5 Ways to Maximize Qualified Dividends

Understanding Qualified Dividends

Qualified dividends are a type of investment income that is taxed at a lower rate compared to ordinary income. To qualify for the lower tax rate, the dividend must meet certain requirements set by the IRS. Understanding these requirements and how to maximize qualified dividends can help investors minimize their tax liability and keep more of their investment earnings.

What are Qualified Dividends?

Qualified dividends are dividends paid by a U.S. corporation or a qualified foreign corporation that meet certain requirements. To be considered qualified, the dividend must be:

- Paid by a U.S. corporation or a qualified foreign corporation

- Held for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date

- Not considered a dividend from a tax-exempt organization

- Not considered a dividend from a corporation that is a tax-exempt organization

5 Ways to Maximize Qualified Dividends

Here are five ways to maximize qualified dividends and minimize your tax liability:

1. Invest in Dividend-Paying Stocks

Investing in dividend-paying stocks is one of the most straightforward ways to maximize qualified dividends. Look for established companies with a history of paying consistent dividends. Some popular dividend-paying stocks include:

- Real Estate Investment Trusts (REITs)

- Master Limited Partnerships (MLPs)

- Large-cap stocks with a history of paying consistent dividends

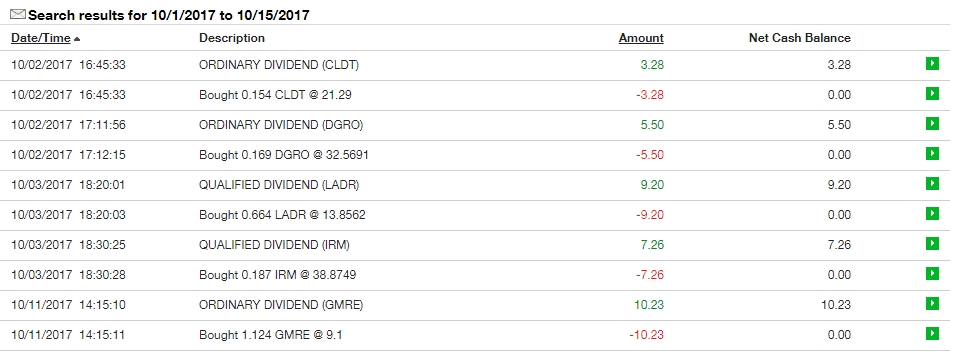

2. Use a Dividend Reinvestment Plan

A dividend reinvestment plan (DRIP) allows you to automatically reinvest your dividend payments into additional shares of the same stock. This can help you maximize your qualified dividends by:

- Reducing the amount of cash you need to invest in the stock

- Increasing the number of shares you own, which can lead to more dividend payments

3. Invest in a Dividend-Focused Mutual Fund

Dividend-focused mutual funds invest in a portfolio of dividend-paying stocks, providing a diversified way to maximize qualified dividends. Look for funds with a history of consistent dividend payments and a low expense ratio.

4. Use a Tax-Efficient Withdrawal Strategy

When withdrawing from a tax-deferred account, such as a 401(k) or IRA, consider using a tax-efficient withdrawal strategy to minimize your tax liability. This may include:

- Withdrawing dividends first, as they are taxed at a lower rate than ordinary income

- Withdrawing from tax-deferred accounts in retirement, when your tax rate may be lower

5. Consult a Tax Professional

A tax professional can help you navigate the complex rules surrounding qualified dividends and provide personalized advice on how to maximize your qualified dividends. They can also help you:

- Identify tax-loss harvesting opportunities to offset gains from dividend-paying stocks

- Develop a tax-efficient investment strategy that takes into account your individual financial situation

📝 Note: It's essential to consult a tax professional to ensure that your investments meet the requirements for qualified dividends and to optimize your tax strategy.

Table: Qualified Dividend Tax Rates

| Taxable Income | Qualified Dividend Tax Rate |

|---|---|

| 0 - 40,400 | 0% |

| 40,401 - 445,850 | 15% |

| $445,851 and above | 20% |

Maximizing Qualified Dividends: A Key to Tax-Efficient Investing

Maximizing qualified dividends requires a combination of investment strategy, tax planning, and regular portfolio monitoring. By understanding the requirements for qualified dividends and using the strategies outlined above, investors can minimize their tax liability and keep more of their investment earnings.

In summary, maximizing qualified dividends involves investing in dividend-paying stocks, using a dividend reinvestment plan, investing in a dividend-focused mutual fund, using a tax-efficient withdrawal strategy, and consulting a tax professional. By following these strategies, investors can optimize their tax strategy and keep more of their investment earnings.

What are qualified dividends?

+Qualified dividends are dividends paid by a U.S. corporation or a qualified foreign corporation that meet certain requirements set by the IRS.

How are qualified dividends taxed?

+Qualified dividends are taxed at a lower rate compared to ordinary income, with rates ranging from 0% to 20% depending on taxable income.

What is a dividend reinvestment plan?

+A dividend reinvestment plan (DRIP) allows you to automatically reinvest your dividend payments into additional shares of the same stock.