Create a Debt Payoff Plan with Free Excel Worksheet

Breaking Free from Debt: A Step-by-Step Guide to Creating a Debt Payoff Plan

Are you tired of feeling overwhelmed by debt? Do you dream of living a debt-free life? Creating a debt payoff plan is the first step towards achieving financial freedom. In this article, we will walk you through a step-by-step guide on how to create a debt payoff plan using a free Excel worksheet.

Understanding Your Debt

Before creating a debt payoff plan, it’s essential to understand the types of debt you have and their corresponding interest rates. Make a list of all your debts, including:

- Credit card debt

- Personal loans

- Car loans

- Mortgage

- Student loans

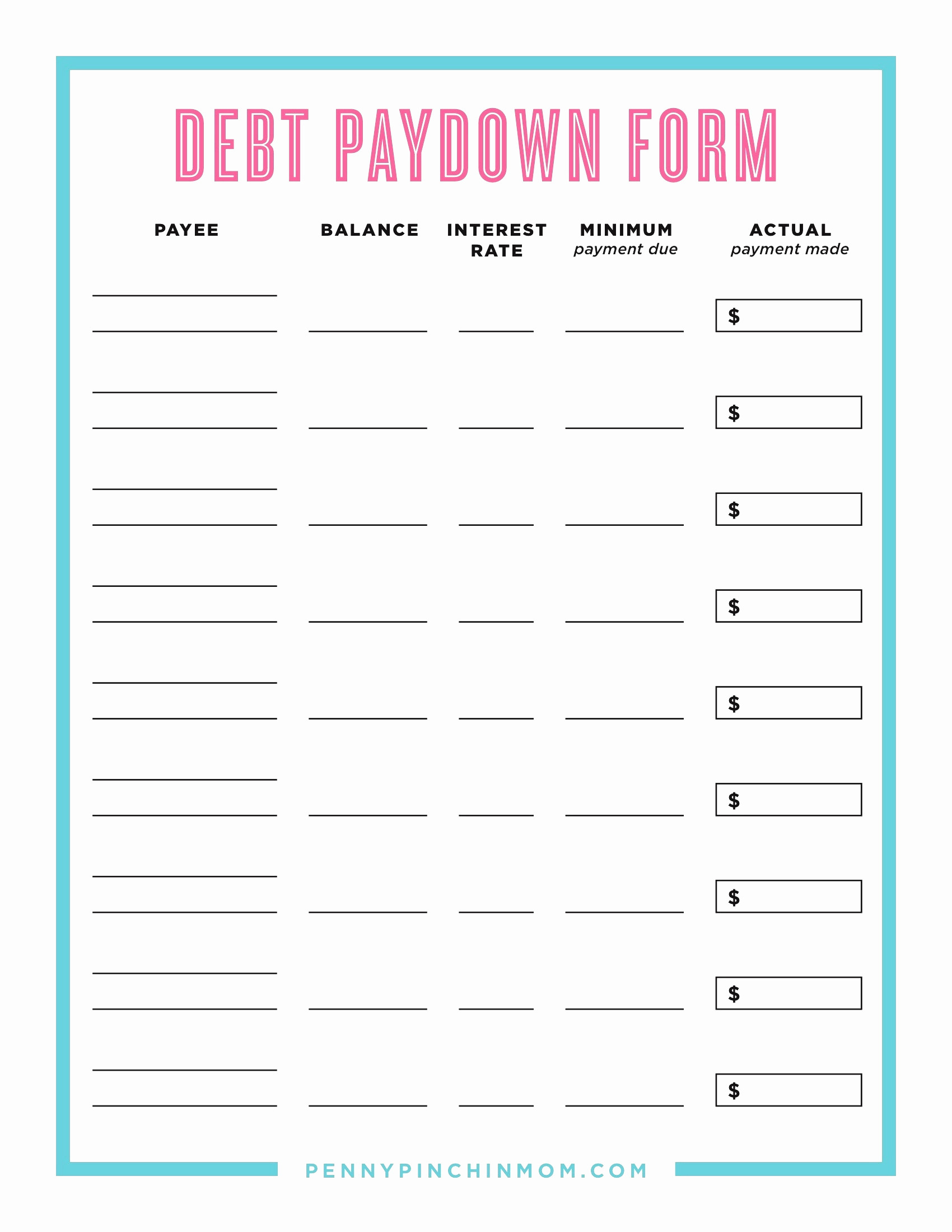

For each debt, note down the following information:

