TurboTax Carryover Worksheet: Simplify Your Tax Return

Understanding the TurboTax Carryover Worksheet

The TurboTax Carryover Worksheet is a valuable tool designed to simplify the process of tracking and reporting carryover amounts from previous tax years. For individuals who have unused deductions, credits, or losses from prior years, this worksheet helps ensure that these carryovers are accurately accounted for and applied to the current tax return. In this article, we will delve into the details of the TurboTax Carryover Worksheet, exploring its purpose, benefits, and step-by-step instructions on how to use it effectively.

What is the TurboTax Carryover Worksheet?

The TurboTax Carryover Worksheet is a feature within the TurboTax software that allows users to track and calculate carryover amounts from previous tax years. This worksheet is specifically designed to help taxpayers manage complex tax situations, ensuring that all applicable carryovers are properly reported and claimed on the current tax return.

Benefits of Using the TurboTax Carryover Worksheet

Using the TurboTax Carryover Worksheet offers several benefits, including:

- Simplified tax preparation: The worksheet helps streamline the tax preparation process by providing a clear and organized way to track and calculate carryover amounts.

- Accurate calculations: The worksheet performs complex calculations, reducing the risk of errors and ensuring that carryovers are accurately reported.

- Maximized refunds: By accurately tracking and claiming carryover amounts, taxpayers can maximize their refunds and minimize their tax liability.

- Reduced audit risk: The worksheet helps ensure that carryovers are properly documented and reported, reducing the risk of audit and potential penalties.

Step-by-Step Instructions for Using the TurboTax Carryover Worksheet

To use the TurboTax Carryover Worksheet effectively, follow these step-by-step instructions:

- Gather necessary documents: Collect all relevant tax documents from previous years, including tax returns, schedules, and supporting documentation.

- Access the worksheet: Log in to your TurboTax account and navigate to the Carryover Worksheet section.

- Enter carryover information: Input the necessary information from previous tax years, including the type of carryover, the amount, and the tax year.

- Calculate carryover amounts: The worksheet will automatically calculate the carryover amounts based on the information entered.

- Review and verify: Review the calculated carryover amounts to ensure accuracy and verify that all applicable carryovers are included.

- Apply carryovers to current tax return: Once verified, apply the carryover amounts to the current tax return, ensuring that all applicable credits, deductions, and losses are claimed.

📝 Note: It is essential to carefully review and verify the carryover amounts to ensure accuracy and avoid potential errors or penalties.

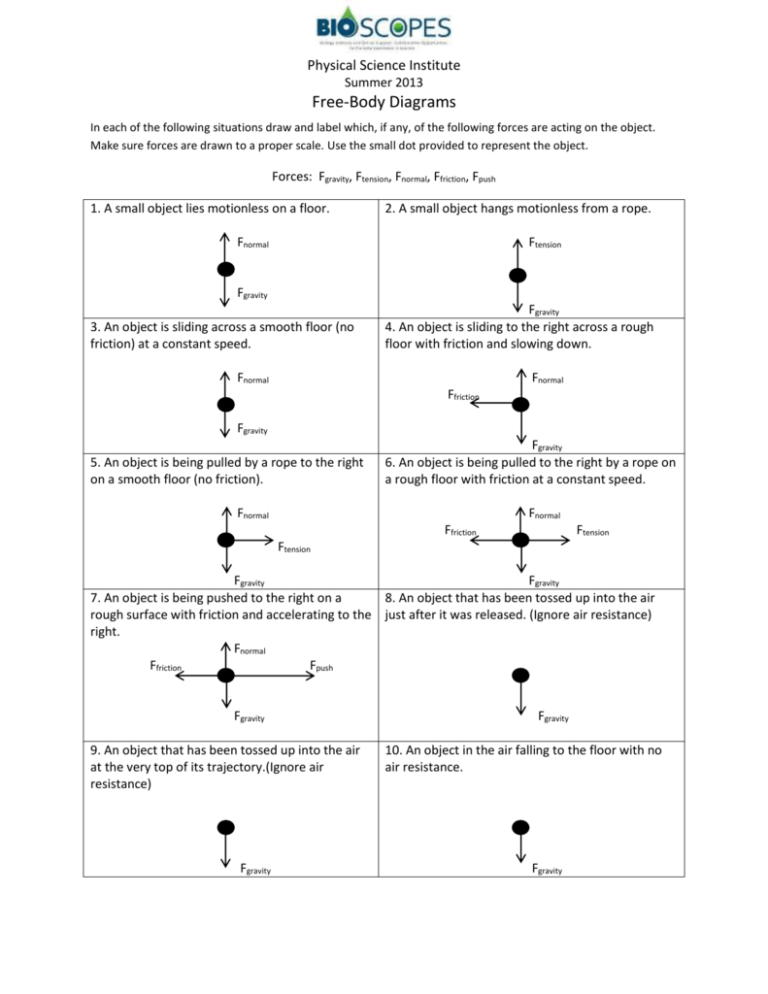

Common Types of Carryovers

The TurboTax Carryover Worksheet can help track and calculate various types of carryovers, including:

- Net Operating Loss (NOL) carryovers: Unused business losses from previous years can be carried over to future tax years.

