5 Tips to Master Schedule 8812 Line 5 Worksheet

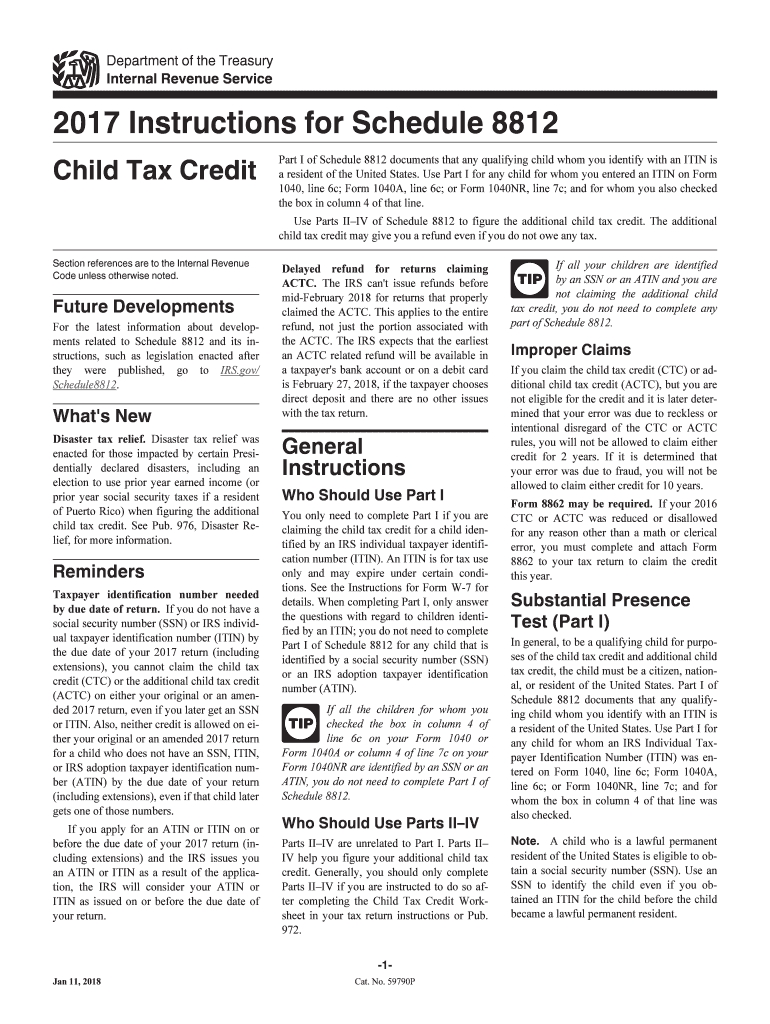

Understanding the Schedule 8812 Line 5 Worksheet

The Schedule 8812 Line 5 Worksheet is a crucial component of the Earned Income Tax Credit (EITC) calculation. It helps determine the amount of credit a taxpayer is eligible for based on their earned income and number of qualifying children. Mastering this worksheet can be a challenge, but with the right guidance, taxpayers can ensure they receive the correct credit amount. Here are five tips to help you master the Schedule 8812 Line 5 Worksheet.

