5 Ways to Calculate Nebraska Inheritance Tax

Understanding Nebraska Inheritance Tax

When a loved one passes away, the last thing on your mind is dealing with taxes. However, it’s essential to understand the tax implications of inheriting assets in Nebraska. Nebraska inheritance tax is a tax on the transfer of property from a deceased person to their beneficiaries. In this article, we will explore five ways to calculate Nebraska inheritance tax and provide you with a comprehensive guide to navigating this complex topic.

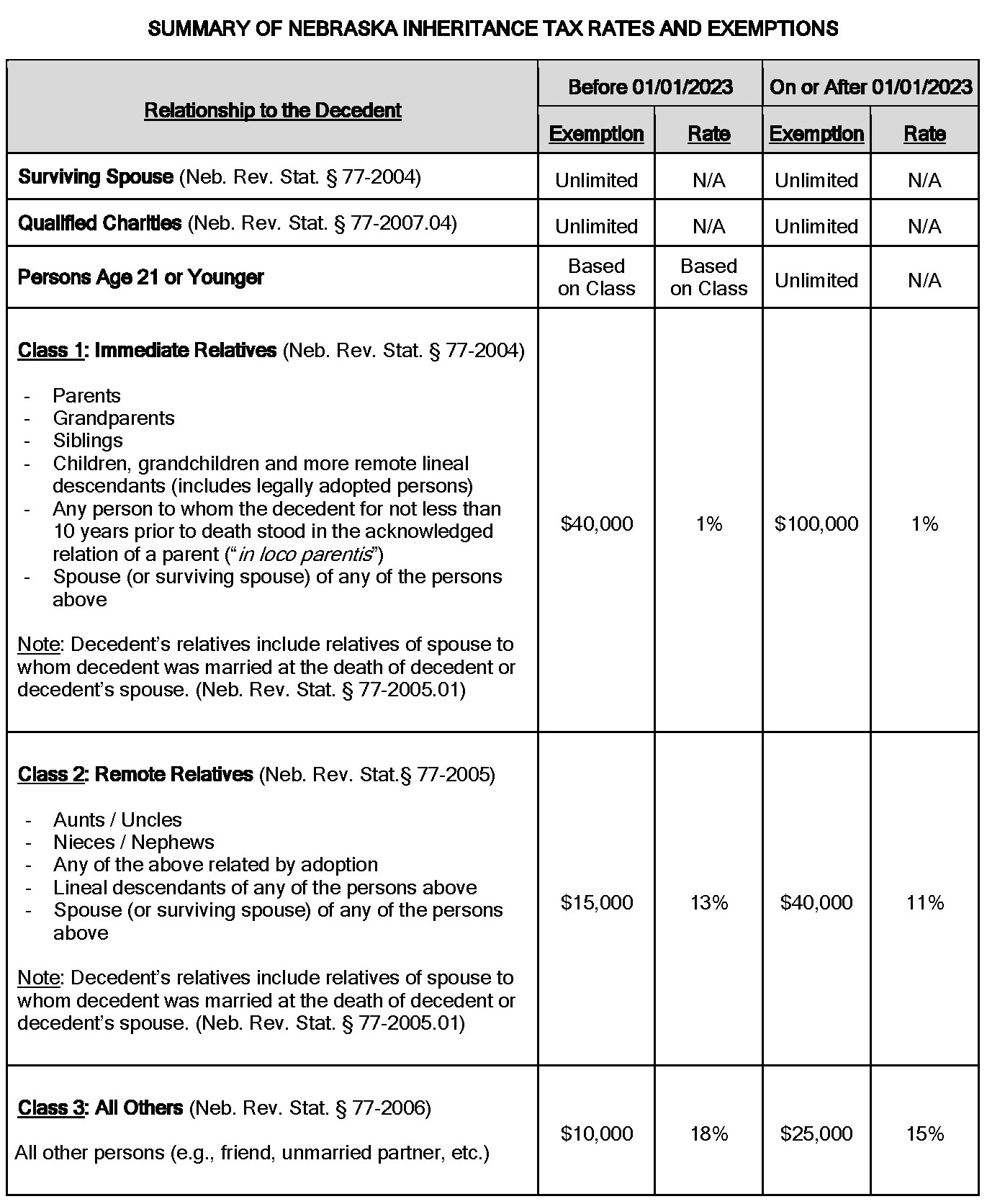

Nebraska Inheritance Tax Rates

Before we dive into the calculation methods, it’s crucial to understand the tax rates applicable in Nebraska. The state has a progressive tax system, with rates ranging from 1% to 18%. The tax rates are applied to the taxable value of the estate, which is determined by the total value of the assets minus any deductions and exemptions.

| Taxable Value of Estate | Tax Rate |

|---|---|

| 0 - $25,000 | 1% |

| $25,001 - $50,000 | 2% |

| $50,001 - $100,000 | 4% |

| $100,001 - $200,000 | 6% |

| $200,001 - $500,000 | 10% |

| $500,001 - $1,000,000 | 12% |

| $1,000,001 and above | 18% |

Method 1: Calculating Tax Using the Tax Rate Schedule

One way to calculate Nebraska inheritance tax is by using the tax rate schedule. To do this, you’ll need to determine the taxable value of the estate and then apply the corresponding tax rate.

📝 Note: This method is suitable for small estates with straightforward calculations.

For example, let’s say the taxable value of the estate is $75,000. Using the tax rate schedule, you would apply a tax rate of 4% to the entire amount.

Tax = 75,000 x 4% = 3,000

Method 2: Using a Tax Calculator or Software

Another way to calculate Nebraska inheritance tax is by using a tax calculator or software. These tools can help simplify the calculation process and reduce errors.

💻 Note: Make sure to choose a reputable and up-to-date tax calculator or software.

Some popular tax calculators and software include TurboTax, H&R Block, and TaxAct. These tools will guide you through the calculation process and provide you with an accurate estimate of the inheritance tax owed.

Method 3: Consulting a Tax Professional

