1099 R Simplified Method Worksheet Explained

Understanding the 1099 R Simplified Method Worksheet

The 1099 R Simplified Method Worksheet is a tool used by the Internal Revenue Service (IRS) to help individuals calculate the taxable amount of their retirement account distributions. This worksheet is particularly useful for taxpayers who have received a distribution from a qualified retirement plan, such as a 401(k) or an IRA. In this article, we will break down the 1099 R Simplified Method Worksheet, explaining its purpose, the information it requires, and how to use it to calculate the taxable amount of your retirement account distribution.

Purpose of the 1099 R Simplified Method Worksheet

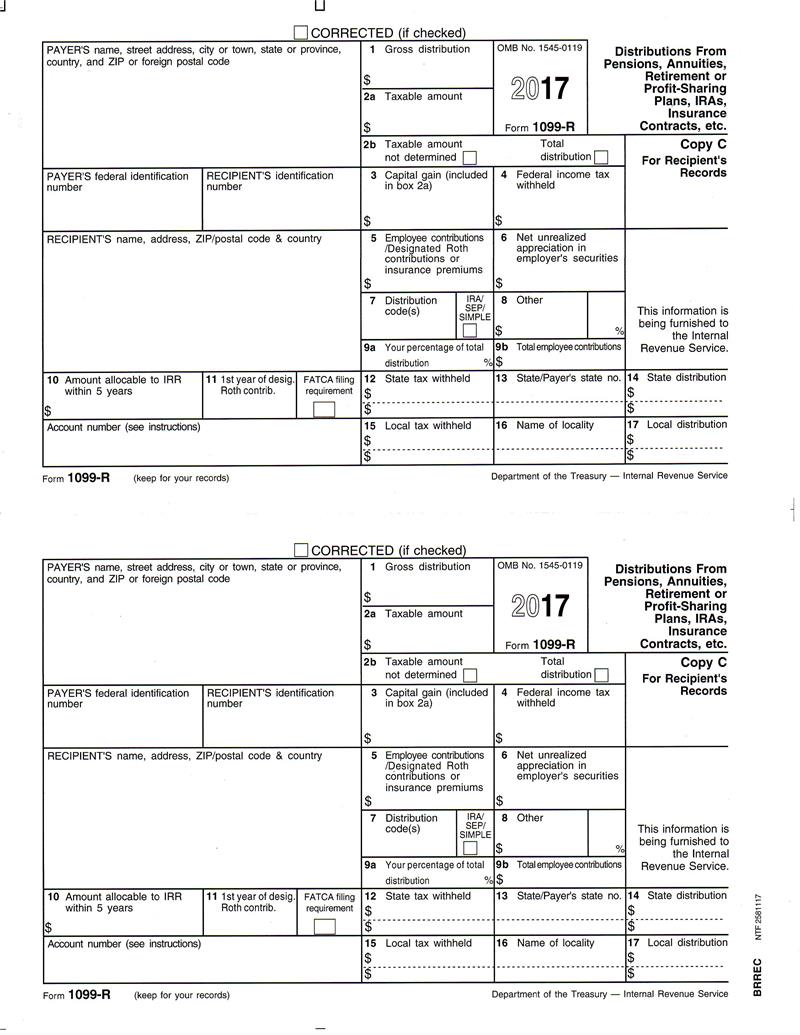

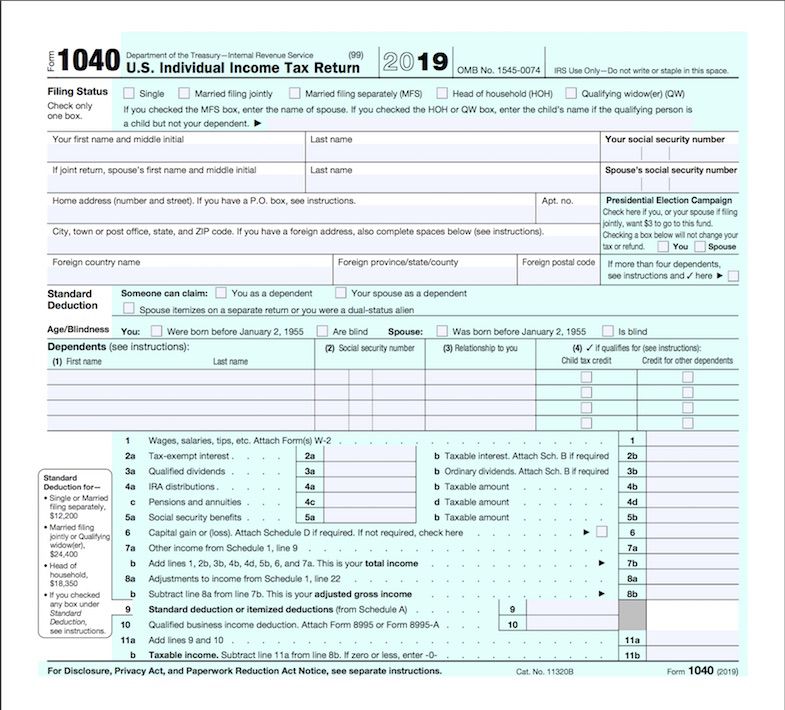

The primary purpose of the 1099 R Simplified Method Worksheet is to help taxpayers calculate the taxable amount of their retirement account distribution. When you receive a distribution from a qualified retirement plan, it is reported to the IRS on a 1099-R form. The 1099-R form shows the total amount of the distribution, but it does not separate the taxable and non-taxable portions. The 1099 R Simplified Method Worksheet is used to make this separation, allowing taxpayers to accurately report the taxable amount of their retirement account distribution on their tax return.

