Magical Rental Income Worksheet Simplified

Unlocking the Secrets of Magical Rental Income: A Simplified Worksheet

Are you a real estate investor looking to unlock the secrets of magical rental income? Do you want to maximize your returns and minimize your stress? Look no further! In this article, we will guide you through a simplified worksheet to help you achieve your goals.

Understanding Rental Income

Before we dive into the worksheet, let’s understand the basics of rental income. Rental income is the money you earn from renting out a property to tenants. It’s a passive income stream that can provide a steady flow of cash, but it requires careful planning and management.

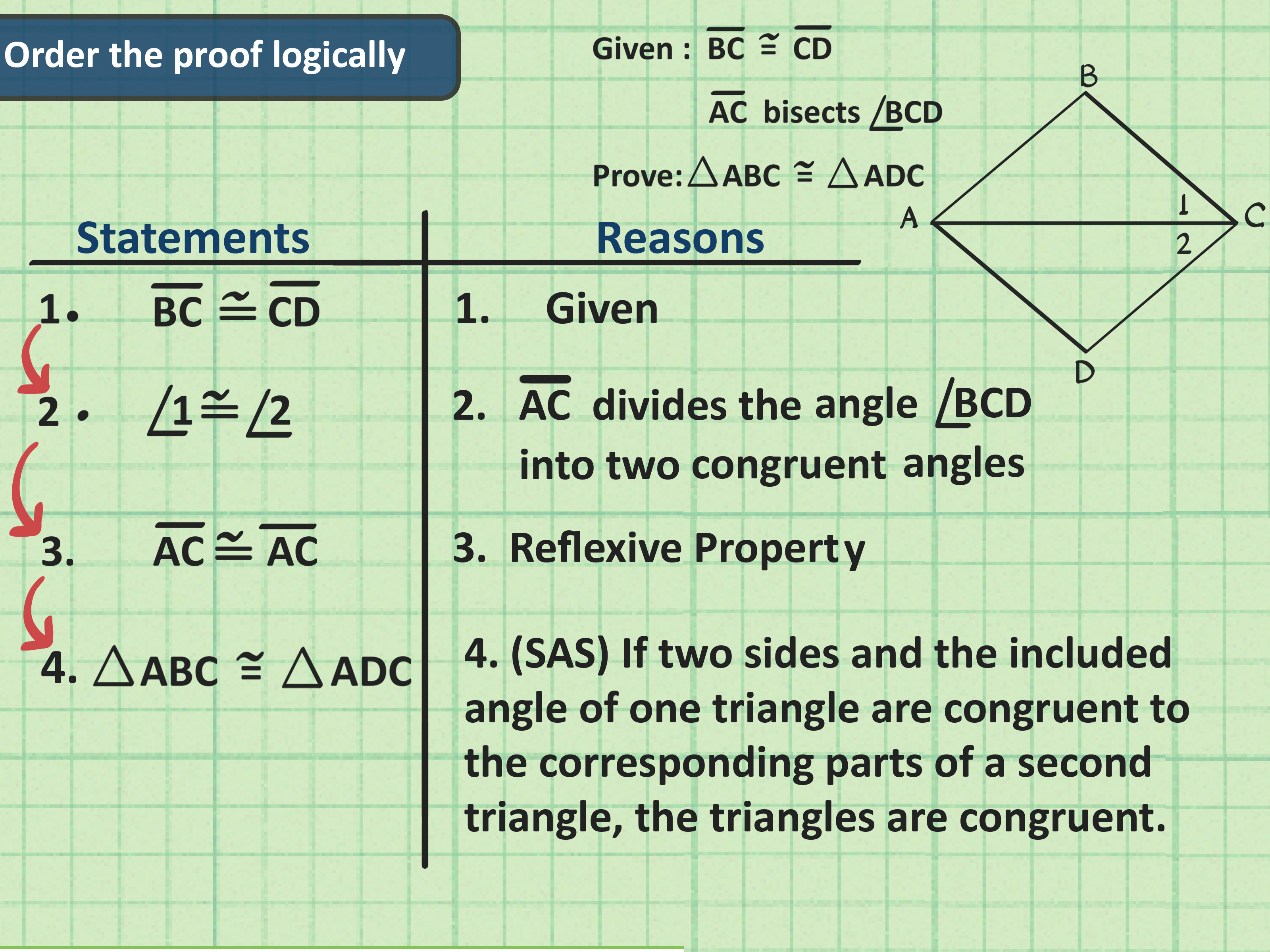

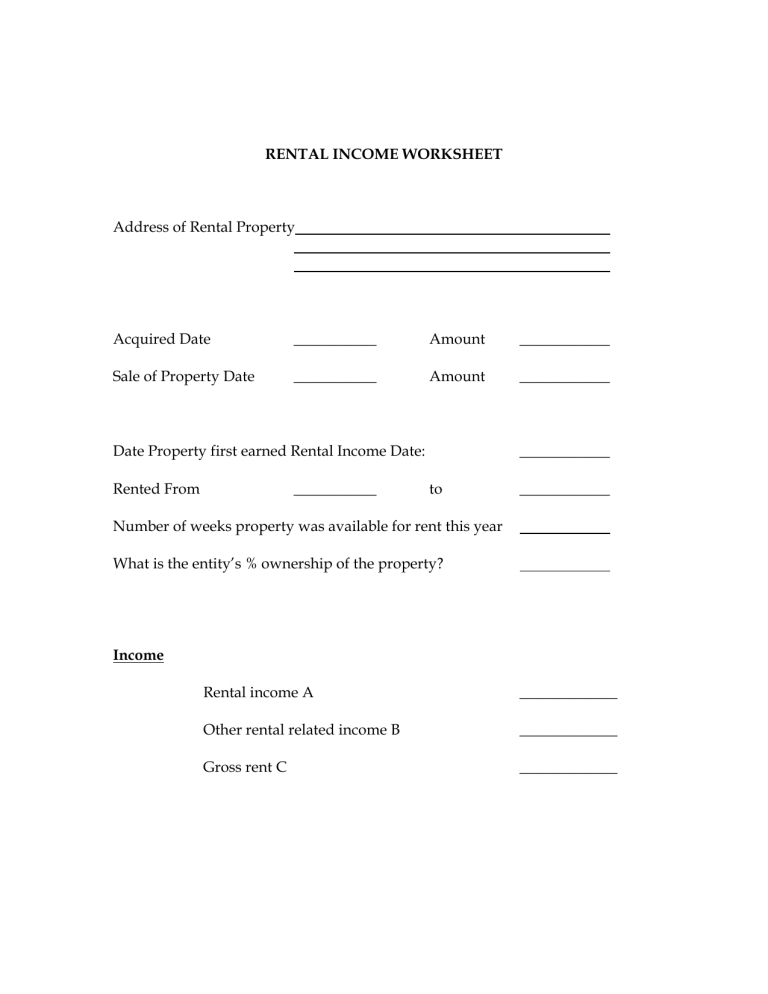

The Magical Rental Income Worksheet

Our simplified worksheet is designed to help you calculate your rental income, expenses, and cash flow. It’s a comprehensive tool that will give you a clear picture of your rental property’s performance.

Section 1: Rental Income

| Description | Monthly | Yearly |

|---|---|---|

| Rent | $ | $ |

| Other Income (e.g., laundry, parking) | $ | $ |

| Total Rental Income | $ | $ |

Section 2: Fixed Expenses

| Description | Monthly | Yearly |

|---|---|---|

| Mortgage Payment | $ | $ |

| Property Taxes | $ | $ |

| Insurance | $ | $ |

| Maintenance and Repairs | $ | $ |

| Property Management Fees | $ | $ |

| Total Fixed Expenses | $ | $ |

Section 3: Variable Expenses

| Description | Monthly | Yearly |

|---|---|---|

| Utilities (e.g., electricity, water, gas) | $ | $ |

| Vacancy Loss | $ | $ |

| Total Variable Expenses | $ | $ |

Section 4: Cash Flow

| Description | Monthly | Yearly |

|---|---|---|

| Total Rental Income | $ | $ |

| Total Fixed Expenses | -$ | -$ |

| Total Variable Expenses | -$ | -$ |

| Net Operating Income (NOI) | $ | $ |

| Cash Flow | $ | $ |

How to Use the Worksheet

- Fill in the sections with your actual numbers.

- Calculate the total rental income, fixed expenses, and variable expenses.

- Calculate the net operating income (NOI) by subtracting the total fixed and variable expenses from the total rental income.

