Dave Ramsey Budget Worksheets: Simple Path to Financial Freedom

Introduction to Dave Ramsey Budget Worksheets

For many individuals, managing finances effectively is a daunting task. Creating a budget can be overwhelming, especially for those who are new to personal finance. However, with the help of Dave Ramsey budget worksheets, achieving financial freedom becomes a more straightforward and achievable goal. In this article, we will delve into the world of Dave Ramsey budget worksheets, exploring what they are, how to use them, and the benefits they offer.

What are Dave Ramsey Budget Worksheets?

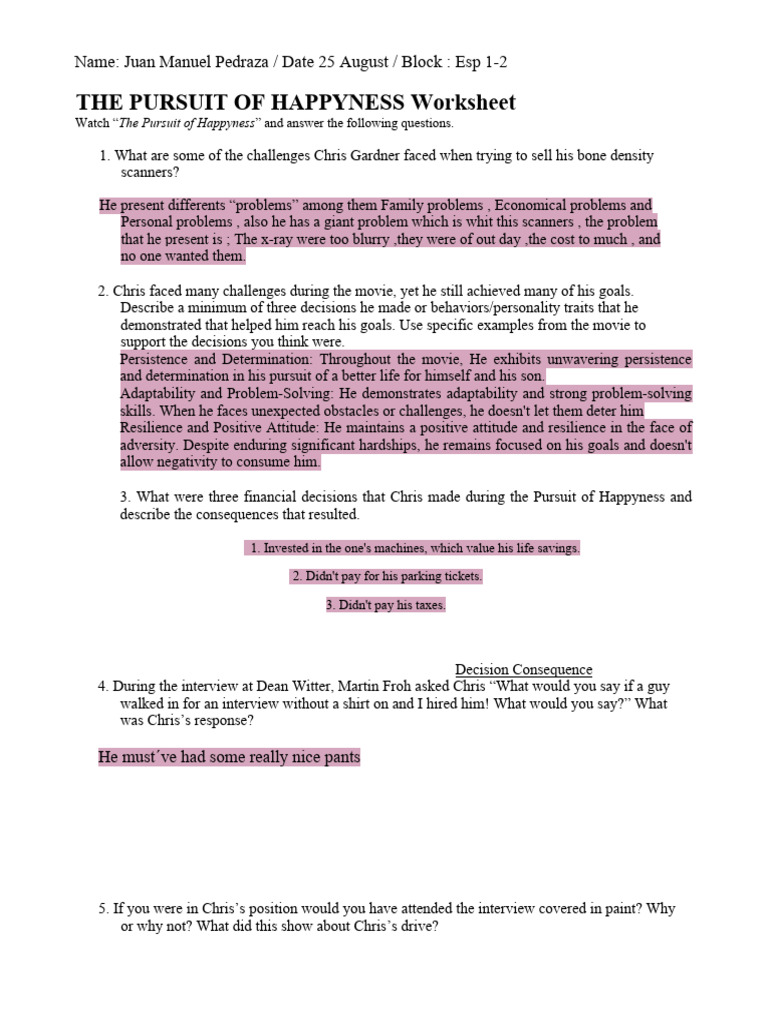

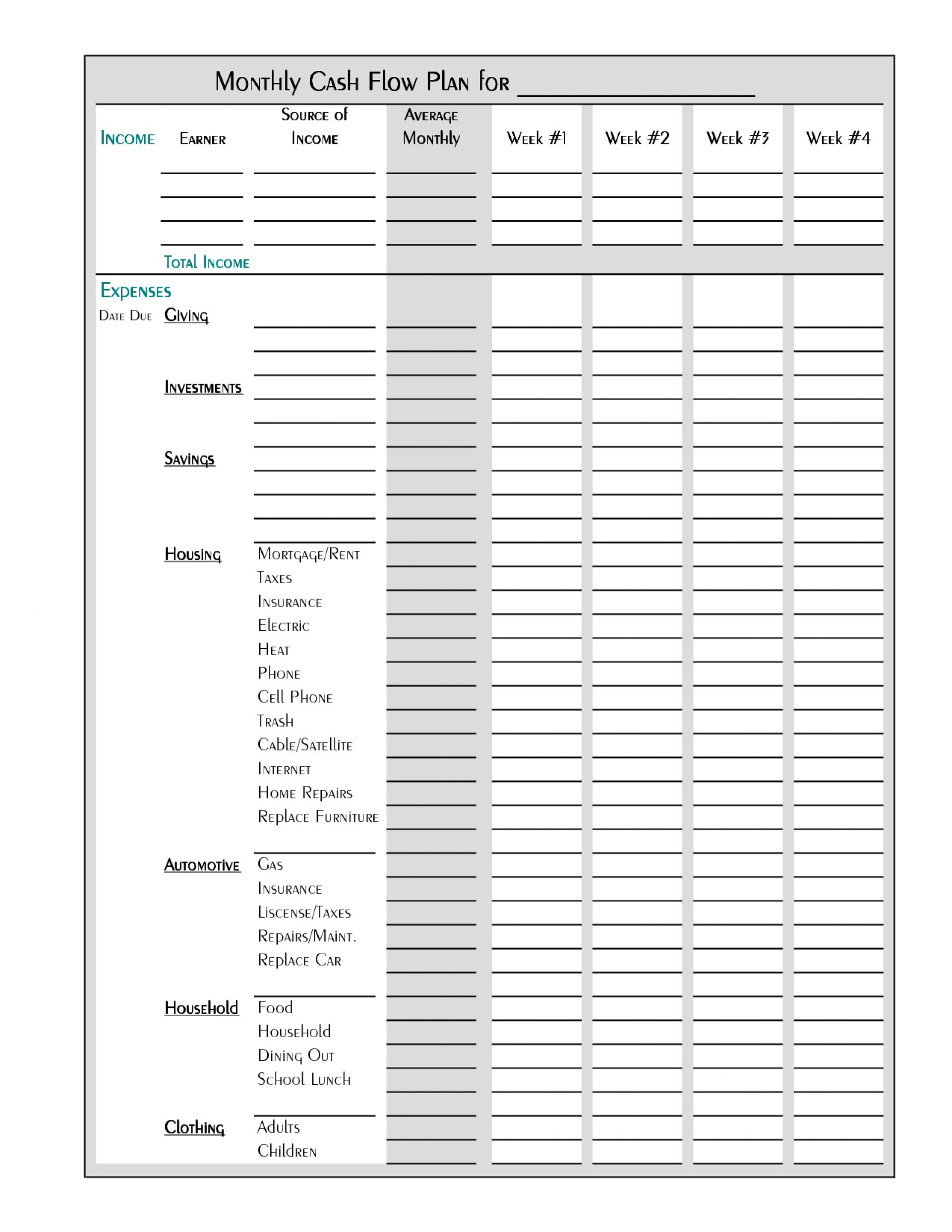

