6 Ways to Master Tax Tables Worksheets and Schedules

Understanding Tax Tables Worksheets and Schedules

Tax season can be a daunting time for many individuals and businesses. One of the most critical components of tax filing is understanding tax tables, worksheets, and schedules. These tools help taxpayers accurately calculate their tax liability and claim deductions and credits. In this article, we will explore six ways to master tax tables, worksheets, and schedules, making the tax filing process more manageable and less stressful.

What are Tax Tables, Worksheets, and Schedules?

Before diving into the tips and strategies, it’s essential to understand what tax tables, worksheets, and schedules are and how they are used.

- Tax Tables: Tax tables are charts that provide the tax liability based on the taxpayer’s filing status and taxable income. They are used to determine the tax owed or the refund due.

- Worksheets: Worksheets are forms used to calculate specific tax-related amounts, such as deductions, credits, and tax liability. They help taxpayers organize their information and perform calculations accurately.

- Schedules: Schedules are additional forms that are attached to the main tax return. They provide detailed information about specific income, deductions, or credits, such as self-employment income, rental income, or charitable donations.

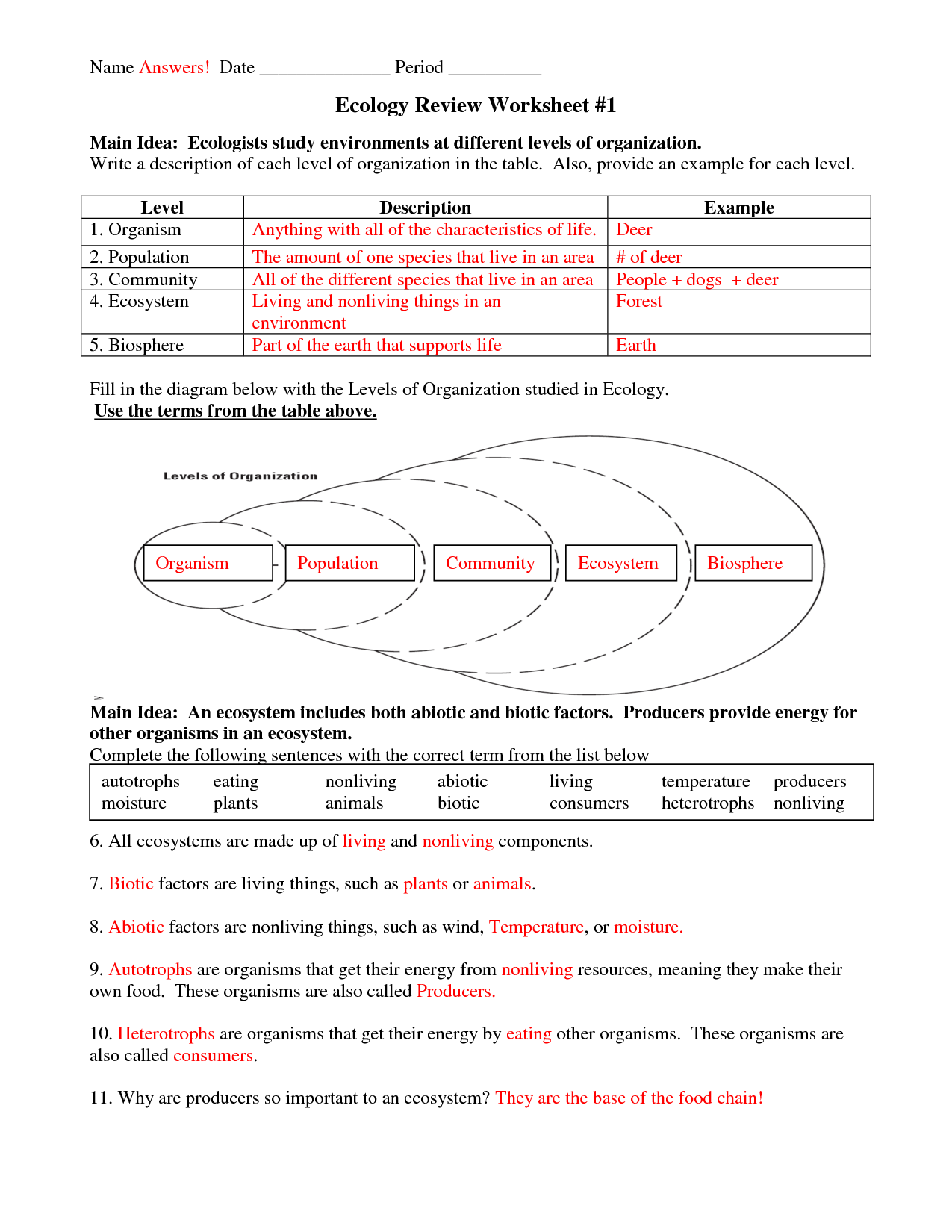

Tip 1: Understand the Different Types of Tax Tables

There are several types of tax tables, including:

- Tax Table: This is the most common type of tax table, which provides the tax liability based on the taxpayer’s filing status and taxable income.

