Magic Income Worksheet Made Easy

Magic Income Worksheet Made Easy

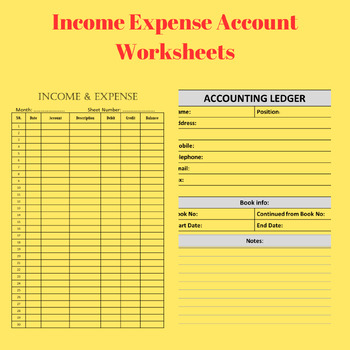

Creating a budget that actually works for you can be a daunting task, especially if you’re not familiar with financial planning. One tool that can help is a Magic Income Worksheet, a simple yet effective way to track your income and expenses. In this post, we’ll break down the Magic Income Worksheet, its benefits, and provide a step-by-step guide on how to use it.

What is a Magic Income Worksheet?

A Magic Income Worksheet is a budgeting tool that helps you allocate your income into different categories, ensuring you have enough money for savings, expenses, and debt repayment. It’s called “magic” because it helps you make the most of your income, making it seem like you have more money than you actually do.

Benefits of Using a Magic Income Worksheet

Using a Magic Income Worksheet has several benefits, including:

- Improved budgeting: By categorizing your income, you’ll have a clear picture of where your money is going.

- Increased savings: You’ll be able to allocate a portion of your income towards savings and investments.

- Reduced debt: By prioritizing debt repayment, you’ll be able to pay off debts faster.

- Reduced financial stress: Having a clear understanding of your finances will reduce stress and anxiety.

How to Use a Magic Income Worksheet

Using a Magic Income Worksheet is straightforward. Here’s a step-by-step guide:

- Gather your financial information: Collect your pay stubs, bills, and any other financial documents.

- Calculate your net income: Calculate your take-home pay, which is your income after taxes.

