7 Tips for Completing Form 941x

Correcting Errors on Form 941: A Step-by-Step Guide to Filing Form 941x

When it comes to filing employment tax returns, accuracy is crucial. However, mistakes can happen, and that’s where Form 941x comes in. The Form 941x, also known as the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, is used to correct errors on previously filed Form 941 returns. In this article, we will provide you with 7 tips for completing Form 941x accurately and efficiently.

Tip 1: Understand the Purpose of Form 941x

Before we dive into the tips, it’s essential to understand the purpose of Form 941x. This form is used to correct errors on previously filed Form 941 returns, which are used to report employment taxes. Form 941x is used to:

- Correct errors in the reporting of employment taxes

- Claim refunds for overpaid employment taxes

- Make adjustments to previously filed returns

Tip 2: Gather Necessary Documents

Before completing Form 941x, gather all necessary documents, including:

- The original Form 941 return that needs to be corrected

- Records of employment taxes paid or withheld

- Records of any adjustments or corrections made

Having these documents readily available will help ensure that you complete the form accurately.

Tip 3: Identify the Type of Error

There are several types of errors that can be corrected on Form 941x, including:

- Math errors: errors in calculations or addition/subtraction

- Reporting errors: errors in reporting employment taxes or withholding

- Administrative errors: errors in processing or handling returns

Identify the type of error you are correcting to ensure you complete the correct sections of the form.

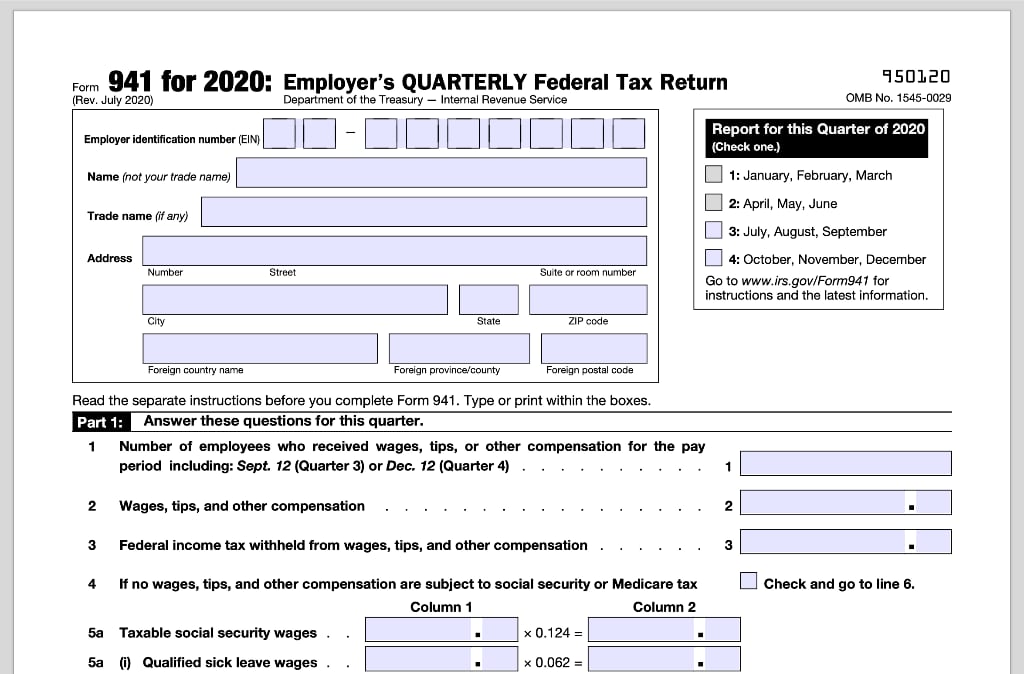

Tip 4: Complete the Header Section

The header section of Form 941x requires the following information:

- Employer’s name and address

- Employer Identification Number (EIN)

- Tax period

- Type of error

Complete this section accurately to ensure that the IRS can process your return correctly.

