Decoding Your Pay Stub: A Simple Worksheet Guide

Understanding Your Pay Stub: A Comprehensive Guide

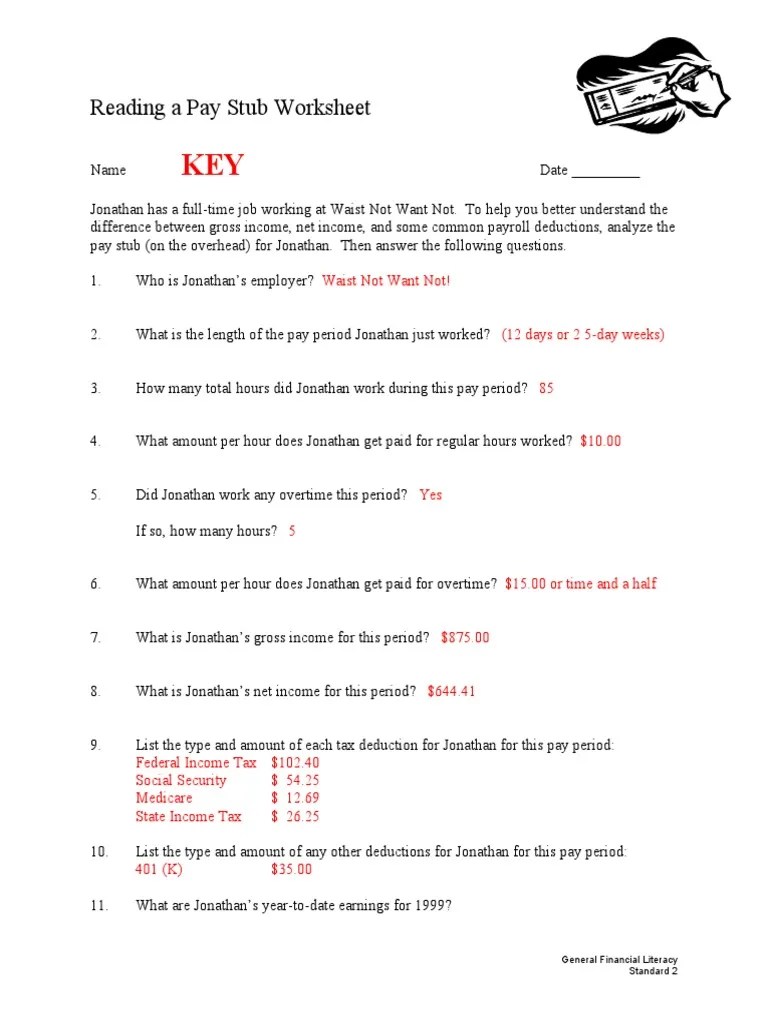

Your pay stub, also known as a payslip, is a crucial document that breaks down your salary, deductions, and other relevant information. Decoding your pay stub can seem daunting, but with this simple worksheet guide, you’ll be able to navigate it with ease.

Why is it Important to Understand Your Pay Stub?

Your pay stub is more than just a piece of paper; it’s a window into your financial situation. By understanding the various components of your pay stub, you can:

- Verify accuracy: Ensure that your employer is paying you correctly and that all deductions are accurate.

- Manage your finances: Make informed decisions about your budget, savings, and expenses.

- Plan for taxes: Understand how much you’ll need to pay in taxes and plan accordingly.

Breaking Down Your Pay Stub: A Worksheet Guide

To help you decode your pay stub, we’ve created a simple worksheet guide. Please refer to your pay stub as we walk through each section.

Section 1: Employee Information

| Field | Description | Example |

|---|---|---|

| Employee Name | Your name as it appears on your payroll records | John Doe |

| Employee ID | Your unique employee identification number | 123456 |

| Pay Period | The specific pay period for which you’re being paid | 01/01/2023 - 01/31/2023 |

Section 2: Earnings

| Field | Description | Example |

|---|---|---|

| Gross Pay | Your total earnings before deductions | $5,000.00 |

| Net Pay | Your take-home pay after deductions | $3,500.00 |

| Hours Worked | The number of hours you worked during the pay period | 80 hours |

Section 3: Deductions

| Field | Description | Example |

|---|---|---|

| Federal Income Tax | The amount withheld for federal income tax | $1,000.00 |

| State Income Tax | The amount withheld for state income tax | $200.00 |

| Health Insurance | The amount deducted for health insurance premiums | $150.00 |

| 401(k) Contributions | The amount deducted for 401(k) contributions | $500.00 |

Section 4: Benefits and Other Information

| Field | Description | Example |

|---|---|---|

| Vacation Time | The amount of vacation time you’ve accrued | 10 days |

| Sick Leave | The amount of sick leave you’ve accrued | 5 days |

| Life Insurance | The amount of life insurance coverage you have | $50,000 |

Common Pay Stub Terms: A Glossary

To help you better understand your pay stub, here are some common terms and their definitions:

- Gross Pay: Your total earnings before deductions.

- Net Pay: Your take-home pay after deductions.

- FICA: Federal Insurance Contributions Act, which includes Social Security and Medicare taxes.

- PTO: Paid Time Off, which includes vacation, sick leave, and other types of leave.

💡 Note: Your pay stub may include additional sections or fields specific to your employer or location.

Tips for Managing Your Finances with Your Pay Stub

By understanding your pay stub, you can make informed decisions about your finances. Here are some tips to get you started:

- Create a budget: Use your net pay to create a budget that accounts for all your expenses.

- Prioritize deductions: Review your deductions and prioritize them based on your financial goals.

- Plan for taxes: Use your pay stub to estimate your tax liability and plan accordingly.

Conclusion

Decoding your pay stub is a simple yet powerful way to take control of your finances. By following this worksheet guide, you’ll be able to navigate your pay stub with ease and make informed decisions about your money. Remember to review your pay stub regularly to ensure accuracy and plan for a brighter financial future.

What is the difference between gross pay and net pay?

+Gross pay is your total earnings before deductions, while net pay is your take-home pay after deductions.

Why do I need to understand my pay stub?

+Understanding your pay stub helps you verify accuracy, manage your finances, and plan for taxes.

What is FICA and how does it affect my pay stub?

+FICA stands for Federal Insurance Contributions Act, which includes Social Security and Medicare taxes. These taxes are withheld from your gross pay and appear on your pay stub.

Related Terms:

- Pay stub Worksheets for students

- Sample pay stubs