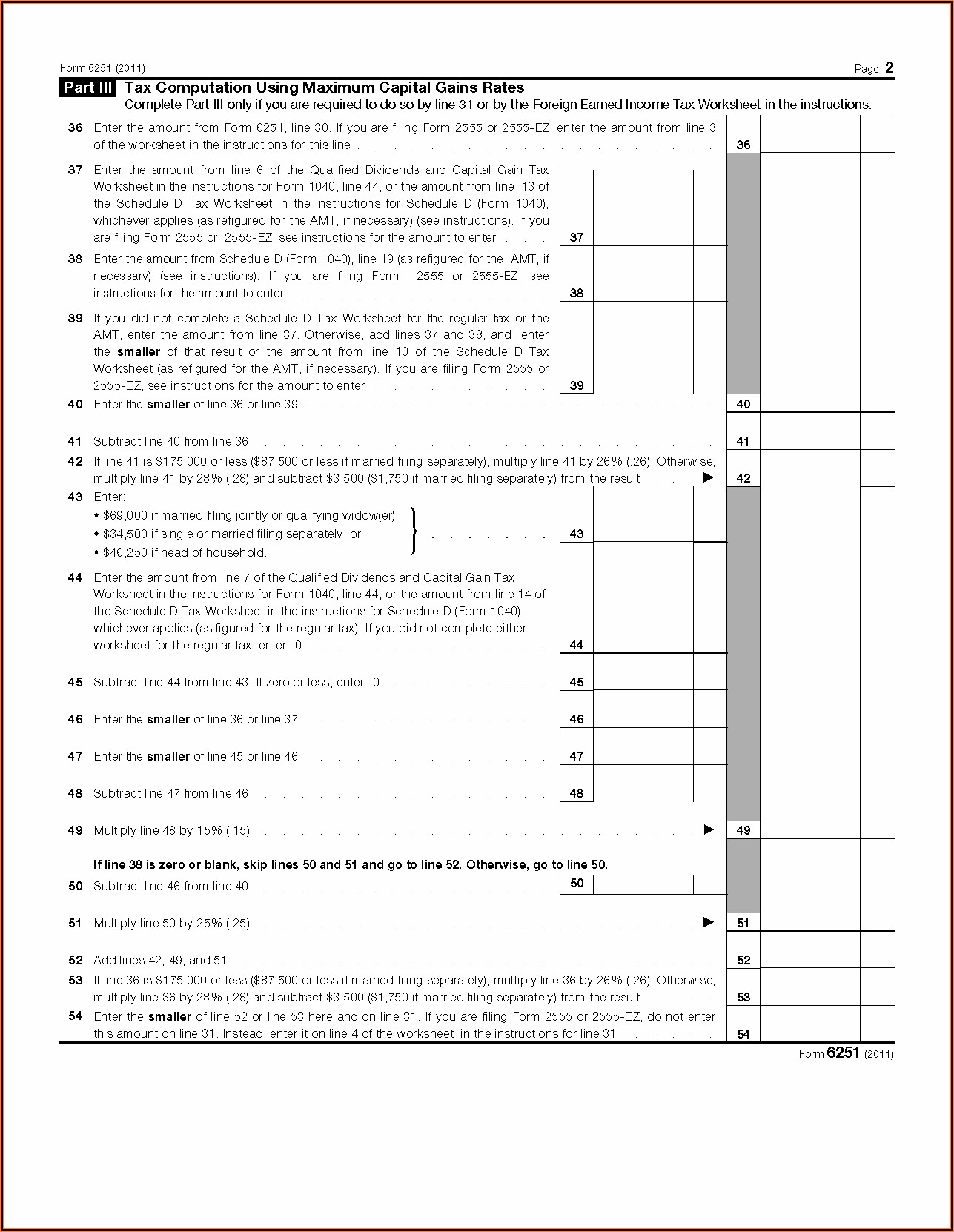

- Tax Computation Worksheet: This worksheet is used to calculate the tax liability when the taxpayer has a complex tax situation, such as self-employment income or rental income.

- Alternative Minimum Tax (AMT) Worksheet: This worksheet is used to calculate the AMT, which is a separate tax calculation that is designed to ensure that taxpayers pay a minimum amount of tax.

📝 Note: It's essential to understand which type of tax table or worksheet is required for your specific tax situation.

Tip 2: Use the Correct Filing Status

The filing status is a critical component of tax tables and worksheets. The correct filing status will ensure that the taxpayer is using the correct tax table and worksheet. The most common filing statuses are:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

📝 Note: The filing status can affect the tax liability, so it's essential to choose the correct one.

Tip 3: Gather All Required Documents

To accurately complete tax tables and worksheets, taxpayers need to gather all required documents, including:

- W-2 forms: These forms show the taxpayer’s income and taxes withheld.

- 1099 forms: These forms show the taxpayer’s income from self-employment, freelance work, or other sources.

- Receipts for deductions: These receipts are required to support deductions, such as charitable donations or medical expenses.

- Proof of filing status: This documentation is required to support the taxpayer’s filing status, such as a marriage certificate or divorce decree.

Tip 4: Use Tax Software or Consult a Tax Professional

Tax software and tax professionals can help taxpayers navigate the complex world of tax tables and worksheets. Tax software, such as TurboTax or H&R Block, can guide taxpayers through the tax filing process and perform calculations accurately. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide personalized guidance and support.

Tip 5: Review and Edit Carefully

