Calculating Your Paycheck Worksheet Answer Key Made Easy

Understanding Your Paycheck Worksheet

Calculating your paycheck can be a daunting task, especially with the various deductions and taxes that come out of your hard-earned money. However, with a paycheck worksheet, you can easily determine how much you’ll take home. In this article, we’ll break down the process of calculating your paycheck worksheet answer key and provide a step-by-step guide to make it easy.

What is a Paycheck Worksheet?

A paycheck worksheet, also known as a paycheck calculator or pay stub calculator, is a tool used to calculate an employee’s take-home pay. It takes into account the employee’s gross income, deductions, and taxes to determine the net pay.

Paycheck Worksheet Answer Key Components

To calculate your paycheck worksheet answer key, you’ll need to gather the following information:

- Gross Income: Your total income before taxes and deductions.

- Federal Income Tax: The amount of federal income tax withheld from your paycheck.

- State Income Tax: The amount of state income tax withheld from your paycheck.

- Social Security Tax: The amount of social security tax withheld from your paycheck.

- Medicare Tax: The amount of medicare tax withheld from your paycheck.

- Other Deductions: Any other deductions, such as health insurance, retirement contributions, or garnishments.

Step-by-Step Guide to Calculating Your Paycheck Worksheet Answer Key

Here’s a step-by-step guide to calculating your paycheck worksheet answer key:

- Determine Your Gross Income: Start by calculating your gross income, which is your total income before taxes and deductions.

- Calculate Federal Income Tax: Use the IRS tax tables or a tax calculator to determine the amount of federal income tax withheld from your paycheck.

- Calculate State Income Tax: Use your state’s tax tables or a tax calculator to determine the amount of state income tax withheld from your paycheck.

- Calculate Social Security Tax: Calculate 6.2% of your gross income, up to the social security wage base.

- Calculate Medicare Tax: Calculate 1.45% of your gross income.

- Calculate Other Deductions: Calculate any other deductions, such as health insurance, retirement contributions, or garnishments.

- Calculate Net Pay: Subtract all deductions from your gross income to determine your net pay.

💡 Note: Make sure to check your pay stub or consult with your HR department to ensure you have the correct information.

Example of a Paycheck Worksheet Answer Key

Here’s an example of a paycheck worksheet answer key:

| Component | Amount |

|---|---|

| Gross Income | $4,000.00 |

| Federal Income Tax | $800.00 |

| State Income Tax | $200.00 |

| Social Security Tax | $248.00 |

| Medicare Tax | $58.00 |

| Health Insurance | $150.00 |

| 401(k) Contribution | $500.00 |

| Net Pay | $2,544.00 |

Conclusion

Calculating your paycheck worksheet answer key may seem like a daunting task, but with the right information and a step-by-step guide, it’s easy to determine your take-home pay. Remember to always check your pay stub or consult with your HR department to ensure you have the correct information.

What is a paycheck worksheet?

+A paycheck worksheet, also known as a paycheck calculator or pay stub calculator, is a tool used to calculate an employee’s take-home pay.

What information do I need to calculate my paycheck worksheet answer key?

+You’ll need to gather information on your gross income, federal income tax, state income tax, social security tax, medicare tax, and other deductions.

How do I calculate my net pay?

+Subtract all deductions from your gross income to determine your net pay.

Related Terms:

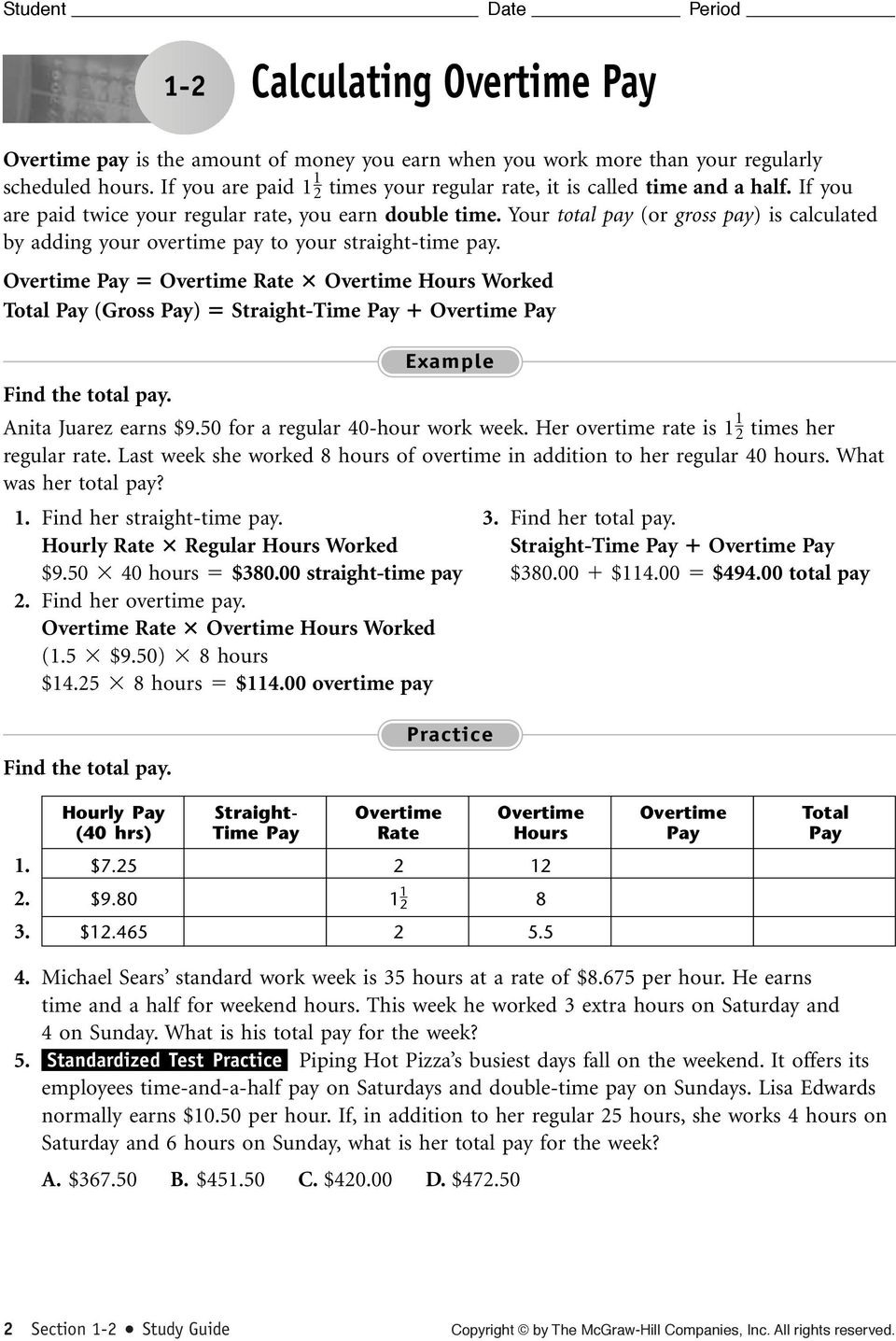

- Calculating overtime pay Worksheet PDF

- Calculating overtime pay worksheet answers

- Calculator