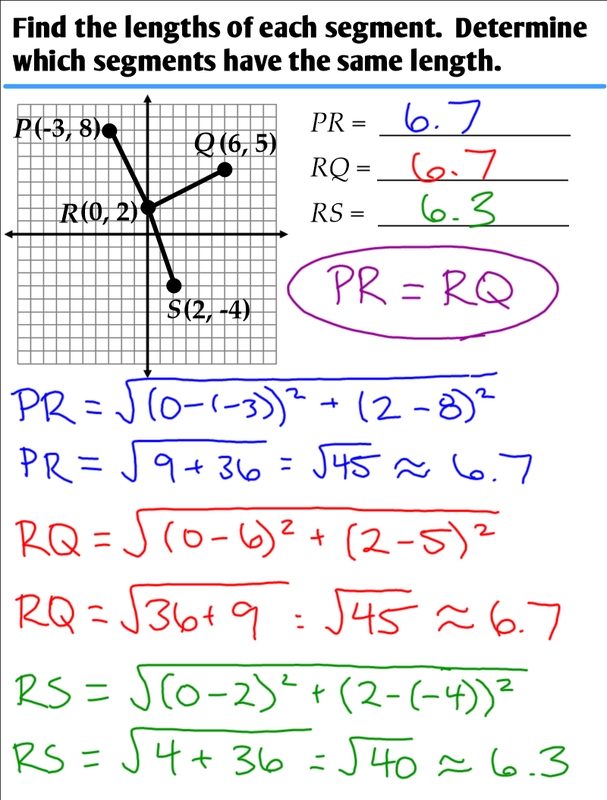

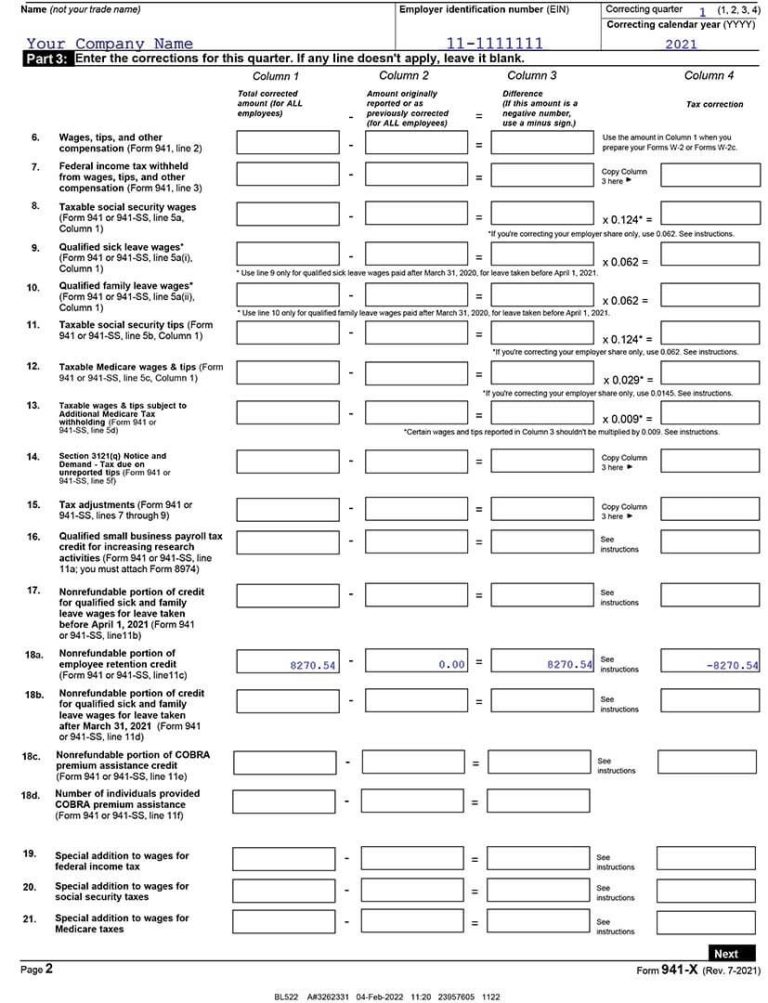

Tip 5: Report Corrections and Adjustments

The correction and adjustment sections of Form 941x require you to report the corrections and adjustments made to the original return. This includes:

- Correcting employment tax liabilities

- Claiming refunds for overpaid employment taxes

- Reporting adjustments to previously filed returns

Use the following table to help you report corrections and adjustments:

| Column | Description |

|---|---|

| a | Corrected employment tax liability |

| b | Claimed refund for overpaid employment taxes |

| c | Adjustments to previously filed returns |

Tip 6: Sign and Date the Form

Once you have completed Form 941x, sign and date the form to certify that the information provided is accurate and true.

🚨 Note: The form must be signed by an authorized representative of the employer.

Tip 7: File the Form Timely

File Form 941x timely to avoid penalties and interest. The IRS recommends filing the form as soon as possible after discovering the error.

🕒 Note: The IRS may waive penalties and interest if you can show reasonable cause for the error and file the form promptly.

In summary, completing Form 941x requires attention to detail and accuracy. By following these 7 tips, you can ensure that you correct errors on your employment tax returns efficiently and effectively.

By correcting errors and making adjustments to previously filed returns, you can avoid penalties and interest, and ensure compliance with employment tax regulations.

What is the purpose of Form 941x?

+Form 941x is used to correct errors on previously filed Form 941 returns, claim refunds for overpaid employment taxes, and make adjustments to previously filed returns.

What type of errors can be corrected on Form 941x?

+Form 941x can be used to correct math errors, reporting errors, and administrative errors.

How do I report corrections and adjustments on Form 941x?

+Use the correction and adjustment sections of Form 941x to report corrections and adjustments made to the original return.

Related Terms:

- form 941 x pdf

- E file 941x

- 941x refund status

- Worksheet 1 IRS

- 940 instructions

- Schedule B Form 941 instructions