Tips for Mastering the Schedule 8812 Line 5 Worksheet

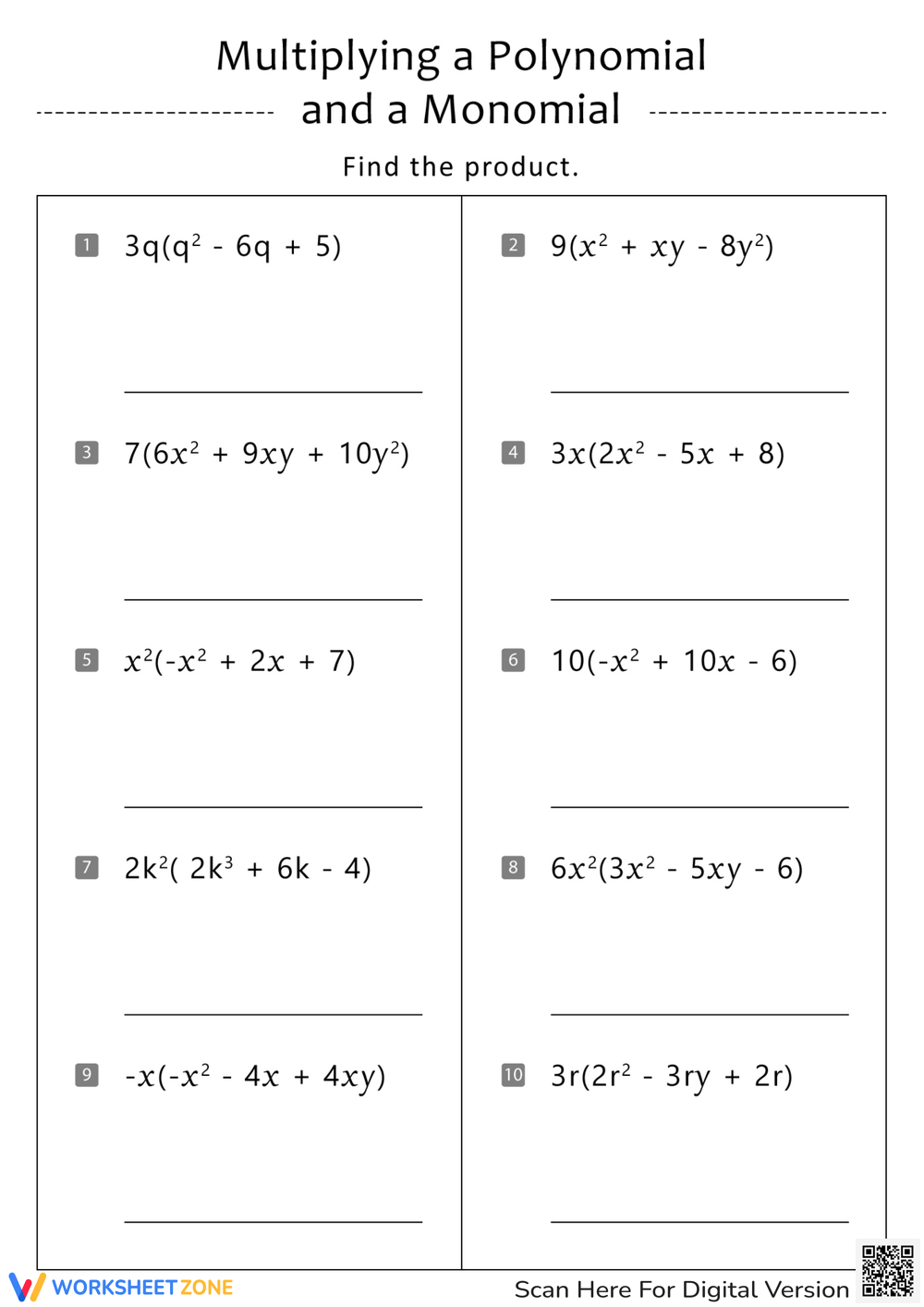

1. Familiarize Yourself with the Worksheet

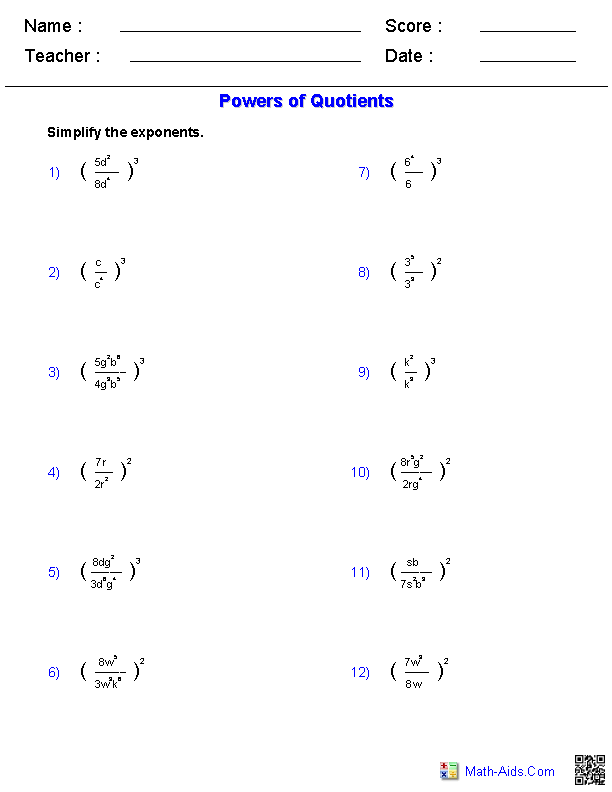

Before starting, take time to review the Schedule 8812 Line 5 Worksheet. Understand the different sections, the information required, and how it relates to the EITC calculation. The worksheet is divided into several parts, each with its own set of instructions and calculations.

2. Gather Necessary Documents

To complete the worksheet accurately, you’ll need to gather the following documents:

- Your W-2 forms for the tax year

- Your 1099 forms for any self-employment income

- Records of any other earned income, such as tips or bonuses

- Information about your qualifying children, including their Social Security numbers and dates of birth

3. Calculate Your Earned Income

Earned income includes wages, salaries, tips, and net earnings from self-employment. To calculate your earned income, follow these steps:

- Add up the total amount of wages and salaries reported on your W-2 forms

- Add any tips or bonuses not reported on your W-2 forms

- Calculate your net earnings from self-employment using Schedule C (Form 1040) or Schedule K-1 (Form 1065)

- Add up the total amount of earned income from all sources

4. Determine Your Number of Qualifying Children

Qualifying children are those who meet certain relationship, age, and residency tests. To determine your number of qualifying children, follow these steps:

- List all your children, including their Social Security numbers and dates of birth

- Determine which children meet the relationship test (e.g., son, daughter, stepchild, or foster child)

- Determine which children meet the age test (e.g., under age 19 or under age 24 if a full-time student)

- Determine which children meet the residency test (e.g., lived with you for more than six months)

5. Use the Worksheet to Calculate Your Credit