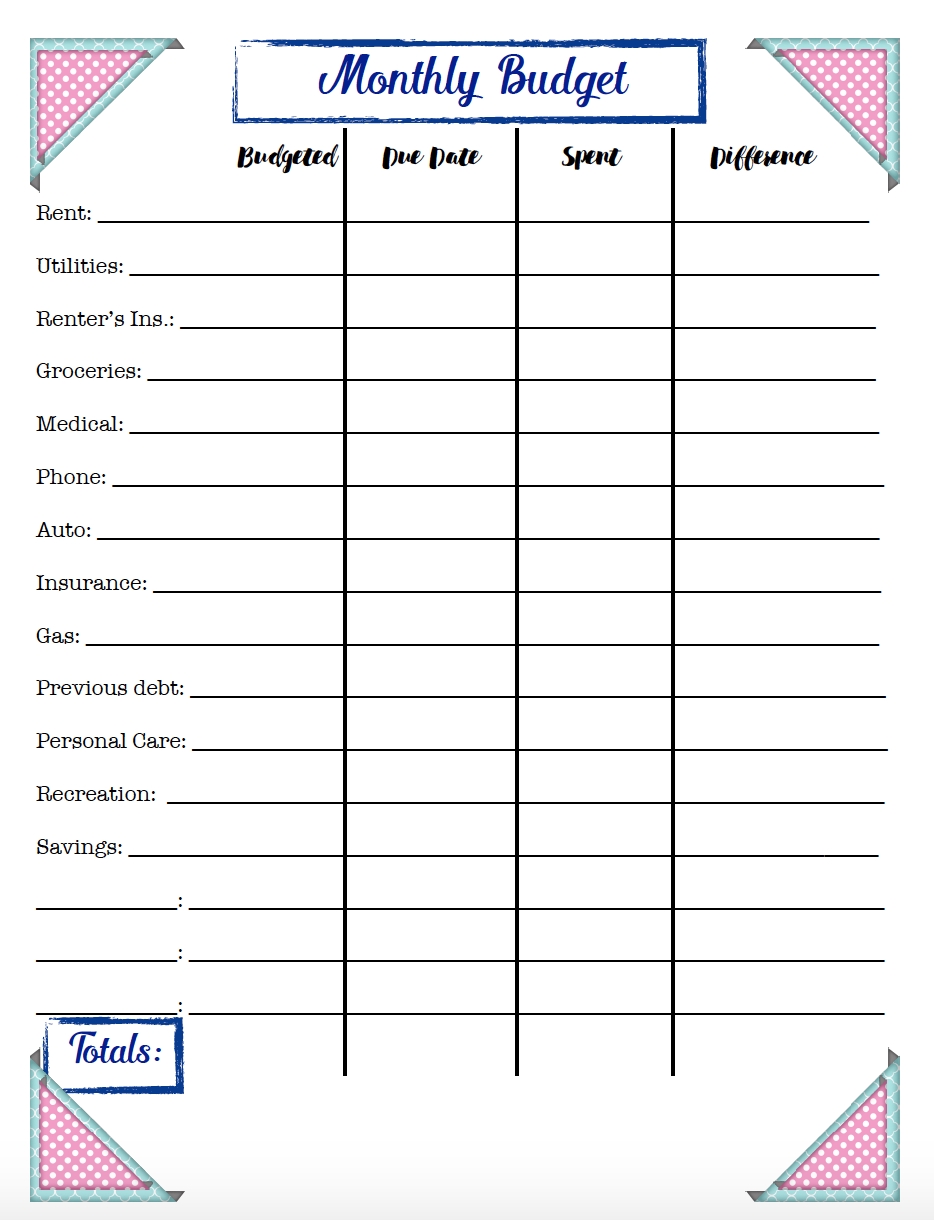

- Categorize your income: Allocate your income into different categories, such as:

- Essential expenses (housing, utilities, food)

- Non-essential expenses (entertainment, hobbies)

- Savings

- Debt repayment

- Investments

- Assign percentages: Assign a percentage of your income to each category. A general rule of thumb is:

- Essential expenses: 50-60%

- Non-essential expenses: 10-20%

- Savings: 10-20%

- Debt repayment: 5-10%

- Investments: 5-10%

- Fill out the worksheet: Use the percentages to fill out the Magic Income Worksheet.

📝 Note: You can adjust the percentages based on your individual financial needs.

Example of a Magic Income Worksheet

Here’s an example of a Magic Income Worksheet:

| Category | Percentage | Amount |

|---|---|---|

| Essential expenses | 55% | $2,750 |

| Non-essential expenses | 15% | $750 |

| Savings | 15% | $750 |

| Debt repayment | 5% | $250 |

| Investments | 10% | $500 |

Tips for Using a Magic Income Worksheet

Here are some tips to keep in mind when using a Magic Income Worksheet:

- Be realistic: Be realistic about your income and expenses.

- Adjust as needed: Adjust the percentages and categories as needed.

- Use the 50/30/20 rule: Allocate 50% of your income towards essential expenses, 30% towards non-essential expenses, and 20% towards savings and debt repayment.

- Prioritize needs over wants: Prioritize essential expenses over non-essential expenses.

By following these steps and tips, you’ll be able to create a Magic Income Worksheet that helps you manage your finances effectively.

In summary, a Magic Income Worksheet is a simple yet effective tool for managing your finances. By allocating your income into different categories, you’ll be able to create a budget that works for you. Remember to be realistic, adjust as needed, and prioritize needs over wants.

What is the difference between a Magic Income Worksheet and a budget?

+A Magic Income Worksheet is a tool that helps you allocate your income into different categories, while a budget is a comprehensive plan for managing your finances.

How often should I update my Magic Income Worksheet?

+You should update your Magic Income Worksheet every few months or whenever your financial situation changes.

Can I use a Magic Income Worksheet if I’m self-employed?

+Yes, you can use a Magic Income Worksheet if you’re self-employed. Simply adjust the income categories to reflect your business income and expenses.