Calculating Tax on Investments: Qualified Dividends and Capital Gains

Understanding Tax on Investments

When it comes to investing, understanding the tax implications is crucial to maximize your returns. The tax landscape can be complex, but this post aims to break down the key concepts related to qualified dividends and capital gains, providing you with a solid foundation to make informed investment decisions.

What are Qualified Dividends?

Qualified dividends are a type of dividend income that is eligible for a lower tax rate. To qualify, the dividend must meet certain requirements:

- Issued by a U.S. corporation: The dividend must be paid by a U.S. corporation or a qualified foreign corporation.

- Held for a minimum period: The investor must have held the stock for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date.

- Not classified as a dividend under certain rules: The dividend must not be classified as a dividend under certain rules, such as those related to dividends received from a foreign corporation.

📝 Note: The list of qualified foreign corporations can be found in the IRS Publication 550.

How are Qualified Dividends Taxed?

Qualified dividends are taxed at a lower rate than ordinary income. The tax rate depends on the investor’s taxable income and filing status.

| Taxable Income | Single Filers | Joint Filers |

|---|---|---|

| 0 - 40,000 | 0% | 0% |

| 40,001 - 445,850 | 15% | 15% |

| $445,851 or more | 20% | 20% |

For example, if a single filer has a taxable income of 50,000 and receives 1,000 in qualified dividends, the tax rate on those dividends would be 15%.

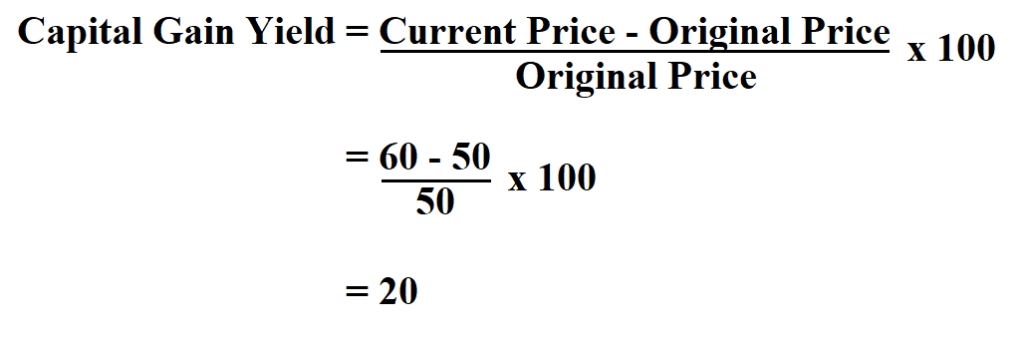

What are Capital Gains?

Capital gains occur when an investor sells a security, such as a stock or mutual fund, for a profit. The gain is calculated by subtracting the cost basis (the original purchase price) from the sale price.

