Create a Ramsey Budget Worksheet Easily Today

Take Control of Your Finances with a Ramsey Budget Worksheet

Creating a budget can be a daunting task, but with the right tools and a solid plan, you can take control of your finances and achieve financial stability. A Ramsey budget worksheet is an excellent tool to help you manage your money effectively. In this article, we’ll guide you through the process of creating a Ramsey budget worksheet easily and efficiently.

Understanding the 7 Baby Steps

Before we dive into creating a budget worksheet, it’s essential to understand the 7 Baby Steps, a financial plan created by Dave Ramsey. These steps provide a clear roadmap to financial stability and are the foundation of the Ramsey budget worksheet.

- Save $1,000 as an emergency fund: This step helps you cover unexpected expenses and avoid debt.

- Pay off all debt using the Debt Snowball: List all your debts, from smallest to largest, and focus on paying off the smallest one first.

- Save 3-6 months of expenses in a savings account: This step helps you build a more extensive emergency fund.

- Invest 15% of your income in retirement accounts: Start building wealth by investing in your future.

- Save for college expenses: If you have children, start saving for their education expenses.

- Pay off your mortgage: Focus on paying off your mortgage to eliminate debt and build wealth.

- Build wealth and give generously: Once you’ve completed the previous steps, focus on building wealth and giving back to your community.