Information Required for the 1099 R Simplified Method Worksheet

To use the 1099 R Simplified Method Worksheet, you will need to have the following information:

- The total amount of the retirement account distribution (reported on the 1099-R form)

- The after-tax contributions made to the retirement account (if any)

- The total amount of the retirement account balance as of December 31 of the prior tax year (if the distribution is from a qualified plan)

📝 Note: You will also need to have a copy of the 1099-R form and any supporting documentation for the after-tax contributions and retirement account balance.

How to Use the 1099 R Simplified Method Worksheet

Using the 1099 R Simplified Method Worksheet is a straightforward process. Here are the steps to follow:

- Determine the total amount of the retirement account distribution: This amount is reported on the 1099-R form.

- Determine the after-tax contributions made to the retirement account: This amount should be documented on the 1099-R form or on a separate statement from the plan administrator.

- Calculate the taxable amount of the retirement account distribution: Use the following formula to calculate the taxable amount:

Taxable Amount = Total Distribution Amount - After-Tax Contributions

- Complete the 1099 R Simplified Method Worksheet: Use the calculated taxable amount and complete the worksheet to determine the taxable amount of the retirement account distribution.

📝 Note: If the distribution is from a qualified plan, you will also need to calculate the taxable amount based on the total amount of the retirement account balance as of December 31 of the prior tax year.

Example of the 1099 R Simplified Method Worksheet

Here is an example of how to complete the 1099 R Simplified Method Worksheet:

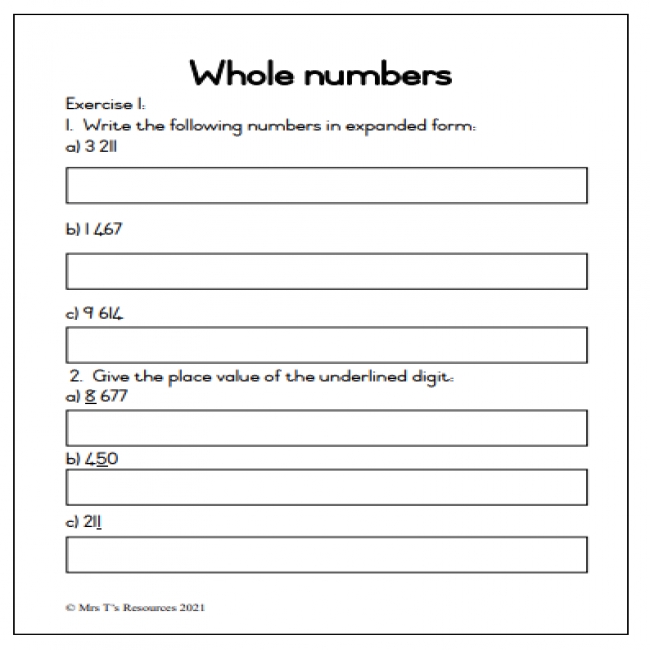

| Line Number | Description | Amount |

|---|---|---|

| 1 | Total distribution amount | $10,000 |

| 2 | After-tax contributions | $2,000 |

| 3 | Taxable amount (Line 1 - Line 2) | $8,000 |

📝 Note: This is a simplified example and actual calculations may vary depending on the specific situation.

Conclusion

The 1099 R Simplified Method Worksheet is a valuable tool for taxpayers who have received a distribution from a qualified retirement plan. By using this worksheet, taxpayers can accurately calculate the taxable amount of their retirement account distribution and report it on their tax return. Remember to keep accurate records of your after-tax contributions and retirement account balance to ensure accurate calculations.

What is the purpose of the 1099 R Simplified Method Worksheet?

+The primary purpose of the 1099 R Simplified Method Worksheet is to help taxpayers calculate the taxable amount of their retirement account distribution.

What information is required to use the 1099 R Simplified Method Worksheet?

+To use the 1099 R Simplified Method Worksheet, you will need to have the total amount of the retirement account distribution, after-tax contributions made to the retirement account, and the total amount of the retirement account balance as of December 31 of the prior tax year (if the distribution is from a qualified plan).

How do I calculate the taxable amount of the retirement account distribution?

+Use the following formula to calculate the taxable amount: Taxable Amount = Total Distribution Amount - After-Tax Contributions.

Related Terms:

- IRS Simplified Method calculator

- Simplified Method Worksheet Instructions

- csf 1099-r

- Simplified method Worksheet Schedule C

- Simplified Method worksheet pension