Once the tax tables and worksheets are completed, it’s essential to review and edit carefully. Taxpayers should check for errors, such as mathematical mistakes or incorrect filing status. A single mistake can result in delays or even an audit.

Tip 6: Stay Organized and Keep Records

Taxpayers should keep accurate records of their tax-related documents, including tax tables and worksheets. This will help taxpayers stay organized and ensure that they have the necessary documentation in case of an audit.

| Tax Table | Description |

|---|---|

| Tax Table | Provides the tax liability based on the taxpayer's filing status and taxable income. |

| Tax Computation Worksheet | Used to calculate the tax liability when the taxpayer has a complex tax situation. |

| Alternative Minimum Tax (AMT) Worksheet | Used to calculate the AMT, which is a separate tax calculation. |

In conclusion, mastering tax tables, worksheets, and schedules requires understanding the different types of tax tables, using the correct filing status, gathering all required documents, using tax software or consulting a tax professional, reviewing and editing carefully, and staying organized and keeping records. By following these tips and strategies, taxpayers can navigate the complex world of tax tables and worksheets with confidence.

What is the purpose of tax tables?

+Tax tables provide the tax liability based on the taxpayer’s filing status and taxable income.

What is the difference between a tax table and a tax computation worksheet?

+A tax table provides the tax liability based on the taxpayer’s filing status and taxable income, while a tax computation worksheet is used to calculate the tax liability when the taxpayer has a complex tax situation.

What is the Alternative Minimum Tax (AMT) worksheet used for?

+The AMT worksheet is used to calculate the AMT, which is a separate tax calculation designed to ensure that taxpayers pay a minimum amount of tax.

Related Terms:

- Tax Table worksheet

- MATH income tax brackets Worksheet

- Financial Algebra Workbook 7 1

- Chapter 7 income taxes answers