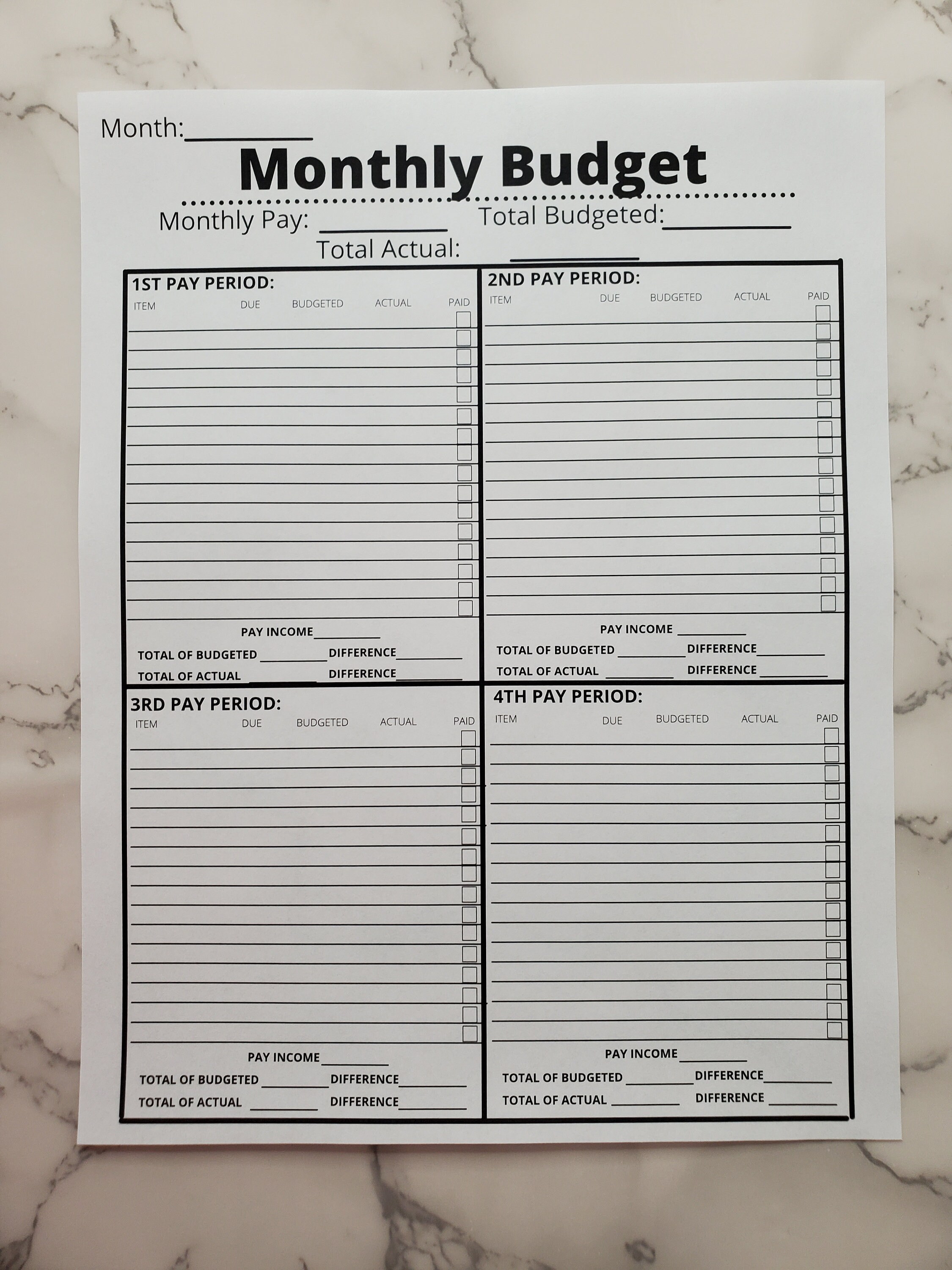

Creating a Ramsey Budget Worksheet

Now that you understand the 7 Baby Steps, it’s time to create a Ramsey budget worksheet. Here’s a step-by-step guide to help you get started:

- Gather your financial information: Collect all your financial documents, including pay stubs, bills, and bank statements.

- Calculate your income: Determine how much money you have coming in each month.

- List your expenses: Categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies).

- Assign percentages: Allocate 50-30-20 percentages to your income:

