IT-2104 Worksheet Solutions and Form Guide

IT-2104 Worksheet Solutions and Form Guide

As a taxpayer, understanding the IT-2104 form is essential for accurately reporting your income and claiming the correct deductions. In this comprehensive guide, we will break down the IT-2104 worksheet solutions and provide a step-by-step form guide to help you navigate the process.

What is the IT-2104 Form?

The IT-2104 form is used by New York State employers to report the income tax withheld from their employees’ wages. It is also used to report the income tax withheld from non-resident individuals who work in New York State. The form is typically filed quarterly and is due on the last day of the month following the end of the quarter.

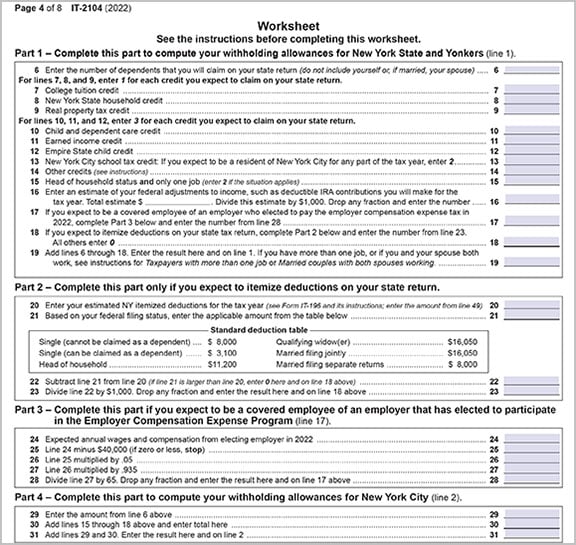

IT-2104 Worksheet Solutions

The IT-2104 worksheet is used to calculate the income tax withheld from employees’ wages. Here is a step-by-step guide to completing the worksheet:

Step 1: Determine the Taxable Wages

Identify the total wages paid to employees during the quarter. This includes gross wages, salaries, and commissions.

Step 2: Calculate the Taxable Wages

Multiply the total wages by the applicable tax rate. The tax rate is typically 6.09% for New York State residents and 8.82% for non-residents.

Step 3: Calculate the Withholding Allowance

Determine the number of withholding allowances the employee is eligible for. The number of allowances is typically based on the employee’s filing status and number of dependents.

Step 4: Calculate the Income Tax Withheld

Multiply the taxable wages by the tax rate and subtract the withholding allowance.

📝 Note: The withholding allowance is used to reduce the amount of income tax withheld from the employee's wages.

IT-2104 Form Guide

Here is a step-by-step guide to completing the IT-2104 form:

Section 1: Employer Information

Provide the employer’s name, address, and federal employer identification number (FEIN).

Section 2: Quarterly Tax Liability

Report the total tax liability for the quarter, including the income tax withheld from employees’ wages.

Section 3: Taxable Wages

Report the total taxable wages paid to employees during the quarter.

Section 4: Withholding Allowance

Report the total withholding allowance for the quarter.

Section 5: Payment and Credit

Report any payments made towards the tax liability and any credits claimed.

📝 Note: Make sure to sign and date the form to avoid any delays or penalties.

| Section | Description |

|---|---|

| Section 1 | Employer Information |

| Section 2 | Quarterly Tax Liability |

| Section 3 | Taxable Wages |

| Section 4 | Withholding Allowance |

| Section 5 | Payment and Credit |

Common Errors to Avoid

When completing the IT-2104 form, make sure to avoid the following common errors:

- Incorrect employer information: Make sure to provide the correct employer name, address, and FEIN.

- Incorrect tax rate: Use the correct tax rate for New York State residents and non-residents.

- Incorrect withholding allowance: Make sure to calculate the correct withholding allowance for each employee.

- Missing signature: Don’t forget to sign and date the form to avoid any delays or penalties.

By following this guide, you can accurately complete the IT-2104 form and avoid any common errors. Remember to always check the official New York State Department of Taxation and Finance website for any updates or changes to the form.

In this comprehensive guide, we have provided step-by-step instructions for completing the IT-2104 worksheet solutions and form guide. By following these instructions, you can accurately report your income tax withheld and claim the correct deductions. Remember to always check the official New York State Department of Taxation and Finance website for any updates or changes to the form.

What is the due date for the IT-2104 form?

+The IT-2104 form is due on the last day of the month following the end of the quarter.

What is the tax rate for New York State residents?

+The tax rate for New York State residents is 6.09%.

What is the withholding allowance?

+The withholding allowance is used to reduce the amount of income tax withheld from the employee’s wages.

Related Terms:

- it 2104 worksheet pdf

- it-2104 worksheet 2024

- IT-2104 calculator

- IT-2104 Worksheet line 19

- it-2104 instructions 2024