Deciphering Your Pay Stub Made Easy

Understanding Your Pay Stub: A Comprehensive Guide

Receiving your pay stub can be a thrilling experience, but deciphering the various numbers and codes can be overwhelming. Your pay stub is more than just a piece of paper or a digital document; it’s a detailed breakdown of your earnings, deductions, and taxes. In this article, we’ll break down the components of a pay stub, helping you make sense of the information and ensure you’re being paid correctly.

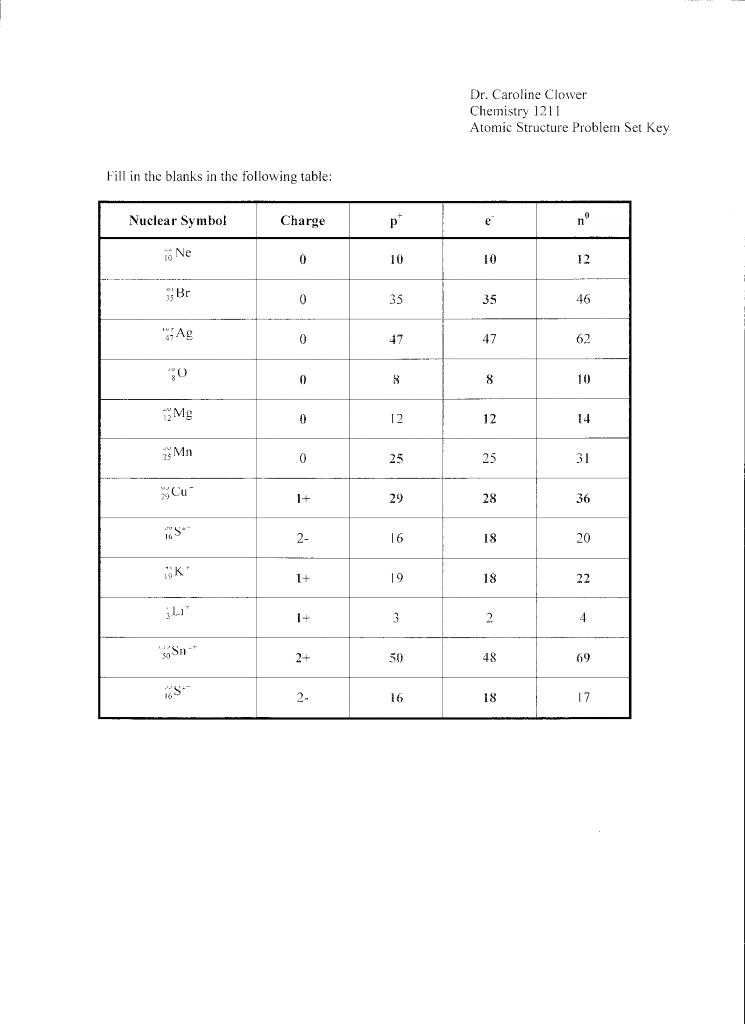

Components of a Pay Stub

A typical pay stub includes the following sections:

- Employee Information: This section displays your name, address, and employee ID number.

- Pay Period: This section shows the dates of the pay period, including the start and end dates.

- Earnings: This section breaks down your earnings, including your hourly rate, number of hours worked, and total earnings.

- Deductions: This section lists the various deductions made from your paycheck, such as taxes, health insurance, and 401(k) contributions.

- Taxes: This section shows the amount of taxes withheld from your paycheck, including federal, state, and local taxes.

- Net Pay: This section displays your take-home pay, which is the amount of money you receive after deductions and taxes.

Deciphering Your Earnings

Your earnings section is one of the most critical parts of your pay stub. Here, you’ll find the following information:

- Gross Pay: This is your total earnings before deductions and taxes.

- Hourly Rate: This is your hourly wage, which is used to calculate your gross pay.

- Hours Worked: This is the total number of hours you worked during the pay period.

- Overtime Pay: If you worked overtime, this section will show the additional amount you earned.

📝 Note: It's essential to review your earnings section carefully to ensure you're being paid correctly. If you notice any discrepancies, contact your HR representative or payroll department immediately.

Understanding Your Deductions

Deductions can be confusing, but they’re essential to understanding your take-home pay. Here are some common deductions you might find on your pay stub:

- Federal Income Tax: This is the amount of federal income tax withheld from your paycheck.

- State Income Tax: This is the amount of state income tax withheld from your paycheck.

- Local Taxes: This is the amount of local taxes withheld from your paycheck.

- Health Insurance: This is the amount deducted for health insurance premiums.

- 401(k) Contributions: This is the amount deducted for 401(k) contributions.