Dave Ramsey budget worksheets are a series of tools designed to help individuals create a personalized budget plan. These worksheets are based on the principles outlined in Dave Ramsey’s financial philosophy, which emphasizes the importance of living below one’s means, getting out of debt, and building wealth over time. The worksheets provide a simple, step-by-step approach to managing finances, making it easier for users to track their income, expenses, and savings.

Benefits of Using Dave Ramsey Budget Worksheets

Using Dave Ramsey budget worksheets offers numerous benefits, including:

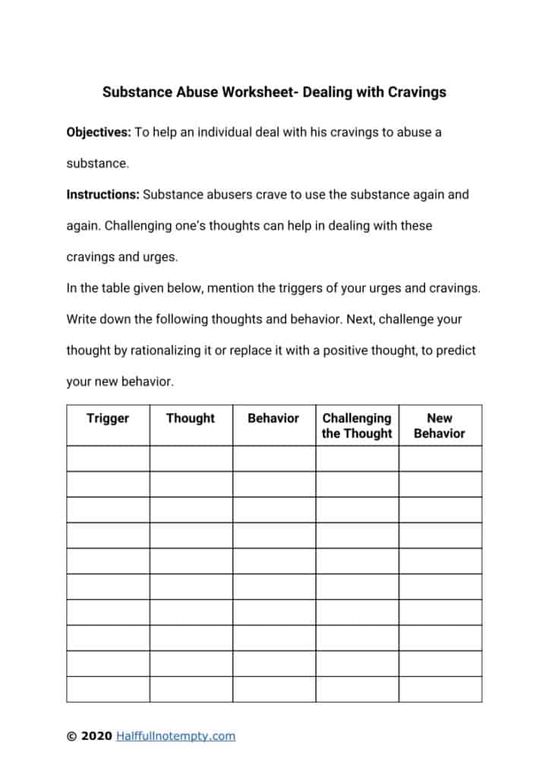

- Improved financial clarity: By tracking income and expenses, users gain a better understanding of where their money is going and can identify areas for improvement.

