5 Ways to Understand Your Pay Stub

Deciphering the Mystery of Your Pay Stub

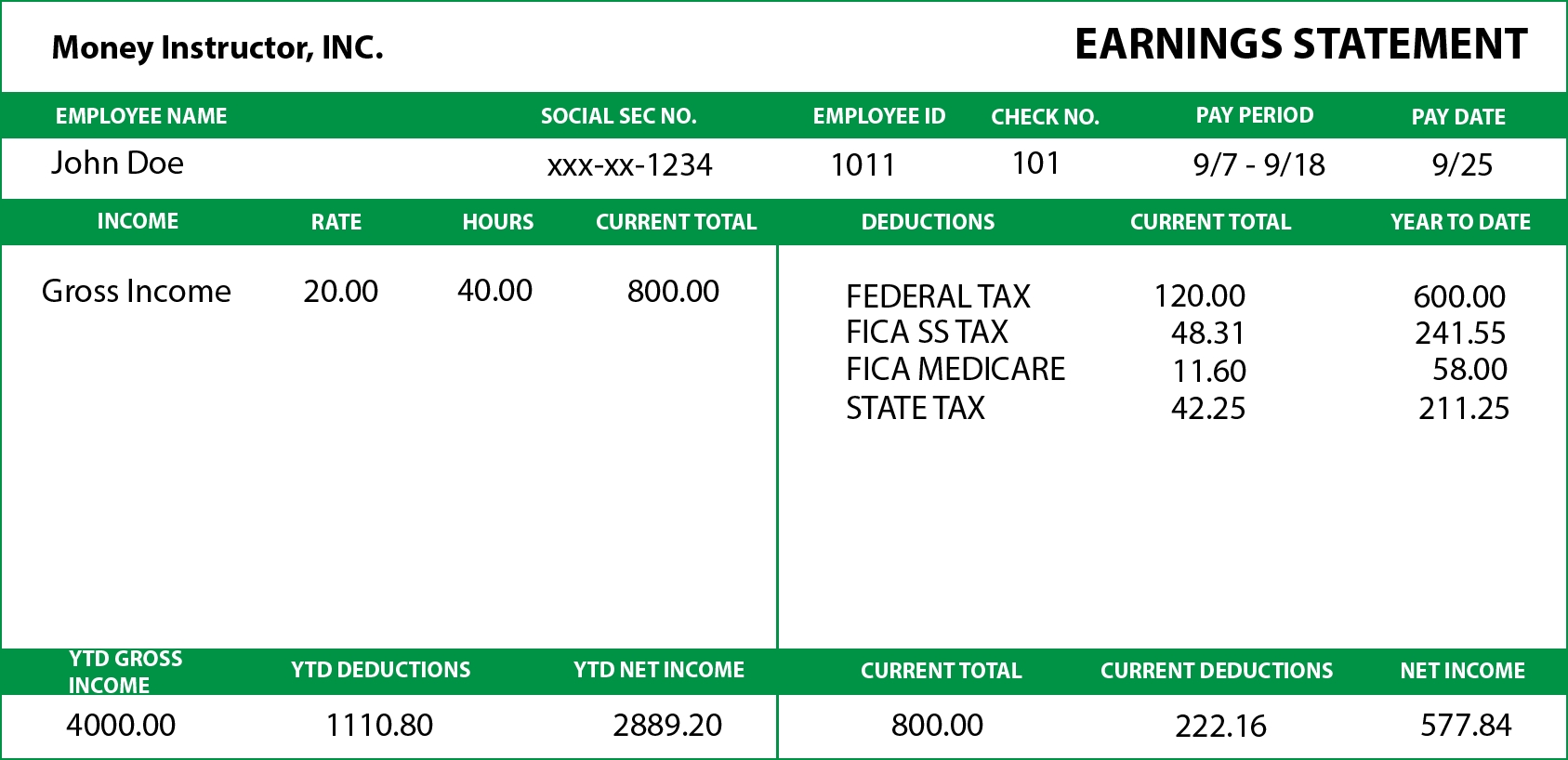

Receiving your paycheck is always a welcome event, but have you ever taken the time to understand the details on your pay stub? Your pay stub is more than just a confirmation of your salary; it’s a breakdown of your earnings, deductions, and benefits. In this article, we’ll explore five ways to understand your pay stub, helping you make sense of the numbers and ensure you’re getting the compensation you deserve.

1. Identify the Components of Your Pay Stub

A typical pay stub includes several key components:

- Gross Pay: Your total earnings before deductions.

- Net Pay: Your take-home pay after deductions.

- Deductions: These can include taxes, health insurance, retirement plans, and other benefits.

- Benefits: These may include paid time off, sick leave, or other perks.

- Taxes: Federal, state, and local taxes withheld from your paycheck.

Understanding these components is crucial to grasping the overall picture of your pay stub.

2. Understand Your Tax Withholdings

Taxes can be a significant portion of your deductions. It’s essential to understand how your tax withholdings are calculated:

- Federal Income Tax: Withheld based on your income tax bracket and the number of dependents you claim.

- State and Local Taxes: Varying rates depending on your location.

- Other Taxes: May include Social Security tax, Medicare tax, or other local taxes.

Keep in mind that tax laws and rates can change, so it’s crucial to review your pay stub regularly to ensure you’re not overpaying or underpaying taxes.

3. Review Your Benefits and Deductions

Benefits and deductions can vary greatly depending on your employer and the plans you’ve opted into. Common benefits and deductions include:

- Health Insurance: Premiums paid for medical, dental, or vision coverage.

- Retirement Plans: Contributions to 401(k), 403(b), or other pension plans.

- Paid Time Off: Accrued vacation days, sick leave, or holidays.

- Other Benefits: Life insurance, disability insurance, or flexible spending accounts.

Make sure you understand what benefits you’re receiving and what deductions are being taken from your paycheck.

4. Check for Errors or Discrepancies

Mistakes can happen, so it’s essential to review your pay stub for errors or discrepancies:

- Gross Pay: Verify that your gross pay matches your expected earnings.

- Deductions: Ensure that deductions are accurate and authorized.

- Benefits: Confirm that benefits are being correctly applied.

If you notice any errors, report them to your HR department or payroll immediately to avoid any further issues.

5. Use Your Pay Stub to Plan Your Finances

Your pay stub is a valuable tool for planning your finances. Use it to:

- Budget: Allocate your net pay into categories, such as rent, utilities, and savings.

- Save: Set aside funds for retirement, emergencies, or large purchases.

- Plan: Adjust your spending habits or benefit elections to optimize your financial situation.

By understanding your pay stub, you’ll be better equipped to manage your finances effectively.

📝 Note: Keep a record of your pay stubs to track changes in your earnings, deductions, and benefits over time.

🤔 Note: If you're unsure about any aspect of your pay stub, don't hesitate to reach out to your HR department or payroll for clarification.

Now that you’ve gained a better understanding of your pay stub, you’ll be able to navigate the complex world of payroll with confidence. Remember to review your pay stub regularly to ensure you’re getting the compensation you deserve.

What is the difference between gross pay and net pay?

+Gross pay is your total earnings before deductions, while net pay is your take-home pay after deductions.

Why are taxes withheld from my paycheck?

+Taxes are withheld to pay for federal, state, and local taxes. The amount withheld is based on your income tax bracket and the number of dependents you claim.

Can I adjust my benefit elections or deductions?

+Yes, you can adjust your benefit elections or deductions, but it may depend on your employer’s policies and the specific plans you’re enrolled in. Consult with your HR department or payroll for more information.