Lihtc Income Calculation Made Easy with This Simple Worksheet

Understanding LIHTC Income Calculation

The Low-Income Housing Tax Credit (LIHTC) program is a crucial tool for creating and preserving affordable housing in the United States. To ensure compliance with the program’s requirements, property owners and managers must accurately calculate the income of potential residents. This calculation is essential to determine whether an applicant meets the program’s income limits and can occupy a tax credit unit.

The Importance of Accurate Income Calculation

Accurate income calculation is vital to avoid non-compliance issues and potential financial penalties. A mistake in income calculation can result in:

- Rent overcharges: Charging a resident more rent than allowed by the program can lead to financial penalties and reputational damage.

- Ineligibility: Incorrectly determining a resident’s eligibility can result in the property losing tax credits.

- Regulatory issues: Failure to comply with income calculation requirements can lead to regulatory scrutiny and potential fines.

Breaking Down the LIHTC Income Calculation

The LIHTC income calculation involves several steps:

- Gross Income: Start by calculating the applicant’s gross income from all sources, including employment, self-employment, and investments.

- Deductions: Apply the applicable deductions, such as:

- $480: A standard deduction for each eligible household member.

- Medical expenses: Out-of-pocket medical expenses exceeding 3% of gross income.

- Child care expenses: Reasonable child care expenses necessary for employment or education.

- Adjusted Gross Income (AGI): Calculate the AGI by subtracting the applicable deductions from the gross income.

- Income Limits: Compare the AGI to the program’s income limits to determine eligibility.

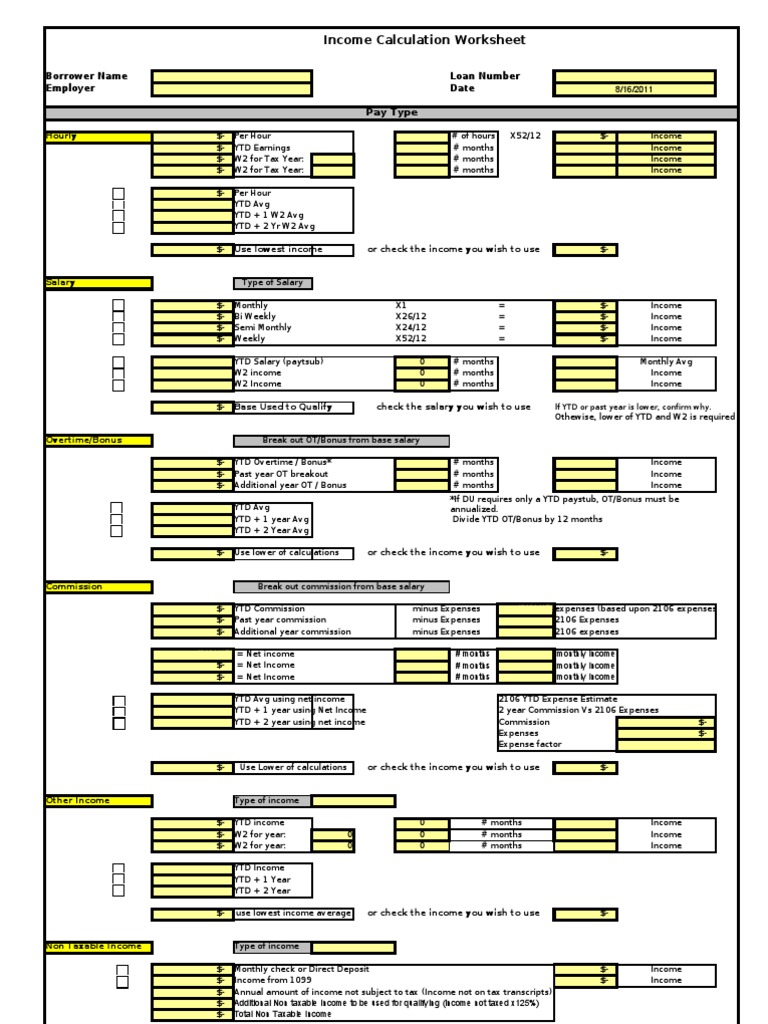

LIHTC Income Calculation Worksheet

To simplify the income calculation process, use the following worksheet:

