Create a Budget with Dave Ramsey's Simple Worksheet

Creating a budget is one of the most important steps in taking control of your finances. With the help of Dave Ramsey’s simple budgeting worksheet, you can create a budget that works for you. In this article, we will guide you through the process of creating a budget using Dave Ramsey’s simple worksheet.

Why Create a Budget?

Before we dive into the process of creating a budget, let’s talk about why it’s so important. A budget is a plan for your money, and it helps you make sure that you’re using your money wisely. By creating a budget, you can:

- Track your income and expenses: See where your money is coming from and where it’s going.

- Make smart financial decisions: Prioritize your spending and make sure you’re using your money for the things that are most important to you.

- Achieve your financial goals: Create a plan to pay off debt, build savings, and achieve long-term financial goals.

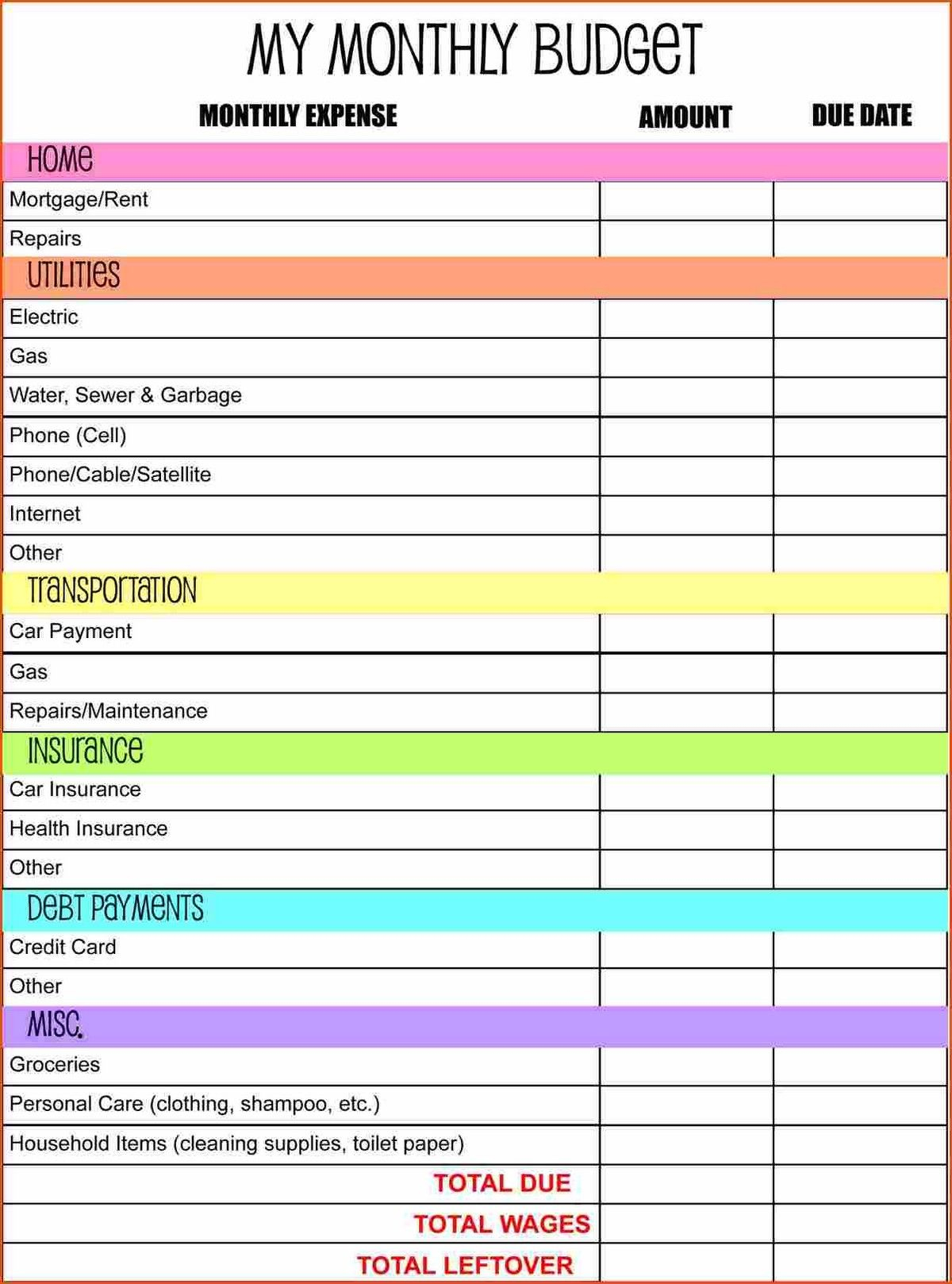

Dave Ramsey's Simple Budgeting Worksheet

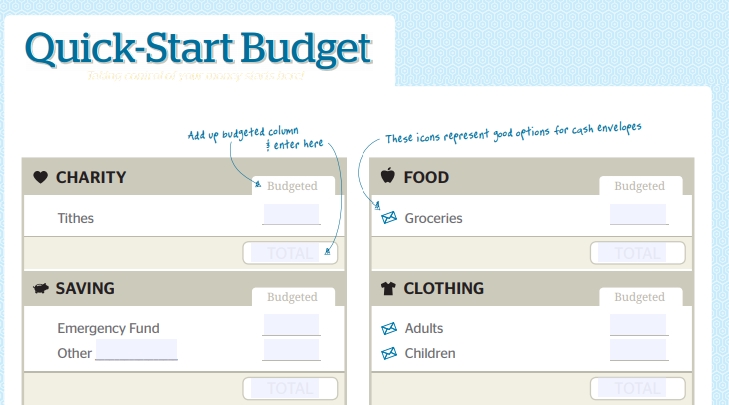

Dave Ramsey’s simple budgeting worksheet is a straightforward and easy-to-use tool that can help you create a budget that works for you. The worksheet includes the following categories:

- Income: List all of your income sources, including your salary, investments, and any side hustles.

- Fixed Expenses: List all of your fixed expenses, including rent/mortgage, utilities, car payment, and insurance.

- Variable Expenses: List all of your variable expenses, including groceries, entertainment, and hobbies.

- Debt Repayment: List all of your debts, including credit cards, student loans, and personal loans.

- Savings: List your savings goals, including emergency fund, retirement savings, and other savings goals.

Here is an example of what the worksheet might look like:

| Category | Monthly Amount |

|---|---|

| Income | $4,000 |

| Fixed Expenses | $2,500 |

| Variable Expenses | $1,000 |

| Debt Repayment | $500 |

| Savings | $500 |

Step 1: List Your Income

The first step in creating a budget is to list all of your income sources. This includes your salary, investments, and any side hustles. Be sure to include all sources of income, no matter how small they may seem.

📝 Note: Make sure to list your income after taxes, not before. This will give you a more accurate picture of how much money you have available to spend.

Step 2: List Your Fixed Expenses