- Creditor’s name

- Outstanding balance

- Interest rate

- Minimum monthly payment

Calculating Your Debt-to-Income Ratio

Your debt-to-income ratio is the percentage of your monthly gross income that goes towards paying off debts. To calculate your debt-to-income ratio, follow these steps:

- List down your monthly gross income

- Calculate your total monthly debt payments

- Divide your total monthly debt payments by your monthly gross income

- Multiply the result by 100 to get the percentage

For example, if your monthly gross income is 4,000 and your total monthly debt payments are 1,200, your debt-to-income ratio would be 30%.

Debt-to-Income Ratio Calculator

| Monthly Gross Income | Total Monthly Debt Payments | Debt-to-Income Ratio |

|---|---|---|

| $4,000 | $1,200 | 30% |

Choosing a Debt Payoff Strategy

There are two popular debt payoff strategies: the Snowball Method and the Avalanche Method.

- Snowball Method: Pay off debts with the smallest balances first, while making minimum payments on larger debts.

- Avalanche Method: Pay off debts with the highest interest rates first, while making minimum payments on other debts.

Choose a strategy that works best for you and your financial situation.

Creating a Debt Payoff Plan

Using the information gathered, create a debt payoff plan using the following steps:

- List down all your debts, starting with the one you want to pay off first.

- Calculate the total amount you can afford to pay each month towards your debt.

- Allocate the total amount among your debts, following your chosen strategy.

