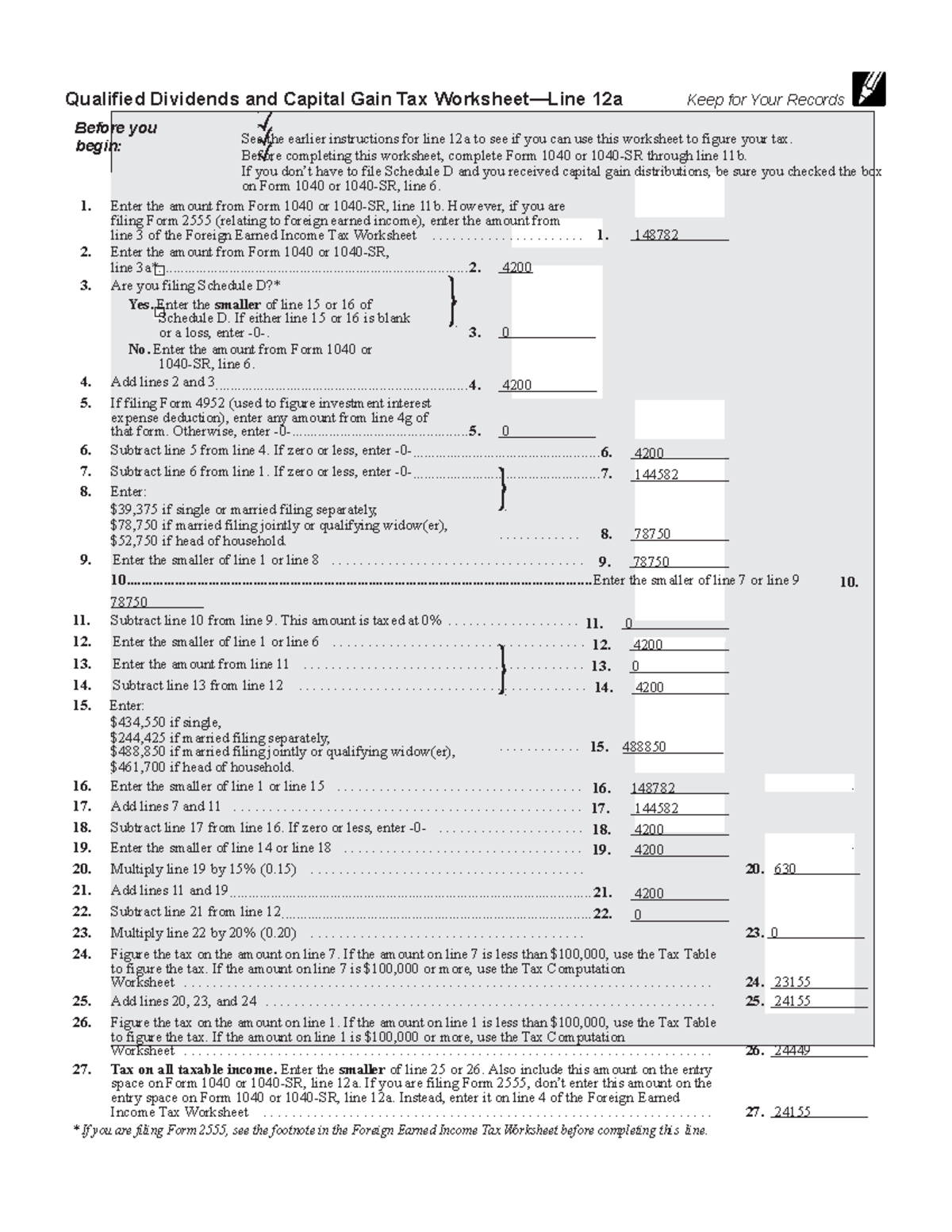

Simplify Your Taxes: Qualified Dividends and Capital Gains

Understanding Qualified Dividends and Capital Gains

When it comes to investing, understanding the tax implications of your investments is crucial to maximizing your returns. Two important concepts to grasp are qualified dividends and capital gains. In this article, we will delve into the world of qualified dividends and capital gains, explaining what they are, how they are taxed, and providing tips on how to simplify your taxes.