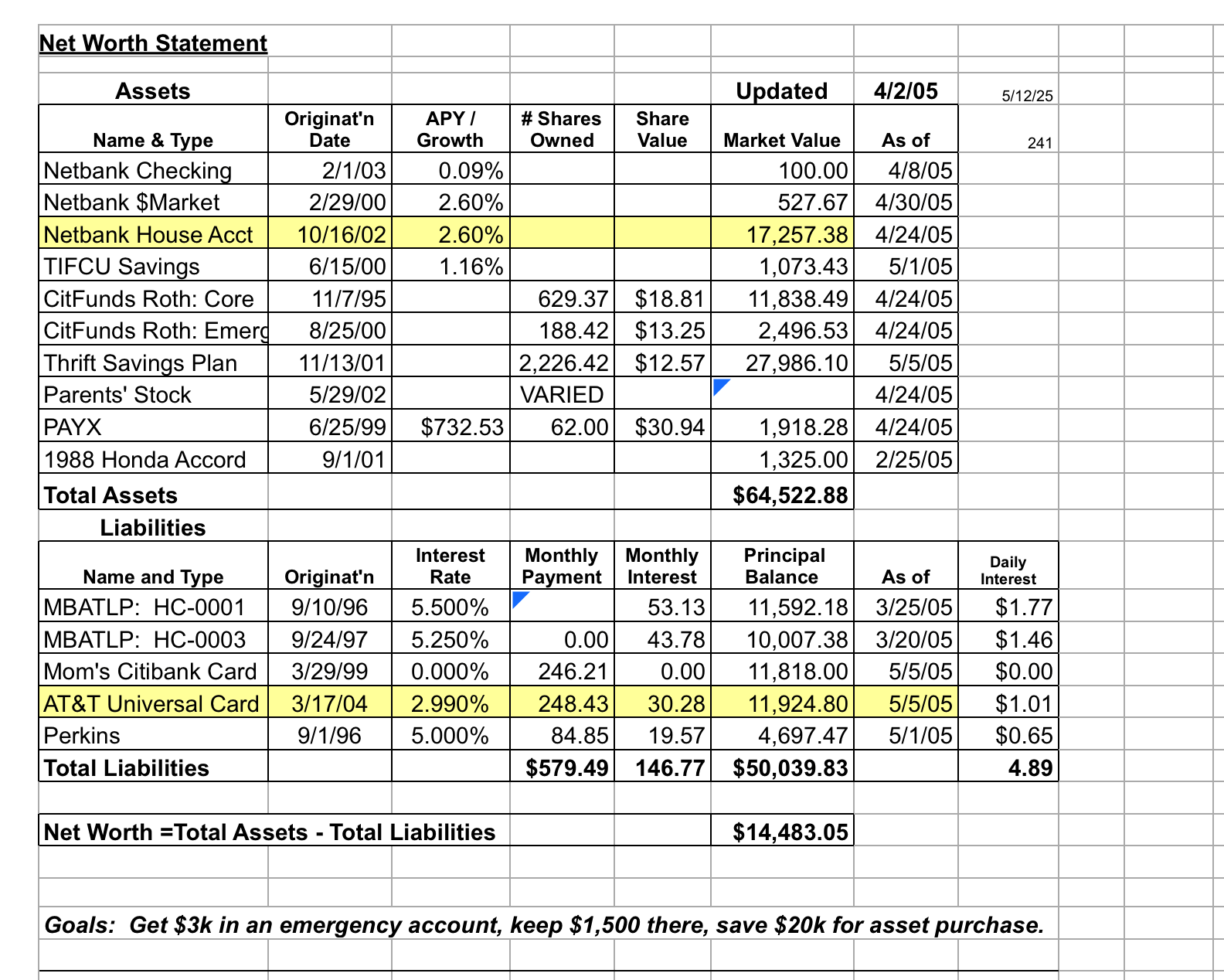

| Income Source | Gross Income | Deductions | Adjusted Gross Income (AGI) |

|---|---|---|---|

| Employment | $_____________ | -$480 (std) | $_____________ |

| Self-employment | $_____________ | -$_____________ (biz exp) | $_____________ |

| Investments | $_____________ | -$_____________ (inv exp) | $_____________ |

| Other income | $_____________ | -$_____________ (other) | $_____________ |

| Total | $_____________ | -$_____________ | $_____________ |

Note: This worksheet is a simplified example and may not cover all income sources or deductions.

📝 Note: Always refer to the most recent LIHTC program guidelines and consult with a qualified tax professional to ensure accurate income calculations.

Best Practices for Accurate Income Calculation

To ensure accurate income calculations, follow these best practices:

- Verify documentation: Request and verify all necessary documentation from applicants, including tax returns, pay stubs, and receipts for deductions.

- Use the correct income limits: Refer to the most recent income limits published by the relevant state or local housing agency.

- Consider all income sources: Include all income sources, including employment, self-employment, and investments, in the calculation.

- Apply deductions carefully: Ensure that only eligible deductions are applied, and calculate the correct amount.

By following these guidelines and using the provided worksheet, property owners and managers can simplify the LIHTC income calculation process and reduce the risk of non-compliance issues.

What is the purpose of the LIHTC income calculation?

+The LIHTC income calculation is used to determine whether an applicant meets the program’s income limits and can occupy a tax credit unit.

What are the consequences of incorrect income calculation?

+Incorrect income calculation can result in rent overcharges, ineligibility, and regulatory issues, leading to financial penalties and reputational damage.

What deductions are applicable in the LIHTC income calculation?

+The applicable deductions include a standard deduction of $480 for each eligible household member, out-of-pocket medical expenses exceeding 3% of gross income, and reasonable child care expenses necessary for employment or education.

Related Terms:

- HUD income Calculation worksheet pdf

- HUD rent Calculation worksheet excel

- Public housing rent Calculation Worksheet

- Income calculation worksheet Excel

- Tenant Rent Calculation Worksheet