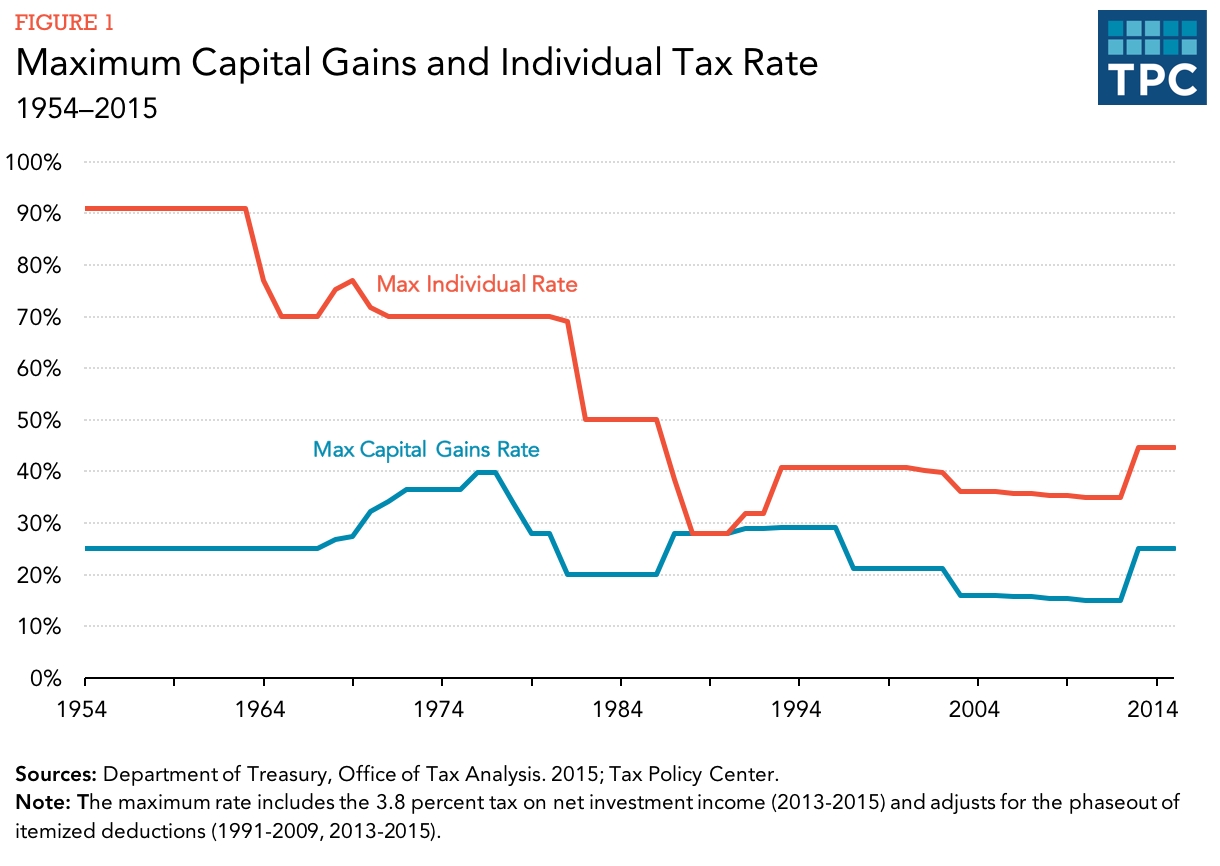

Short-Term vs. Long-Term Capital Gains

Capital gains can be classified as short-term or long-term, depending on the holding period.

- Short-term capital gains: Occur when the security is held for one year or less.

- Long-term capital gains: Occur when the security is held for more than one year.

How are Capital Gains Taxed?

The tax rate on capital gains depends on the holding period and the investor’s taxable income.

| Holding Period | Tax Rate |

|---|---|

| One year or less (short-term) | Ordinary income tax rate |

| More than one year (long-term) | 0%, 15%, or 20% |

Long-Term Capital Gains Tax Rates

| Taxable Income | Single Filers | Joint Filers |

|---|---|---|

| 0 - 40,000 | 0% | 0% |

| 40,001 - 445,850 | 15% | 15% |

| $445,851 or more | 20% | 20% |

For example, if a single filer has a taxable income of 50,000 and sells a stock for a 10,000 profit after holding it for two years, the tax rate on that gain would be 15%.

Calculating Tax on Investments

To calculate the tax on investments, follow these steps:

- Determine the type of income: Is it a qualified dividend or a capital gain?

- Calculate the gain or dividend: Determine the amount of the gain or dividend.

- Determine the tax rate: Based on the investor’s taxable income and the type of income.

- Apply the tax rate: Calculate the tax owed on the gain or dividend.

| Investment Type | Taxable Income | Tax Rate | Tax Owed |

|---|---|---|---|

| Qualified Dividend | $50,000 | 15% | $150 (15% of $1,000 dividend) |

| Long-Term Capital Gain | $50,000 | 15% | $1,500 (15% of $10,000 gain) |

By understanding the tax implications of qualified dividends and capital gains, investors can make informed decisions to minimize their tax liability and maximize their returns.

To summarize, it’s essential to understand the tax implications of investments to make informed decisions. By knowing the difference between qualified dividends and capital gains, investors can minimize their tax liability and maximize their returns. Keep in mind that tax laws and regulations can change, so it’s always a good idea to consult with a tax professional or financial advisor to ensure you’re making the most tax-efficient decisions for your investments.

What is the difference between qualified dividends and ordinary dividends?

+Qualified dividends are taxed at a lower rate than ordinary dividends. Qualified dividends meet certain requirements, such as being paid by a U.S. corporation and being held for a minimum period.

How do I calculate the tax on a long-term capital gain?

+To calculate the tax on a long-term capital gain, determine the gain amount and apply the applicable tax rate based on your taxable income and filing status.

Are all capital gains taxed at the same rate?

+No, capital gains can be taxed at different rates depending on the holding period. Short-term capital gains are taxed at the ordinary income tax rate, while long-term capital gains are taxed at a lower rate.