- Reduced debt: The worksheets help users prioritize debt repayment and create a plan to become debt-free.

- Increased savings: By allocating a portion of their income towards savings, users can build an emergency fund and work towards long-term financial goals.

- Enhanced financial discipline: The worksheets promote financial discipline by encouraging users to stick to their budget and make conscious spending decisions.

How to Use Dave Ramsey Budget Worksheets

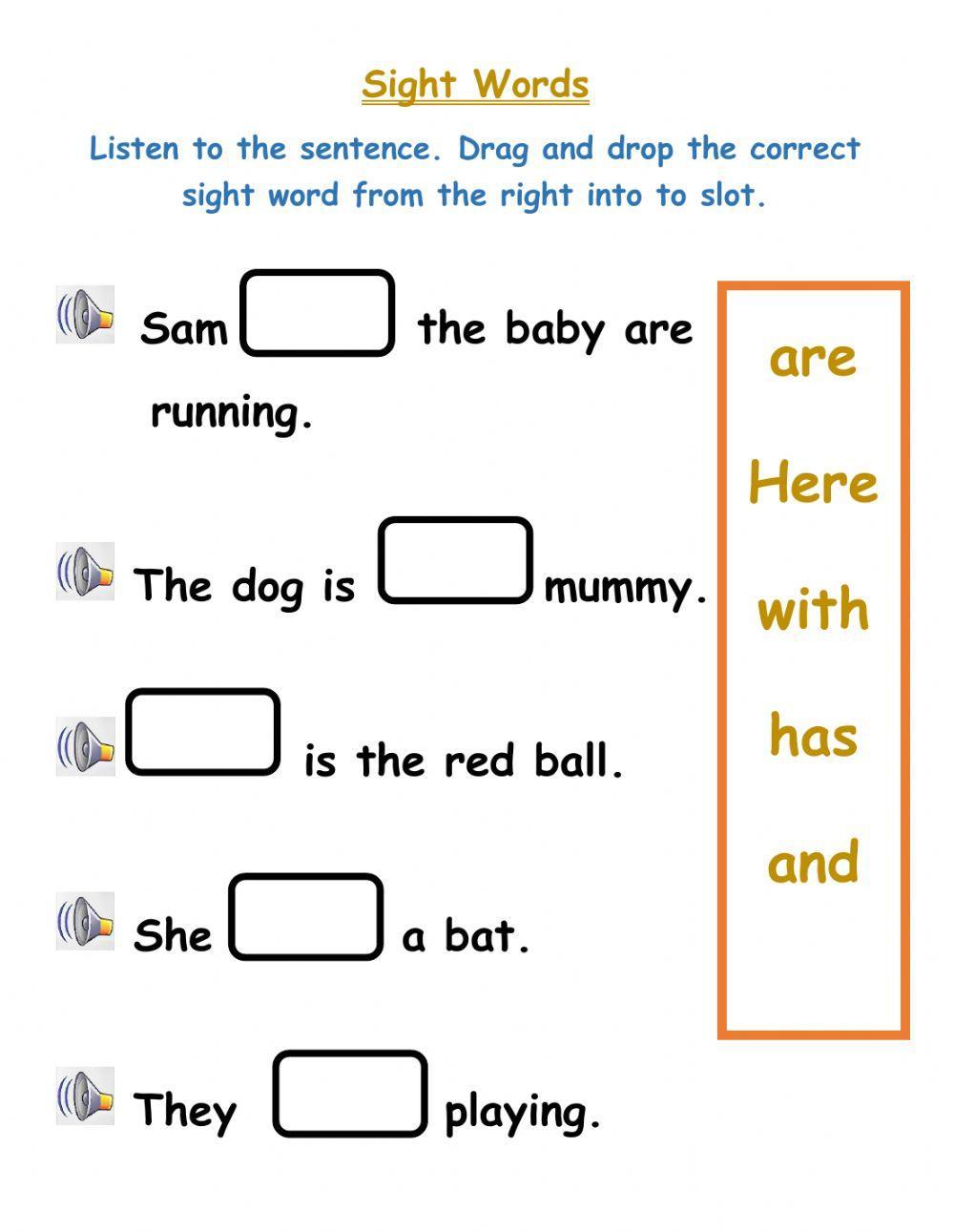

Using Dave Ramsey budget worksheets is a straightforward process. Here’s a step-by-step guide to get you started:

- Determine your income: Calculate your total monthly income from all sources.