If you’re not comfortable calculating the inheritance tax yourself, you can consult a tax professional. A tax professional can help you navigate the complex tax laws and ensure you’re taking advantage of all available deductions and exemptions.

🤝 Note: Choose a tax professional with experience in Nebraska inheritance tax law.

A tax professional can also help you with more complex calculations, such as those involving trusts, gifts, and charitable donations.

Method 4: Using a Tax Planning Strategy

Another way to calculate Nebraska inheritance tax is by using a tax planning strategy. This involves taking steps to minimize the taxable value of the estate and reduce the amount of inheritance tax owed.

📈 Note: Tax planning strategies should be implemented before the deceased person's passing.

Some common tax planning strategies include:

- Creating a trust to hold assets

- Making gifts to beneficiaries during the deceased person’s lifetime

- Establishing a charitable foundation

- Using life insurance to pay inheritance tax

Method 5: Filing a Tax Return

The final way to calculate Nebraska inheritance tax is by filing a tax return. The executor of the estate is responsible for filing the inheritance tax return, which must be submitted to the Nebraska Department of Revenue.

📝 Note: The inheritance tax return must be filed within 12 months of the deceased person's passing.

The tax return will require you to report the taxable value of the estate, claim any deductions and exemptions, and calculate the inheritance tax owed.

Conclusion

Calculating Nebraska inheritance tax can be a complex and time-consuming process. By using one of the five methods outlined above, you can ensure you’re meeting your tax obligations and minimizing the amount of inheritance tax owed. Remember to seek professional advice if you’re unsure about any aspect of the calculation process.

What is the deadline for filing the Nebraska inheritance tax return?

+The inheritance tax return must be filed within 12 months of the deceased person’s passing.

Can I use a tax calculator or software to calculate Nebraska inheritance tax?

+Yes, you can use a tax calculator or software to calculate Nebraska inheritance tax. However, make sure to choose a reputable and up-to-date tool.

What is the highest tax rate applicable in Nebraska inheritance tax?

+The highest tax rate applicable in Nebraska inheritance tax is 18%.