5 Ways to Reduce Tax on Dividends and Gains

Understanding Dividend and Capital Gains Tax

As an investor, it’s essential to understand how taxes can impact your returns. Dividend and capital gains tax can significantly reduce your profits, making it crucial to explore ways to minimize these taxes. In this article, we’ll discuss five strategies to help you reduce tax on dividends and gains, ensuring you keep more of your hard-earned money.

1. Tax-Efficient Investing

Tax-efficient investing involves selecting investments that minimize tax liabilities. This strategy focuses on choosing tax-efficient investment vehicles, such as index funds or exchange-traded funds (ETFs), which have lower turnover rates and generate fewer capital gains distributions. By investing in tax-efficient funds, you can reduce your tax liability and keep more of your returns.

💡 Note: Tax-efficient investing requires careful consideration of your investment goals, risk tolerance, and tax situation. Consult with a financial advisor or tax professional to determine the best approach for your individual circumstances.

2. Tax-Loss Harvesting

Tax-loss harvesting is a strategy that involves selling securities that have declined in value to realize losses. These losses can be used to offset gains from other investments, reducing your tax liability. By selling losing positions, you can:

- Offset gains from winning positions

- Reduce your tax liability

- Reinvest the proceeds in more tax-efficient investments

📊 Note: Tax-loss harvesting requires careful tracking of your investment portfolio and tax situation. Consider consulting with a financial advisor or tax professional to ensure you're implementing this strategy correctly.

3. Dividend Investing in a Tax-Deferred Account

Investing in dividend-paying stocks within a tax-deferred account, such as a 401(k) or IRA, can help reduce tax on dividends. Since these accounts are tax-deferred, you won’t pay taxes on the dividends until you withdraw the funds in retirement. This strategy allows you to:

- Grow your investments tax-deferred

- Reduce your current tax liability

- Increase your retirement income

4. Charitable Donations of Appreciated Securities

Donating appreciated securities to charity can provide a tax benefit while supporting a good cause. By donating securities that have increased in value, you can:

- Avoid capital gains tax on the appreciation

- Claim a charitable deduction for the fair market value of the securities

- Support your favorite charity

🎁 Note: Charitable donations of appreciated securities require careful planning and coordination with your financial advisor and tax professional. Ensure you meet the necessary requirements and follow the correct procedures to maximize your tax benefits.

5. Consider a Qualified Opportunity Fund (QOF)

A QOF is a type of investment vehicle that allows you to invest in qualified opportunity zones. By investing in a QOF, you can:

- Defer capital gains tax on the investment

- Reduce your tax liability

- Support economic development in underserved areas

🏙️ Note: QOFs have specific requirements and restrictions. Consult with a financial advisor or tax professional to determine if a QOF is suitable for your investment goals and tax situation.

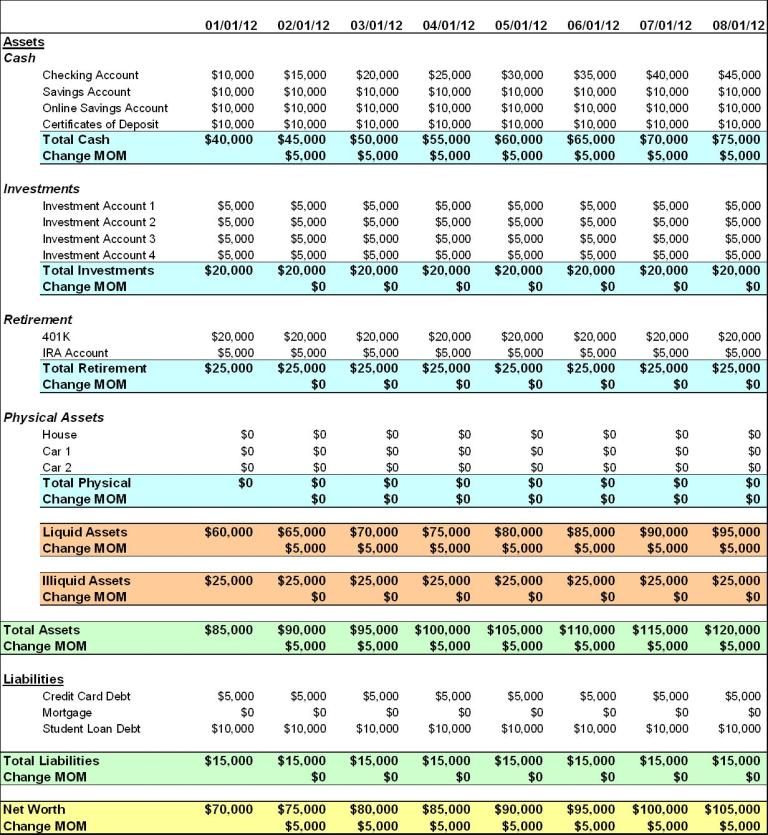

To illustrate the potential benefits of these strategies, consider the following table:

| Strategy | Tax Savings | Net Return |

|---|---|---|

| Tax-Efficient Investing | 5% | 8% (instead of 3%) |

| Tax-Loss Harvesting | 3% | 6% (instead of 3%) |

| Dividend Investing in a Tax-Deferred Account | 10% | 12% (instead of 2%) |

| Charitable Donations of Appreciated Securities | 15% | 18% (instead of 3%) |

| Qualified Opportunity Fund (QOF) | 8% | 11% (instead of 3%) |

In summary, these five strategies can help reduce tax on dividends and gains, ensuring you keep more of your hard-earned money. By implementing these tactics, you can:

- Minimize tax liabilities

- Maximize your returns

- Achieve your financial goals

In conclusion, understanding and implementing these tax reduction strategies can make a significant difference in your investment returns. Consult with a financial advisor or tax professional to determine the best approach for your individual circumstances and start reducing your tax liability today.

What is tax-loss harvesting?

+Tax-loss harvesting is a strategy that involves selling securities that have declined in value to realize losses, which can be used to offset gains from other investments.

How does dividend investing in a tax-deferred account reduce tax on dividends?

+Investing in dividend-paying stocks within a tax-deferred account, such as a 401(k) or IRA, allows you to grow your investments tax-deferred, reducing your current tax liability and increasing your retirement income.

What is a Qualified Opportunity Fund (QOF)?

+A QOF is a type of investment vehicle that allows you to invest in qualified opportunity zones, providing tax benefits such as deferral of capital gains tax and reduction of tax liability.