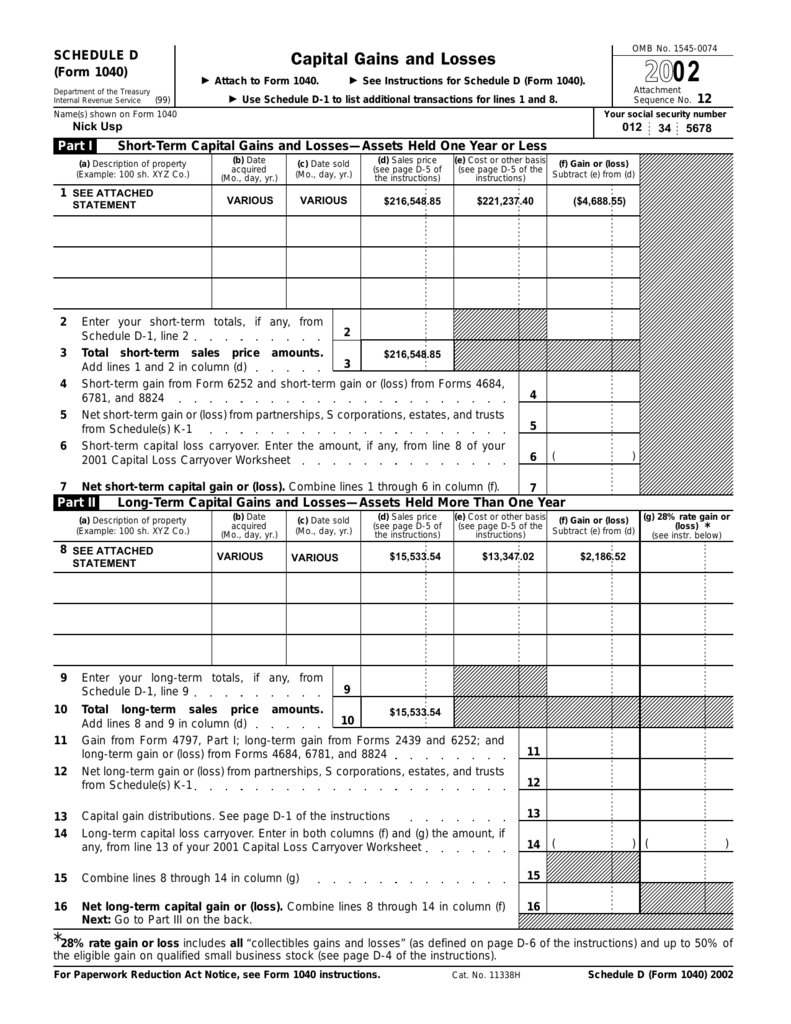

- Capital loss carryovers: Unused capital losses from previous years can be carried over to future tax years.

- Charitable contribution carryovers: Unused charitable contributions from previous years can be carried over to future tax years.

- Credit carryovers: Unused tax credits from previous years can be carried over to future tax years.

Tips for Managing Carryovers

To effectively manage carryovers and maximize their benefits, consider the following tips:

- Keep accurate records: Maintain detailed records of all carryovers, including the type, amount, and tax year.

- Monitor carryover balances: Regularly review carryover balances to ensure accuracy and identify potential issues.

- Plan ahead: Consider the impact of carryovers on future tax years and plan accordingly.

What is the purpose of the TurboTax Carryover Worksheet?

+The TurboTax Carryover Worksheet is designed to help taxpayers track and calculate carryover amounts from previous tax years, ensuring that all applicable credits, deductions, and losses are claimed on the current tax return.

What types of carryovers can be tracked using the TurboTax Carryover Worksheet?

+The TurboTax Carryover Worksheet can help track and calculate various types of carryovers, including Net Operating Loss (NOL) carryovers, capital loss carryovers, charitable contribution carryovers, and credit carryovers.

How do I access the TurboTax Carryover Worksheet?

+To access the TurboTax Carryover Worksheet, log in to your TurboTax account and navigate to the Carryover Worksheet section.

In summary, the TurboTax Carryover Worksheet is a valuable tool designed to simplify the process of tracking and reporting carryover amounts from previous tax years. By following the step-by-step instructions and tips outlined in this article, taxpayers can accurately track and claim carryover amounts, maximizing their refunds and minimizing their tax liability.