What are Qualified Dividends?

Qualified dividends are a type of dividend that is eligible for a lower tax rate. To qualify, the dividend must meet certain requirements:

- The dividend must be paid by a U.S. corporation or a qualified foreign corporation.

- The dividend must be paid on a share of stock that you have held for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date.

- The corporation paying the dividend must have a significant presence in the United States.

Qualified dividends are taxed at a lower rate than ordinary income. The tax rate on qualified dividends is 0%, 15%, or 20%, depending on your tax bracket.

What are Capital Gains?

Capital gains occur when you sell an investment, such as a stock, bond, or mutual fund, for more than its original purchase price. There are two types of capital gains:

- Short-term capital gains: These occur when you sell an investment that you have held for one year or less. Short-term capital gains are taxed as ordinary income.

- Long-term capital gains: These occur when you sell an investment that you have held for more than one year. Long-term capital gains are taxed at a lower rate than ordinary income.

Tax Rates on Qualified Dividends and Capital Gains

The tax rates on qualified dividends and capital gains are as follows:

| Taxable Income | Qualified Dividends | Long-term Capital Gains |

|---|---|---|

| 0 - 40,125 | 0% | 0% |

| 40,126 - 445,850 | 15% | 15% |

| $445,851 and above | 20% | 20% |

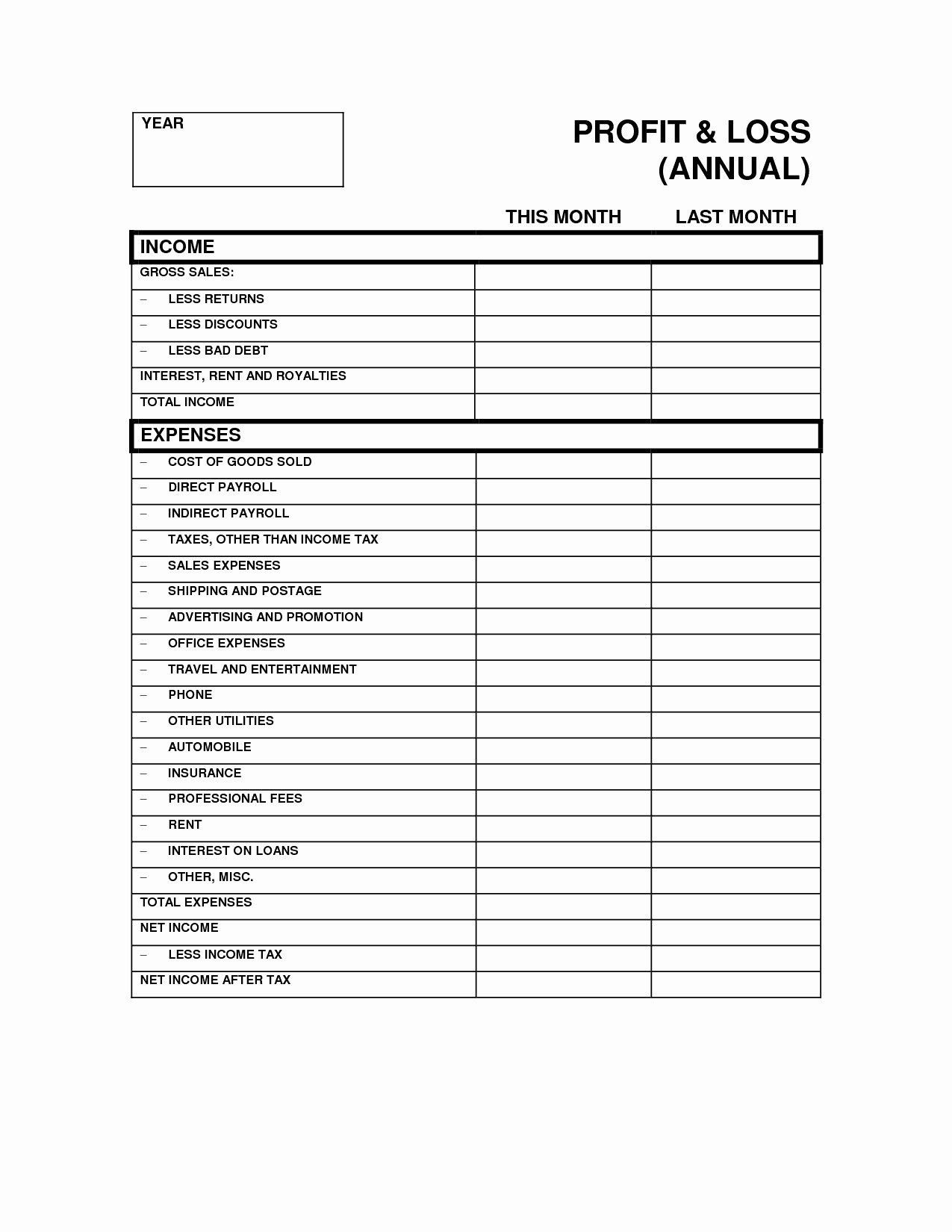

How to Simplify Your Taxes

To simplify your taxes, consider the following tips:

- Keep accurate records: Keep track of your investment purchases and sales, as well as any dividends you receive. This will help you accurately report your income and calculate your taxes.

- Hold investments for the long term: Holding investments for more than one year can help you qualify for lower tax rates on capital gains.

- Invest in tax-efficient funds: Consider investing in index funds or other tax-efficient funds that minimize turnover and capital gains distributions.

- Consider tax-loss harvesting: If you have investments that have declined in value, consider selling them to offset gains from other investments.

📝 Note: Tax laws and rates are subject to change, so it's essential to consult with a tax professional or financial advisor to ensure you are in compliance with current tax laws.

