Photographer Tax Deduction Worksheet: Maximize Your Business Savings

Understanding Tax Deductions for Photographers

As a photographer, you’re likely aware that your profession comes with a unique set of expenses. From equipment and software to travel and marketing, the costs of running a photography business can add up quickly. Fortunately, many of these expenses are eligible for tax deductions, which can help minimize your taxable income and reduce your tax liability. In this article, we’ll provide a comprehensive guide to help you navigate the world of tax deductions for photographers.

Business Expenses vs. Personal Expenses

Before we dive into the specific deductions available to photographers, it’s essential to understand the difference between business expenses and personal expenses. Business expenses are costs incurred solely for the purpose of generating income from your photography business. Examples might include:

- Equipment purchases (e.g., cameras, lenses, tripods)

- Software and editing tools (e.g., Adobe Creative Cloud)

- Marketing expenses (e.g., website design, advertising)

- Travel expenses related to photo shoots or conferences

Personal expenses, on the other hand, are costs that are not directly related to your business. Examples might include:

- Personal camera equipment used for non-business purposes

- Travel expenses for vacations or personal trips

- Home office expenses that are not dedicated solely to your business

Tax Deductions for Photographers

Now that we’ve covered the basics, let’s explore some specific tax deductions available to photographers:

- Equipment and Supplies: Deduct the cost of cameras, lenses, tripods, lighting equipment, and other supplies used for your business.

- Software and Editing Tools: Deduct the cost of software subscriptions (e.g., Adobe Creative Cloud) and editing tools used for your business.

- Marketing Expenses: Deduct the cost of marketing materials (e.g., business cards, brochures), website design, and advertising expenses.

- Travel Expenses: Deduct the cost of travel expenses related to photo shoots or conferences, including transportation, meals, and lodging.

- Home Office Deduction: If you use a dedicated space in your home for your business, you may be eligible for a home office deduction. This can include a portion of your rent or mortgage interest, utilities, and other expenses.

- Education and Training: Deduct the cost of workshops, conferences, and online courses related to photography and business development.

- Insurance: Deduct the cost of liability insurance, equipment insurance, and other insurance premiums related to your business.

📝 Note: Keep accurate records of all business expenses, including receipts, invoices, and bank statements, to support your tax deductions.

Tracking Expenses for Tax Deductions

To maximize your tax deductions, it’s crucial to track your expenses throughout the year. Here are some tips to help you stay organized:

- Use Accounting Software: Utilize accounting software (e.g., QuickBooks, Xero) to track your expenses and categorize them for tax purposes.

- Keep a Separate Business Bank Account: Maintain a separate business bank account to keep your business expenses separate from personal expenses.

- Use a Credit Card or Debit Card: Use a credit card or debit card for business expenses to help track and categorize expenses.

- Keep Receipts and Invoices: Keep receipts and invoices for all business expenses, including small purchases (e.g., coffee, snacks).

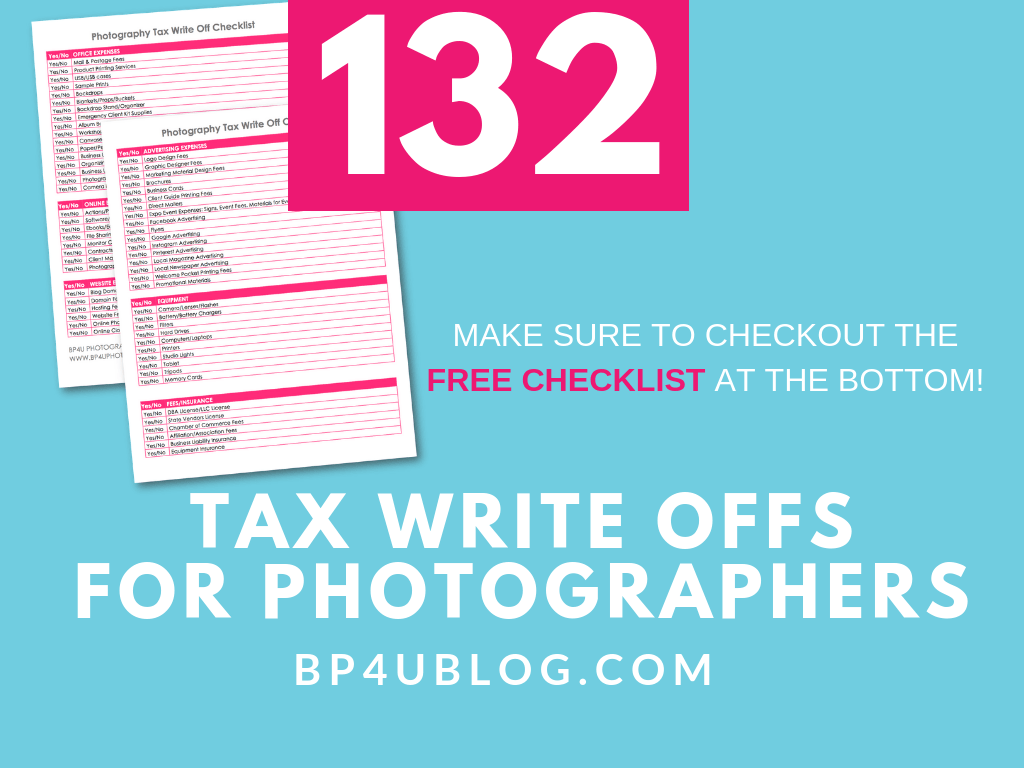

Photographer Tax Deduction Worksheet

To help you stay organized and maximize your tax deductions, we’ve created a worksheet to track your expenses throughout the year.

| Expense Category | January | February | March | April | May | June | July | August | September | October | November | December |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equipment and Supplies | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ |

| Software and Editing Tools | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ |

| Marketing Expenses | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ |

| Travel Expenses | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ |

| Home Office Deduction | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ |

| Education and Training | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ |

| Insurance | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ |

By using this worksheet to track your expenses throughout the year, you’ll be well-prepared to maximize your tax deductions come tax season.

In conclusion, tax deductions can play a significant role in reducing your taxable income and minimizing your tax liability. By understanding the different types of tax deductions available to photographers and keeping accurate records of your expenses, you can ensure you’re taking advantage of all the deductions you’re eligible for.

What is the difference between business expenses and personal expenses?

+Business expenses are costs incurred solely for the purpose of generating income from your photography business, while personal expenses are costs that are not directly related to your business.

How do I track my expenses for tax deductions?

+Use accounting software, keep a separate business bank account, and use a credit card or debit card for business expenses to help track and categorize expenses.

What is the home office deduction, and how do I qualify?

+The home office deduction allows you to deduct a portion of your rent or mortgage interest, utilities, and other expenses related to your home office. To qualify, you must use a dedicated space in your home for your business and keep accurate records of your expenses.

Related Terms:

- Photographer tax deductions

- Camera tax deduction

- Do freelance photographers pay taxes

- Is Canva tax deductible

- Photographer not paying taxes

- Photography expenses spreadsheet