Once you have calculated your earned income and determined your number of qualifying children, use the Schedule 8812 Line 5 Worksheet to calculate your EITC. The worksheet will guide you through the calculation, taking into account your earned income, number of qualifying children, and other factors.

📝 Note: The EITC calculation can be complex, and small errors can result in a reduced credit amount or even an audit. Consider consulting a tax professional or using tax preparation software to ensure accuracy.

Additional Tips

- Double-check your calculations: Make sure to review your calculations carefully to avoid errors.

- Use the correct filing status: Your filing status can affect your EITC calculation. Make sure to use the correct filing status for your situation.

- Keep accurate records: Keep accurate records of your earned income and qualifying children, as these will be necessary to complete the worksheet.

Conclusion

Mastering the Schedule 8812 Line 5 Worksheet requires attention to detail and a solid understanding of the EITC calculation. By following these five tips, taxpayers can ensure they receive the correct credit amount and avoid common errors. Remember to take your time, gather all necessary documents, and double-check your calculations to ensure accuracy.

What is the purpose of the Schedule 8812 Line 5 Worksheet?

+The Schedule 8812 Line 5 Worksheet is used to calculate the Earned Income Tax Credit (EITC) based on earned income and number of qualifying children.

What documents do I need to complete the worksheet?

+You’ll need your W-2 forms, 1099 forms, records of other earned income, and information about your qualifying children, including their Social Security numbers and dates of birth.

How do I calculate my earned income?

+Calculate your earned income by adding up wages, salaries, tips, and net earnings from self-employment. Use Schedule C (Form 1040) or Schedule K-1 (Form 1065) to calculate net earnings from self-employment.