- 50% for needs

- 30% for discretionary spending

- 20% for saving and debt repayment

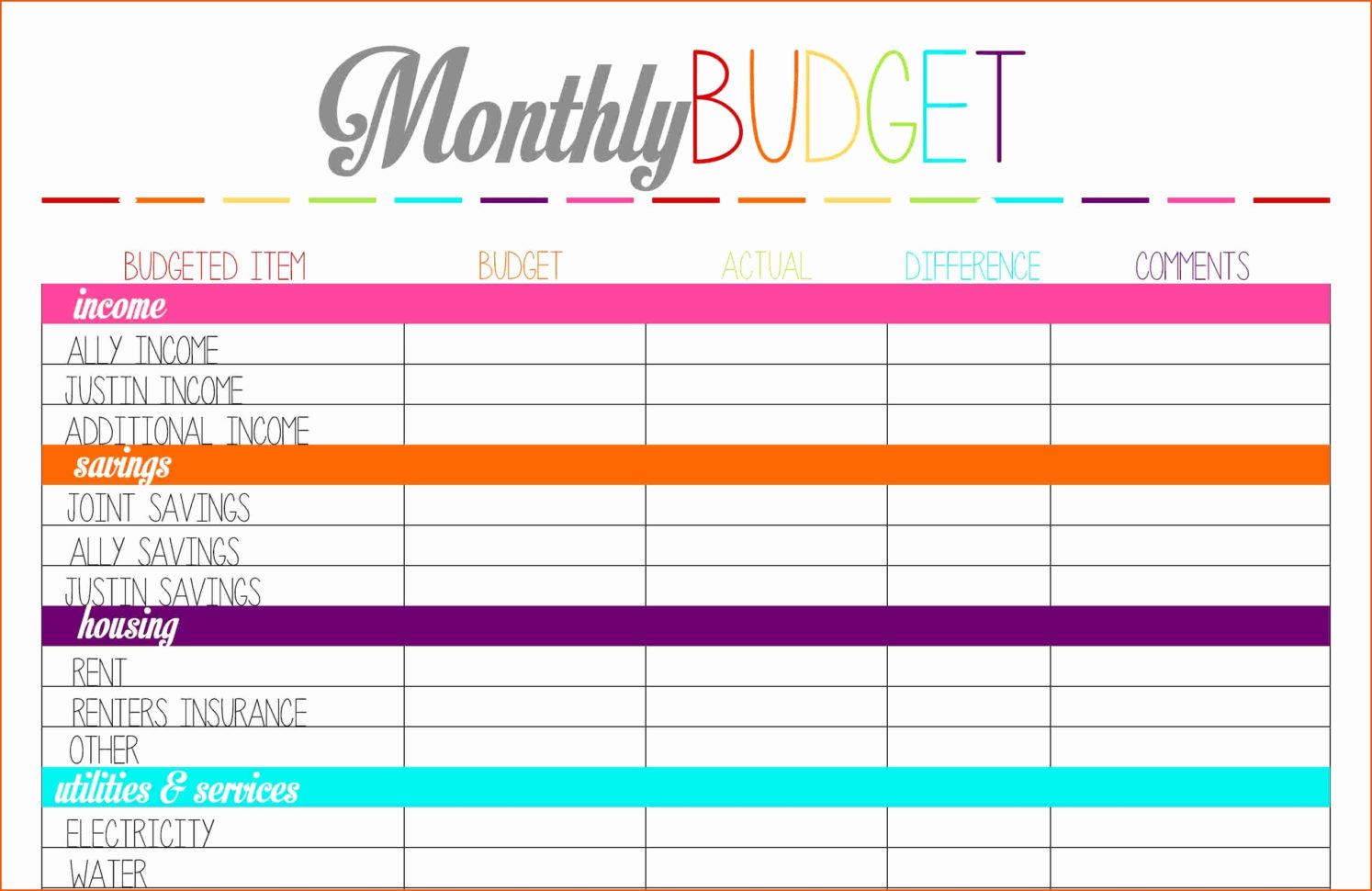

- Fill out the budget worksheet: Use the following table to create your budget worksheet:

| Category | Budgeted Amount | Actual Spending |

|---|---|---|

| Income | $____________ | $____________ |

| Housing | $____________ | $____________ |

| Utilities | $____________ | $____________ |

| Food | $____________ | $____________ |

| Transportation | $____________ | $____________ |

| Insurance | $____________ | $____________ |

| Debt Repayment | $____________ | $____________ |

| Savings | $____________ | $____________ |

| Entertainment | $____________ | $____________ |

| Miscellaneous | $____________ | $____________ |

Tracking Your Expenses

To ensure you’re staying on track with your budget, it’s essential to track your expenses regularly. Here are some tips to help you stay on track:

- Use a budgeting app: Consider using a budgeting app like Mint or You Need a Budget (YNAB) to track your expenses.

- Keep receipts: Keep receipts for all your purchases, no matter how small.

- Review your budget regularly: Regularly review your budget to ensure you’re staying on track.

📝 Note: Tracking your expenses can help you identify areas where you can cut back and make adjustments to your budget.

Conclusion

Creating a Ramsey budget worksheet is a straightforward process that can help you take control of your finances and achieve financial stability. By following the 7 Baby Steps and using the budget worksheet, you can create a clear plan for managing your money and achieving your financial goals. Remember to regularly track your expenses and review your budget to ensure you’re staying on track.

What is the Debt Snowball method?

+The Debt Snowball method is a debt reduction strategy that involves listing all your debts, from smallest to largest, and focusing on paying off the smallest one first. Once you’ve paid off the smallest debt, use the money to attack the next smallest debt, and so on.

How often should I review my budget?

+It’s essential to review your budget regularly to ensure you’re staying on track. Consider reviewing your budget every month or every quarter to make adjustments and stay focused on your financial goals.

Can I use a budgeting app to track my expenses?

+Yes, there are many budgeting apps available that can help you track your expenses, such as Mint or You Need a Budget (YNAB). These apps can help you stay on top of your finances and make it easier to stick to your budget.