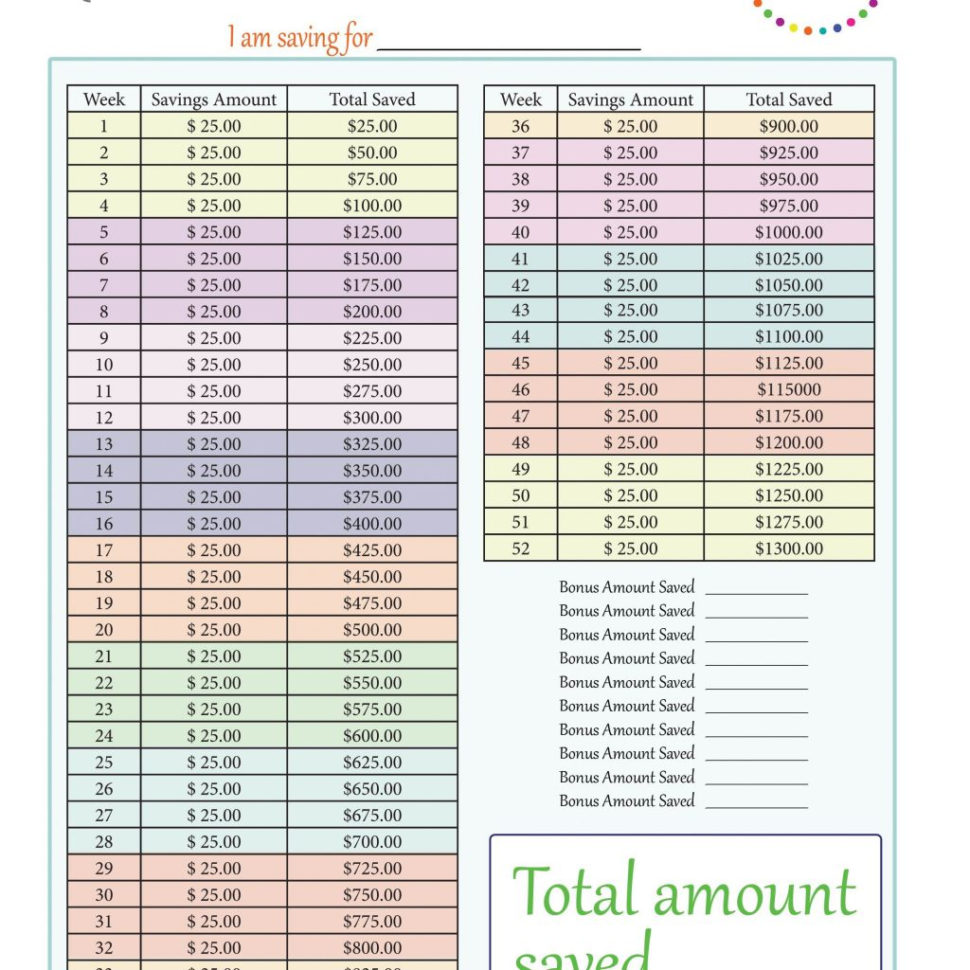

- Set a realistic timeline for paying off each debt.

- Review and adjust your plan regularly.

Debt Payoff Plan Worksheet

| Creditor | Outstanding Balance | Interest Rate | Minimum Monthly Payment | Payoff Amount | Payoff Timeline |

|---|---|---|---|---|---|

| Credit Card A | $2,000 | 18% | $50 | $100 | 12 months |

| Personal Loan B | $5,000 | 10% | $100 | $200 | 24 months |

| Car Loan C | $10,000 | 6% | $200 | $300 | 36 months |

Free Excel Worksheet

To make it easier for you to create a debt payoff plan, we have created a free Excel worksheet that you can download and use.

[Insert download link]

This worksheet includes the following templates:

- Debt List Template: List down all your debts and their corresponding information.

- Debt-to-Income Ratio Calculator: Calculate your debt-to-income ratio.

- Debt Payoff Plan Template: Create a debt payoff plan based on your chosen strategy.

Sticking to Your Plan

Creating a debt payoff plan is just the first step. Sticking to your plan requires discipline and commitment. Here are some tips to help you stay on track:

- Set realistic goals and deadlines.

- Automate your payments to ensure timely payments.

- Review and adjust your plan regularly.

- Avoid taking on new debt.

💡 Note: Avoid using credit cards or taking on new debt while paying off existing debts.

Maintaining Momentum

Paying off debt can be a long and challenging process. To maintain momentum, consider the following:

- Celebrate small victories along the way.

- Share your progress with a friend or family member.

- Reward yourself for reaching milestones.

🎉 Note: Treating yourself to something nice can help motivate you to stay on track.

Conclusion

Creating a debt payoff plan is the first step towards achieving financial freedom. By following the steps outlined in this article and using our free Excel worksheet, you can take control of your debt and start building a brighter financial future.

Remember, paying off debt takes time and discipline, but the sense of accomplishment and financial freedom you’ll gain is worth it.

FAQ Section

What is the best debt payoff strategy?

+The best debt payoff strategy depends on your individual financial situation. The Snowball Method and the Avalanche Method are two popular strategies. Choose the one that works best for you.

How long does it take to pay off debt?

+The time it takes to pay off debt depends on the amount of debt, interest rates, and your monthly payments. Create a debt payoff plan to get an estimate of how long it will take to pay off your debt.

What is the debt-to-income ratio?

+The debt-to-income ratio is the percentage of your monthly gross income that goes towards paying off debts. A lower debt-to-income ratio indicates better financial health.

Related Terms:

- Debt calculator spreadsheet

- Budgeting template Excel free

- Budget dashboard Excel template free

- Template cost control Excel

- Excel loan calculator

- Personal finance Excel