Example of Qualified Dividends and Capital Gains

Let’s say you own 100 shares of XYZ stock, which you purchased for 50 per share. You hold the stock for two years and then sell it for 75 per share. The sale of the stock results in a long-term capital gain of 2,500 (7,500 - $5,000).

If the corporation pays a qualified dividend of 1 per share, you will receive a total dividend of 100. Assuming you are in the 24% tax bracket, the qualified dividend will be taxed at 15%, resulting in a tax liability of $15.

| Investment | Purchase Price | Sale Price | Capital Gain | Tax Rate | Tax Liability |

|---|---|---|---|---|---|

| XYZ Stock | $5,000 | $7,500 | $2,500 | 15% | $375 |

| Qualified Dividend | - | - | - | 15% | $15 |

Tips for Minimizing Taxes on Qualified Dividends and Capital Gains

Here are some additional tips for minimizing taxes on qualified dividends and capital gains:

- Consider investing in a tax-deferred account: Investing in a 401(k) or IRA can help you defer taxes on your investments until you withdraw the funds.

- Use tax-loss harvesting: Selling investments that have declined in value can help you offset gains from other investments.

- Invest in municipal bonds: Municipal bonds are tax-free at the federal level and may be tax-free at the state and local level.

What is the difference between a qualified dividend and an ordinary dividend?

+A qualified dividend is eligible for a lower tax rate, while an ordinary dividend is taxed as ordinary income. Qualified dividends must meet certain requirements, such as being paid by a U.S. corporation or a qualified foreign corporation.

How do I report qualified dividends and capital gains on my tax return?

+Qualified dividends and capital gains are reported on Schedule D of Form 1040. You will need to complete Form 8949 to report your capital gains and losses.

Can I deduct investment expenses on my tax return?

+Yes, you may be able to deduct investment expenses, such as investment management fees, on your tax return. However, these expenses are subject to certain limits and phase-outs.

In conclusion, understanding qualified dividends and capital gains is essential to minimizing taxes on your investments. By keeping accurate records, holding investments for the long term, and investing in tax-efficient funds, you can simplify your taxes and maximize your returns.