Checkbook Register Worksheet 1 Answer Key

Understanding the Importance of a Checkbook Register

A checkbook register, also known as a check ledger or transaction register, is a crucial tool for managing your finances effectively. It helps you keep track of all your transactions, including deposits, withdrawals, and fees, to ensure accuracy and prevent errors. In this blog post, we will explore the significance of a checkbook register and provide a comprehensive guide on how to use it.

What is a Checkbook Register?

A checkbook register is a document or digital tool that allows you to record and monitor all transactions related to your checking account. It typically includes columns for the date, description, debit, credit, and balance. By regularly updating your register, you can:

- Track your spending: Keep a record of all your transactions, including purchases, bills, and withdrawals.

- Monitor your balance: Ensure you have sufficient funds in your account to avoid overdrafts and fees.

- Detect errors: Identify discrepancies between your records and bank statements to prevent unauthorized transactions.

How to Use a Checkbook Register

Using a checkbook register is straightforward. Here’s a step-by-step guide:

- Set up your register: Create a table with columns for the date, description, debit, credit, and balance. You can use a physical notebook, spreadsheet, or digital app.

- Record transactions: Write down each transaction, including deposits, withdrawals, and fees, in the corresponding columns.

- Update your balance: Calculate your new balance after each transaction by adding or subtracting the amount from the previous balance.

- Reconcile your account: Regularly compare your register with your bank statement to ensure accuracy and detect any errors.

Benefits of Using a Checkbook Register

Using a checkbook register offers numerous benefits, including:

- Improved financial management: Stay on top of your finances by tracking your spending and monitoring your balance.

- Error detection: Identify discrepancies between your records and bank statements to prevent unauthorized transactions.

- Budgeting: Create a budget based on your spending habits and financial goals.

- Reduced stress: Feel more in control of your finances and reduce stress related to managing your money.

Common Mistakes to Avoid

When using a checkbook register, it’s essential to avoid common mistakes, such as:

- Inaccurate calculations: Double-check your math to ensure accuracy.

- Missing transactions: Record all transactions, including small purchases and fees.

- Not reconciling your account: Regularly compare your register with your bank statement to detect errors.

📝 Note: It's essential to regularly review and update your checkbook register to ensure accuracy and detect errors.

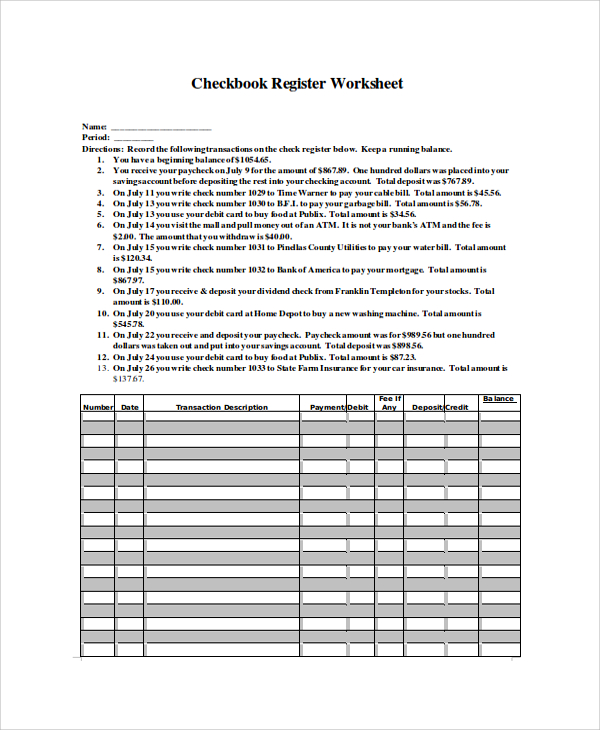

Checkbook Register Worksheet 1 Answer Key

Here is an example of a completed checkbook register worksheet:

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 01/01 | Deposit | $0.00 | $100.00 | $100.00 |

| 01/05 | Withdrawal | $20.00 | $0.00 | $80.00 |

| 01/10 | Purchase | $30.00 | $0.00 | $50.00 |

| 01/15 | Deposit | $0.00 | $50.00 | $100.00 |

By following this example and using a checkbook register, you can effectively manage your finances and achieve financial stability.

In summary, a checkbook register is a powerful tool for managing your finances. By regularly updating your register, you can track your spending, monitor your balance, and detect errors. Remember to avoid common mistakes, such as inaccurate calculations and missing transactions, to ensure accuracy and financial stability.

What is the purpose of a checkbook register?

+The purpose of a checkbook register is to record and monitor all transactions related to your checking account, allowing you to track your spending, monitor your balance, and detect errors.

How do I set up a checkbook register?

+To set up a checkbook register, create a table with columns for the date, description, debit, credit, and balance. You can use a physical notebook, spreadsheet, or digital app.

What are the benefits of using a checkbook register?

+The benefits of using a checkbook register include improved financial management, error detection, budgeting, and reduced stress.