6 Steps to Divide Property in a Texas Divorce

Understanding Texas Divorce Laws

In Texas, dividing property during a divorce can be a complex and challenging process. The Lone Star State follows community property laws, which means that most assets acquired during the marriage are considered community property and subject to division. However, this doesn’t necessarily mean that everything will be split 50⁄50. The court’s goal is to divide the property in a fair and equitable manner, taking into account various factors.

Step 1: Identify Community and Separate Property

To begin the process, it’s essential to distinguish between community property and separate property. Community property includes:

- Assets acquired during the marriage, such as:

- Real estate

- Bank accounts

- Investments

- Retirement accounts

- Personal property (e.g., vehicles, jewelry, furniture)

- Income earned during the marriage

- Debts incurred during the marriage

On the other hand, separate property includes:

- Assets owned before the marriage

- Gifts or inheritances received during the marriage

- Personal injury awards or settlements

- Property acquired with separate property funds

Step 2: Gather Financial Information

To ensure a fair division of property, it’s crucial to gather detailed financial information about both spouses’ assets, debts, and income. This includes:

- Bank statements

- Investment accounts

- Retirement account statements

- Real estate deeds and appraisals

- Vehicle titles and appraisals

- Credit card statements

- Loan documents

- Business financial statements (if applicable)

Step 3: Determine the Value of Assets

Accurate valuation of assets is vital in dividing property fairly. Spouses may agree on the value of certain assets, or they may need to hire experts, such as appraisers or accountants, to determine the value of:

- Real estate

- Businesses

- Investments

- Retirement accounts

- Personal property (e.g., artwork, collectibles, vehicles)

Step 4: Consider Debts and Liabilities

Debts and liabilities must also be considered when dividing property. Community debts, such as credit card balances, mortgages, and car loans, will typically be divided between the spouses. However, separate debts, such as those incurred before the marriage or after separation, may be the responsibility of the individual spouse.

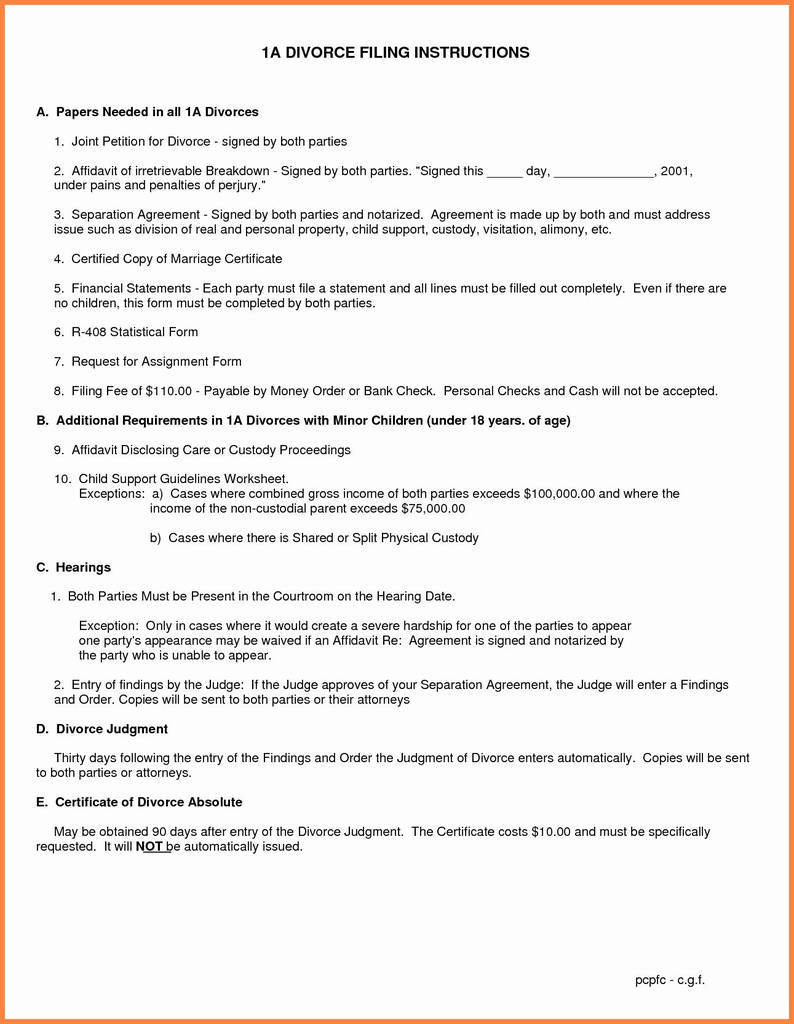

Step 5: Negotiate a Settlement or Go to Trial

Spouses can either negotiate a settlement agreement or go to trial to determine the division of property. A settlement agreement can be reached through mediation, collaborative law, or traditional negotiations between attorneys. If a settlement cannot be reached, the case will proceed to trial, where a judge will make a final decision.

📝 Note: It's essential to work with an experienced family law attorney to ensure your rights are protected and your interests are represented throughout the process.

Step 6: Finalize the Division of Property

Once a settlement agreement is reached or a trial is concluded, the division of property will be finalized. The court will issue a decree outlining the division of assets, debts, and liabilities. Spouses must then comply with the terms of the decree, which may involve:

- Transferring ownership of assets

- Paying debts and liabilities

- Dividing retirement accounts

- Selling or distributing community property

By following these six steps, spouses can navigate the complex process of dividing property in a Texas divorce. Remember to work with an experienced family law attorney to ensure a fair and equitable division of assets.

What is community property in Texas?

+In Texas, community property includes most assets acquired during the marriage, such as real estate, bank accounts, investments, and personal property.

How is property divided in a Texas divorce?

+The court’s goal is to divide the property in a fair and equitable manner, taking into account various factors, such as the length of the marriage, income, and contributions to the community estate.

Can I keep my separate property in a Texas divorce?

+Yes, separate property, such as assets owned before the marriage or gifts and inheritances, is typically not subject to division in a Texas divorce.

Related Terms:

- Free printable divorce asset worksheet

- Property division in divorce Texas

- Divorce worksheet pdf

- Property Division Worksheet divorce

- Divorce asset worksheet excel