Next, list all of your fixed expenses. These are expenses that remain the same from month to month, such as:

- Rent/mortgage

- Utilities (electricity, water, gas, etc.)

- Car payment

- Insurance (health, auto, home, etc.)

- Minimum debt payments (credit cards, student loans, etc.)

Be sure to include all fixed expenses, no matter how small they may seem.

Step 3: List Your Variable Expenses

Now, list all of your variable expenses. These are expenses that can vary from month to month, such as:

- Groceries

- Entertainment (dining out, movies, etc.)

- Hobbies

- Travel

- Gifts

Be sure to include all variable expenses, no matter how small they may seem.

Step 4: List Your Debt Repayment

Next, list all of your debts, including credit cards, student loans, and personal loans. Be sure to include the minimum payment for each debt, as well as any additional payments you plan to make.

📝 Note: Make sure to prioritize your debt repayment by focusing on the debt with the highest interest rate first.

Step 5: List Your Savings Goals

Finally, list your savings goals, including emergency fund, retirement savings, and other savings goals. Be sure to include a specific amount for each savings goal.

📝 Note: Make sure to prioritize your savings goals by focusing on the most important goals first.

Conclusion

Creating a budget with Dave Ramsey’s simple worksheet is a straightforward and easy-to-use tool that can help you take control of your finances. By following these steps, you can create a budget that works for you and helps you achieve your financial goals.

Remember, budgeting is not just about cutting expenses, it’s about making smart financial decisions that align with your goals and values. By following these steps and regularly reviewing and adjusting your budget, you can achieve financial freedom and live the life you want.

What is the 50/30/20 rule?

+The 50/30/20 rule is a simple way to allocate your income towards different expenses. 50% of your income should go towards fixed expenses, 30% towards variable expenses, and 20% towards savings and debt repayment.

How often should I review my budget?

+You should review your budget regularly, ideally every month, to ensure you’re on track with your financial goals. You can also review your budget quarterly or annually to make adjustments as needed.

What is an emergency fund?

+An emergency fund is a savings account that’s set aside for unexpected expenses, such as car repairs or medical bills. It’s recommended to have 3-6 months’ worth of living expenses in your emergency fund.