Suze Orman Budget Worksheet Made Simple

Understanding the Suze Orman Budget Worksheet

Suze Orman, a well-known financial expert, created a budget worksheet to help individuals manage their finances effectively. The Suze Orman budget worksheet is a simple yet powerful tool to track income and expenses, making it easier to achieve financial stability. In this article, we will break down the Suze Orman budget worksheet and provide a step-by-step guide on how to use it.

Why Use the Suze Orman Budget Worksheet?

The Suze Orman budget worksheet is an excellent tool for those who want to take control of their finances. It helps individuals:

- Track income and expenses: Get a clear picture of where your money is coming from and where it’s going.

- Set financial goals: Identify areas where you can cut back and allocate funds to achieve your financial objectives.

- Reduce debt: Create a plan to pay off debts and start building wealth.

- Build savings: Set aside funds for emergencies and long-term goals.

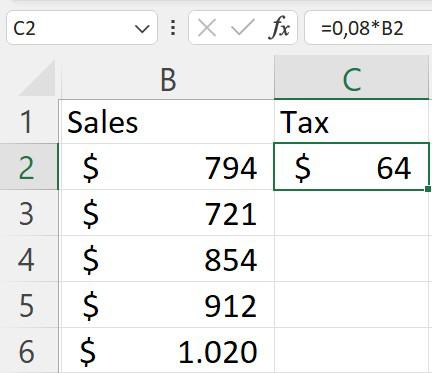

How to Use the Suze Orman Budget Worksheet

To get started, you’ll need to gather some information about your income and expenses. Follow these steps:

- Determine your net income: Calculate your take-home pay, which is your income after taxes and other deductions.

- List your fixed expenses: Include essential expenses like rent/mortgage, utilities, groceries, transportation, and minimum debt payments.

- List your variable expenses: Include non-essential expenses like entertainment, hobbies, and travel.

- Calculate your total expenses: Add up your fixed and variable expenses.

- Determine your disposable income: Subtract your total expenses from your net income.

Suze Orman Budget Worksheet

| Category | Amount |

|---|---|

| Net Income | $________ |

| Fixed Expenses | |

| ‣ Rent/Mortgage | $________ |

| ‣ Utilities | $________ |

| ‣ Groceries | $________ |

| ‣ Transportation | $________ |

| ‣ Minimum Debt Payments | $________ |

| Total Fixed Expenses | $________ |

| Variable Expenses | |

| ‣ Entertainment | $________ |

| ‣ Hobbies | $________ |

| ‣ Travel | $________ |

| Total Variable Expenses | $________ |

| Total Expenses | $________ |

| Disposable Income | $________ |

Allocating Your Disposable Income

Now that you have calculated your disposable income, it’s time to allocate it towards your financial goals. Suze Orman recommends allocating 50% of your disposable income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Allocation Categories

| Category | Percentage | Amount |

|---|---|---|

| Necessary Expenses | 50% | $________ |

| Discretionary Spending | 30% | $________ |

| Saving and Debt Repayment | 20% | $________ |

Tips for Using the Suze Orman Budget Worksheet

- Be honest and accurate: Make sure to include all your income and expenses.

- Review and adjust regularly: Review your budget regularly and make adjustments as needed.

- Prioritize needs over wants: Be mindful of the difference between necessary expenses and discretionary spending.

- Automate your savings: Set up automatic transfers to your savings and investment accounts.

💡 Note: Remember to review and adjust your budget regularly to ensure you're on track with your financial goals.

Common Challenges and Solutions

- Challenge: I don’t have enough income to cover my expenses.

- Solution: Consider reducing expenses, increasing income, or seeking assistance from a financial advisor.

- Challenge: I’m struggling to stick to my budget.

- Solution: Identify areas where you can improve, and consider using budgeting apps or seeking support from a financial community.

Conclusion

The Suze Orman budget worksheet is a powerful tool to help you manage your finances effectively. By following these simple steps, you can create a budget that works for you and helps you achieve your financial goals. Remember to review and adjust your budget regularly, and don’t hesitate to seek help if you need it.

What is the purpose of the Suze Orman budget worksheet?

+The Suze Orman budget worksheet is designed to help individuals track their income and expenses, set financial goals, reduce debt, and build savings.

How often should I review and adjust my budget?

+It’s recommended to review and adjust your budget regularly, ideally every few months, to ensure you’re on track with your financial goals.

What if I don’t have enough income to cover my expenses?

+Consider reducing expenses, increasing income, or seeking assistance from a financial advisor.

Related Terms:

- Suze Orman budget tips

- Suze Orman free downloads

- Suze Orman Show

- Suze Orman video

- Suze Orman app

- Suze Orman investing