5 Steps to Pay Off Debt with Dave Ramsey's Snowball

Breaking the Debt Cycle: 5 Steps to Pay Off Debt with Dave Ramsey's Snowball

Are you tired of living paycheck to paycheck, weighed down by the burden of debt? You’re not alone. Millions of Americans struggle with debt, feeling like they’re drowning in a sea of credit card bills, loans, and mortgage payments. But there is hope. With the help of Dave Ramsey’s Snowball method, you can break the debt cycle and start building a brighter financial future.

What is the Debt Snowball?

The Debt Snowball is a debt reduction strategy popularized by personal finance expert Dave Ramsey. It involves listing all your debts, from smallest to largest, and focusing on paying off the smallest one first. Once you’ve cleared the smallest debt, you use the money to attack the next one, and so on. The idea is to build momentum and confidence as you quickly eliminate smaller debts, creating a “snowball” effect that helps you tackle even the largest debts.

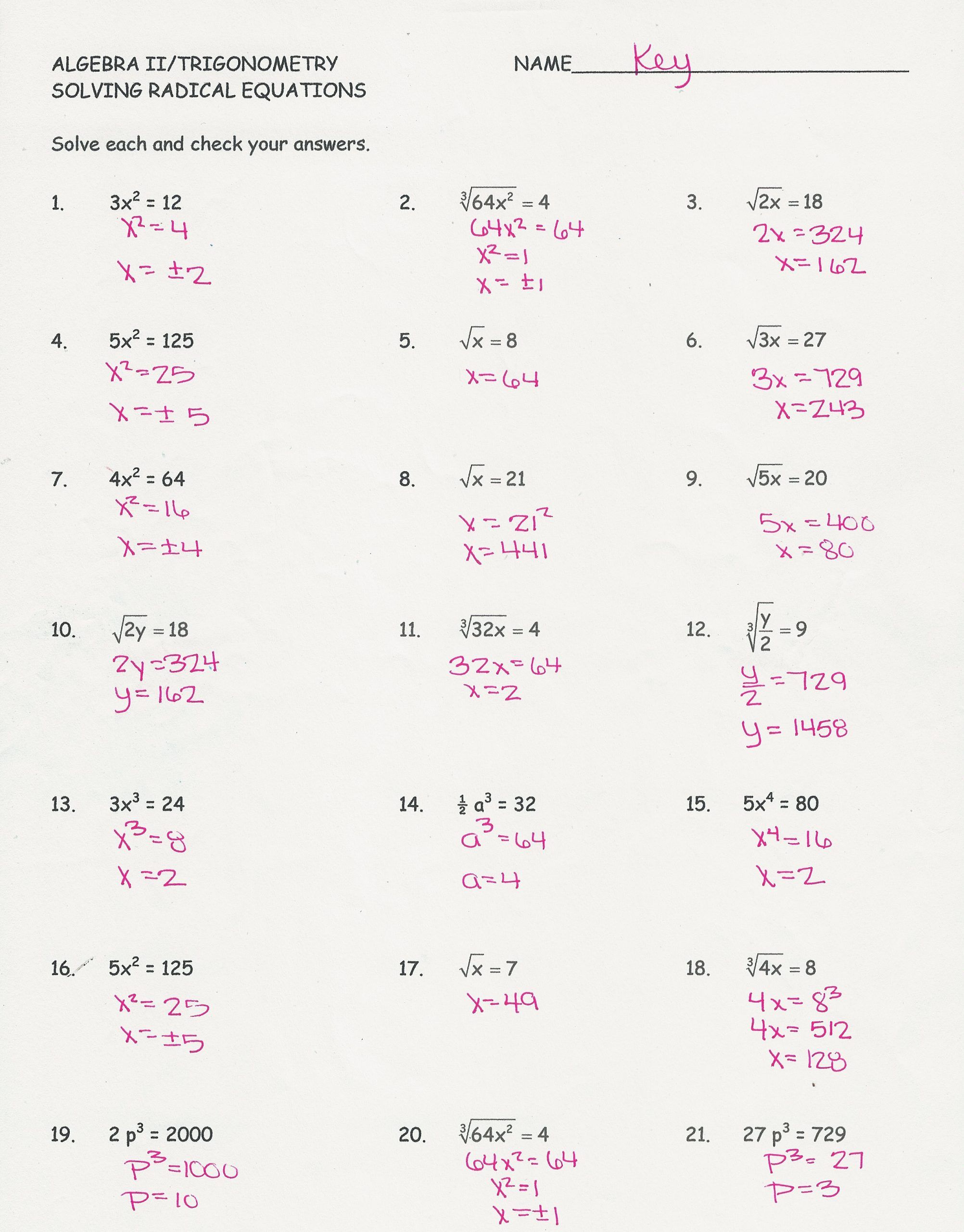

Step 1: Face Your Debt

Before you can start paying off debt, you need to face the reality of your financial situation. Make a list of all your debts, including credit cards, loans, and mortgage payments. Write down the balance, interest rate, and minimum payment for each debt. Be honest with yourself, and don’t be afraid to confront the total amount you owe.

Debt Inventory Worksheet:

| Debt | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card A | $2,500 | 18% | $50 |

| Car Loan | $10,000 | 6% | $300 |

| Student Loan | $30,000 | 4% | $100 |

| Mortgage | $150,000 | 5% | $1,000 |

Step 2: Create a Budget

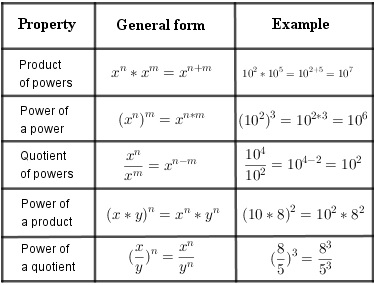

To pay off debt, you need to free up as much money as possible in your budget. Start by tracking your income and expenses to see where your money is going. Make a budget that accounts for all your necessary expenses, such as rent/mortgage, utilities, food, and transportation. Then, identify areas where you can cut back and allocate that money towards your debt.

50/30/20 Budget Rule:

- 50% of your income goes towards necessary expenses (housing, utilities, food)

- 30% towards discretionary spending (entertainment, hobbies)

- 20% towards saving and debt repayment

Step 3: Build an Emergency Fund

Before you start paying off debt, it’s essential to build a small emergency fund to cover unexpected expenses. Aim to save $1,000 or one month’s worth of expenses in a separate savings account. This fund will help you avoid going further into debt when unexpected expenses arise.