- Calculate the cash flow by subtracting the mortgage payment from the NOI.

Notes

📝 Note: This worksheet is a simplified version of a comprehensive rental income analysis. It's essential to consult with a financial advisor or accountant to ensure accuracy and completeness.

📊 Note: Use this worksheet as a starting point and adjust it according to your specific needs and circumstances.

Embedding Images

To enhance readability, let’s embed an image of a rental property.

[Image: A photo of a rental property]

Tips and Strategies

To maximize your rental income and minimize stress, consider the following tips and strategies:

- Conduct thorough market research: Understand the local market, including rental rates, vacancy rates, and competition.

- Screen tenants carefully: Use a comprehensive tenant screening process to minimize the risk of default or damage.

- Maintain the property: Regular maintenance can help prevent costly repairs and reduce vacancies.

- Monitor cash flow: Keep a close eye on your cash flow to ensure you can cover expenses and mortgage payments.

Conclusion

Unlocking the secrets of magical rental income requires careful planning, management, and analysis. Our simplified worksheet is a powerful tool to help you calculate your rental income, expenses, and cash flow. By following the tips and strategies outlined above, you can maximize your returns and minimize your stress.

What is the most important factor in determining rental income?

+The most important factor in determining rental income is the local market conditions, including rental rates, vacancy rates, and competition.

How can I minimize vacancies and reduce the risk of default?

+Conduct thorough market research, screen tenants carefully, and maintain the property regularly to minimize vacancies and reduce the risk of default.

What is the difference between net operating income (NOI) and cash flow?

+Net operating income (NOI) is the income from the property minus operating expenses, while cash flow is the NOI minus mortgage payments and other debt obligations.