- Identify your expenses: List all your monthly expenses, including fixed expenses (rent, utilities, groceries) and variable expenses (entertainment, hobbies).

- Categorize your expenses: Group your expenses into categories (housing, transportation, food, etc.).

- Set financial goals: Determine what you want to achieve with your budget (pay off debt, save for a down payment on a house, etc.).

- Fill out the worksheets: Use the Dave Ramsey budget worksheets to allocate your income towards different expense categories and savings goals.

📝 Note: Be sure to review and revise your budget regularly to ensure you're on track to meet your financial goals.

Types of Dave Ramsey Budget Worksheets

Dave Ramsey offers a variety of budget worksheets to suit different financial situations and goals. Some of the most popular worksheets include:

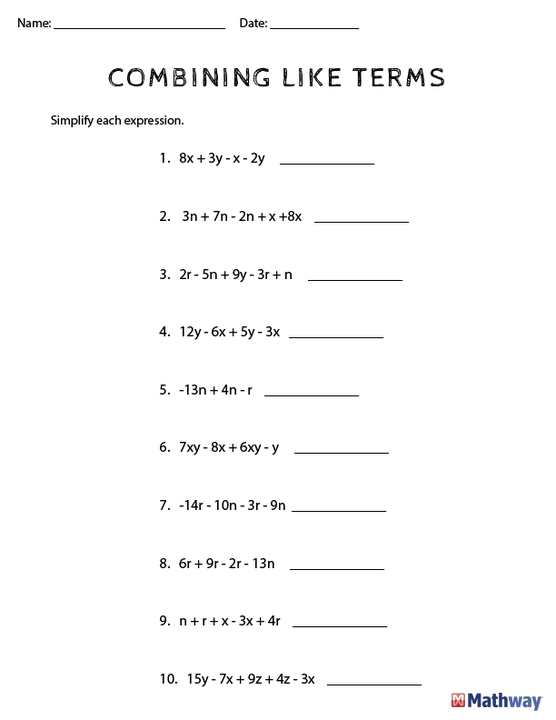

- Budget Form: A basic budget worksheet for tracking income and expenses.

- Debt Snowball Worksheet: A worksheet specifically designed to help users pay off debt using the debt snowball method.

- Emergency Fund Worksheet: A worksheet to help users build an emergency fund to cover unexpected expenses.

Alternatives to Dave Ramsey Budget Worksheets

While Dave Ramsey budget worksheets are an excellent resource, there are alternative budgeting tools available. Some popular alternatives include:

- Mint: A free online budgeting app that tracks income and expenses.

- You Need a Budget (YNAB): A budgeting app that helps users manage their finances and achieve their financial goals.

- Microsoft Excel: A spreadsheet software that can be used to create a personalized budget plan.

Conclusion

Dave Ramsey budget worksheets offer a simple and effective way to manage finances and achieve financial freedom. By following the steps outlined in this article and using the worksheets, individuals can gain a better understanding of their financial situation and create a plan to achieve their financial goals.

What is the debt snowball method?

+The debt snowball method is a debt reduction strategy that involves paying off debts in a specific order, starting with the smallest balance first.

How often should I review and revise my budget?

+It’s a good idea to review and revise your budget regularly, ideally every 3-6 months, to ensure you’re on track to meet your financial goals.

Can I use Dave Ramsey budget worksheets if I’m not in debt?

+Yes, the worksheets can be used by anyone looking to manage their finances effectively, regardless of whether they have debt or not.

Related Terms:

- Dave Ramsey budget forms PDF

- Dave Ramsey monthly budget PDF

- Dave Ramsey zero-based budget pdf

- Budget worksheet PDF

- Monthly budget worksheet PDF

- Dave Ramsey Worksheets Free