🚨 Note: Don't worry too much about the interest rates on your debts at this stage. The goal is to build momentum and confidence by quickly eliminating smaller debts.

Step 4: Pay Off Debts with the Snowball

Now it’s time to start paying off your debts using the Snowball method. List your debts in order from smallest to largest, and focus on paying off the smallest one first. Make the minimum payment on all debts except the smallest one, which you’ll attack with as much money as possible.

Debt Snowball Example:

- Credit Card A ($2,500)

- Car Loan ($10,000)

- Student Loan ($30,000)

- Mortgage ($150,000)

In this example, you’d focus on paying off Credit Card A first, while making the minimum payment on the other debts. Once you’ve paid off Credit Card A, you’d move on to the Car Loan, and so on.

Step 5: Maintain Momentum and Stay Motivated

Paying off debt is a marathon, not a sprint. It’s essential to maintain momentum and stay motivated throughout the process. Celebrate your victories along the way, and remind yourself why you’re working so hard to become debt-free.

Tips to Stay Motivated:

- Share your goals with a trusted friend or family member and ask them to hold you accountable

- Use visual aids like a debt repayment chart or a motivation board to track your progress

- Reward yourself with small treats or experiences when you reach milestones

By following these 5 steps and using the Debt Snowball method, you can break the debt cycle and start building a brighter financial future.

In the end, becoming debt-free requires discipline, patience, and persistence. But with the right strategy and mindset, you can achieve financial freedom and live the life you deserve.

What is the Debt Snowball method?

+The Debt Snowball is a debt reduction strategy that involves listing all your debts, from smallest to largest, and focusing on paying off the smallest one first. Once you’ve cleared the smallest debt, you use the money to attack the next one, and so on.

How do I create a budget to pay off debt?

+Start by tracking your income and expenses to see where your money is going. Make a budget that accounts for all your necessary expenses, and identify areas where you can cut back and allocate that money towards your debt.

Why do I need an emergency fund to pay off debt?

+An emergency fund helps you avoid going further into debt when unexpected expenses arise. Aim to save $1,000 or one month’s worth of expenses in a separate savings account.

Related Terms:

- Free debt snowball worksheet PDF

- Debt snowball spreadsheet Excel

- Debt snowball calculator

- Debt payoff worksheet Excel free

- Debt snowball method

- Debt snowball app