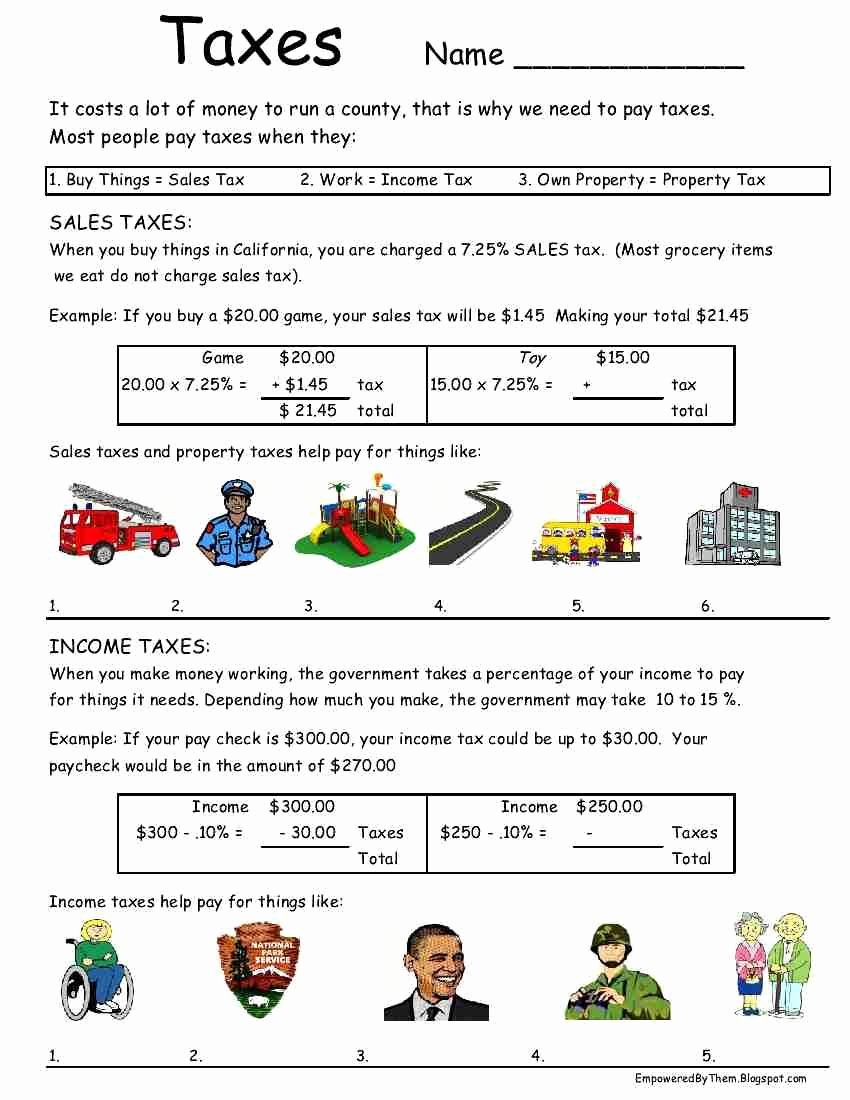

Taxes: What You Need to Know

Taxes can be complex, but understanding how they work can help you make sense of your pay stub. Here are some key things to know:

- Federal Income Tax: This is the tax withheld from your paycheck and sent to the federal government.

- State Income Tax: This is the tax withheld from your paycheck and sent to your state government.

- Local Taxes: This is the tax withheld from your paycheck and sent to your local government.

Common Pay Stub Mistakes

While pay stubs are generally accurate, mistakes can happen. Here are some common mistakes to look out for:

- Incorrect Hourly Rate: If your hourly rate is incorrect, it can affect your gross pay and deductions.

- Incorrect Hours Worked: If the number of hours you worked is incorrect, it can affect your gross pay and deductions.

- Incorrect Deductions: If your deductions are incorrect, it can affect your take-home pay.

📝 Note: If you notice any mistakes on your pay stub, contact your HR representative or payroll department immediately to correct the error.

Conclusion

Understanding your pay stub is crucial to ensuring you’re being paid correctly. By taking the time to review your pay stub carefully, you can catch any mistakes and ensure you’re receiving the correct amount of money. Remember, if you have any questions or concerns, don’t hesitate to reach out to your HR representative or payroll department.

What is a pay stub?

+A pay stub is a document that shows your earnings, deductions, and taxes for a specific pay period.

Why is it essential to review my pay stub carefully?

+Reviewing your pay stub carefully ensures you’re being paid correctly and catches any mistakes or discrepancies.

What should I do if I notice a mistake on my pay stub?

+If you notice a mistake on your pay stub, contact your HR representative or payroll department immediately to correct the error.

Related Terms:

- Pay stub Worksheets for students

- Sample pay stubs

- Paycheck worksheet PDF