and employment information.

- Credit Accounts: This section lists all your credit accounts, including credit cards, loans, and mortgages. It includes information such as:

- Account type (e.g., credit card, loan, mortgage)

- Account status (e.g., open, closed, paid)

- Credit limit

- Balance

- Payment history

- Public Records: This section includes information about any public records related to your credit, such as:

- Bankruptcies

- Foreclosures

- Tax liens

- Court judgments

- Inquiries: This section lists all the times your credit report was accessed by a lender or creditor.

Isabella's Combined Credit Report Worksheet

To help you better understand your credit report, we’ve created a worksheet based on Isabella’s combined credit report. Please note that this is a sample report, and you should obtain a copy of your own credit report from the three major credit reporting agencies (Experian, TransUnion, and Equifax).

Personal Information

| Category | Information |

|---|---|

| Name | Isabella Smith |

| Address | 123 Main St, Anytown, USA 12345 |

| Social Security Number | XXX-XX-1234 |

| Employment | Marketing Manager at XYZ Corporation |

Credit Accounts

| Account Type | Account Status | Credit Limit | Balance | Payment History |

|---|---|---|---|---|

| Credit Card | Open | $2,000 | $1,500 | On-time payments |

| Car Loan | Open | $20,000 | $15,000 | Late payment (30 days) |

| Student Loan | Open | $30,000 | $25,000 | On-time payments |

| Mortgage | Open | $150,000 | $120,000 | On-time payments |

Public Records

| Type | Date | Amount |

|---|---|---|

| Bankruptcy | 2015 | $10,000 |

| Foreclosure | 2018 | $50,000 |

Inquiries

| Date | Lender/Creditor |

|---|---|

| 2020-02-15 | Credit Card Company A |

| 2020-03-20 | Auto Loan Lender B |

| 2020-04-01 | Mortgage Lender C |

Analyzing Your Credit Report

Now that you have a better understanding of the components of a credit report, let’s analyze Isabella’s report:

- Credit Utilization Ratio: Isabella’s credit utilization ratio is high, with a total balance of 161,500 and a total credit limit of 202,000. This may negatively impact her credit score.

- Payment History: Isabella has made on-time payments for most of her accounts, but she has a late payment on her car loan. This may also negatively impact her credit score.

- Public Records: Isabella has a bankruptcy and foreclosure on her report, which can significantly lower her credit score.

📝 Note: It's essential to review your credit report regularly to ensure it's accurate and up-to-date.

Conclusion

Understanding your credit report is crucial for maintaining good credit health. By reviewing your report regularly and analyzing the information, you can identify areas for improvement and make informed financial decisions. Remember to check your credit report from all three major credit reporting agencies and dispute any errors or inaccuracies.

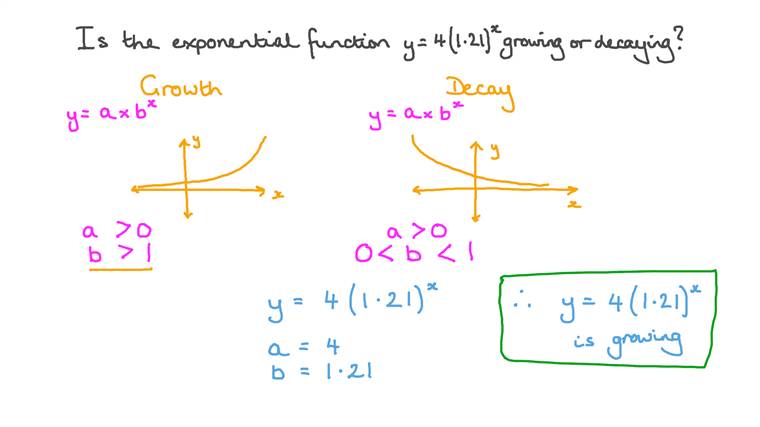

What is a credit utilization ratio?

+A credit utilization ratio is the percentage of your available credit that you’re using. It’s calculated by dividing your total balance by your total credit limit.

How do public records affect my credit score?

+Public records, such as bankruptcies and foreclosures, can significantly lower your credit score. This is because they indicate a higher level of credit risk.

How often should I check my credit report?

+You should check your credit report at least once a year, but it’s recommended to check it every 3-4 months to ensure it’s accurate and up-to-date.