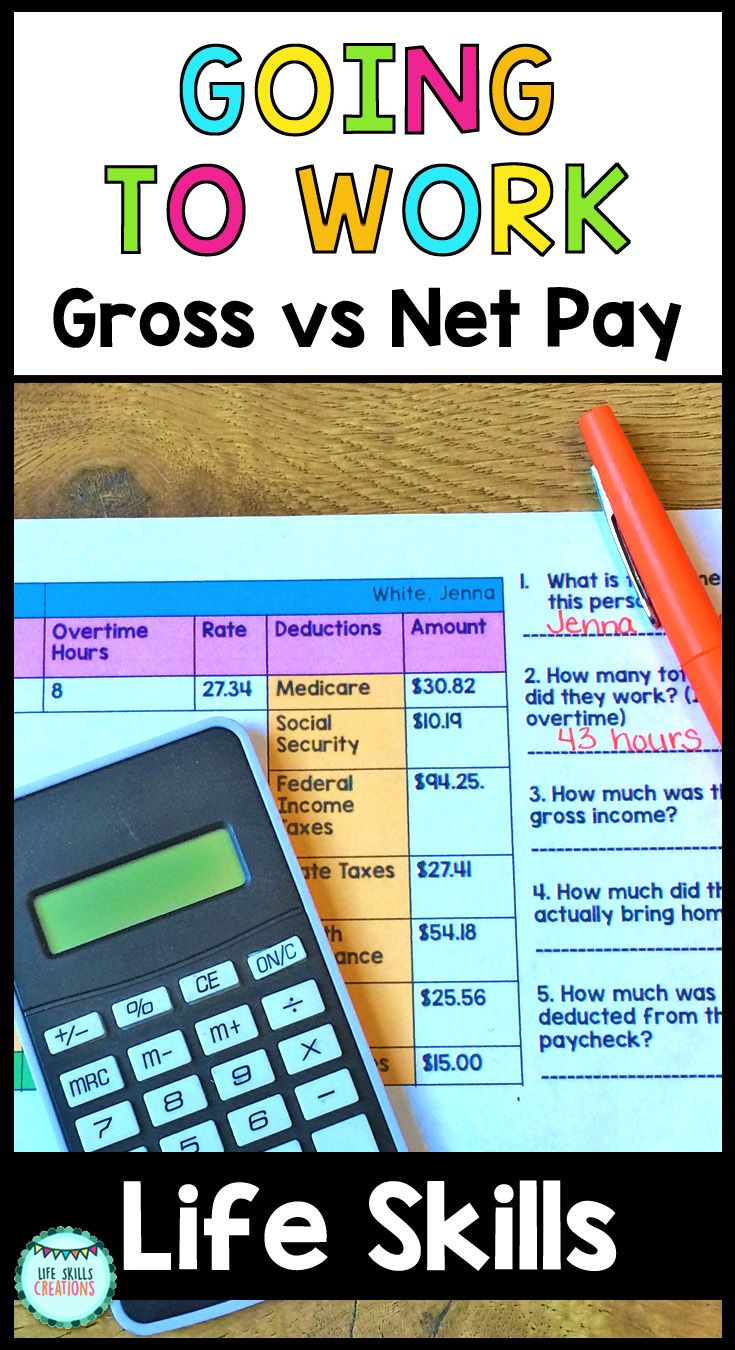

5 Steps to Calculate Gross Pay Accurately

Understanding Gross Pay and Its Importance

Gross pay, also known as gross income, is the total amount of money an employee earns before any deductions or taxes are taken out. Calculating gross pay accurately is crucial for both employers and employees, as it affects the overall compensation package and tax obligations. In this article, we will outline a step-by-step guide on how to calculate gross pay accurately.

Step 1: Determine the Employee's Earnings

The first step in calculating gross pay is to determine the employee’s earnings. This includes:

- Hourly wage: The employee’s hourly rate of pay.

- Number of hours worked: The total number of hours worked by the employee during the pay period.

- Salary: The employee’s annual or monthly salary.

If the employee is paid hourly, multiply the hourly wage by the number of hours worked. If the employee is paid a salary, use the annual or monthly salary as the earnings.

📝 Note: Make sure to include any overtime pay, bonuses, or commissions in the employee's earnings.

Step 2: Calculate Overtime Pay (If Applicable)

If the employee worked overtime, calculate the overtime pay by multiplying the number of overtime hours worked by the overtime rate. The overtime rate is usually 1.5 times the regular hourly wage.

| Overtime Hours | Overtime Rate | Overtime Pay |

|---|---|---|

| 10 hours | $20/hour x 1.5 | $300 |

Add the overtime pay to the employee’s earnings.

Step 3: Add Bonuses and Commissions (If Applicable)

If the employee received any bonuses or commissions, add them to the employee’s earnings.

- Bonuses: One-time payments made to employees for exceptional performance or achievements.

- Commissions: Payments made to employees for sales or revenue generated.

📝 Note: Make sure to include any bonuses or commissions in the employee's earnings, but only if they are taxable.

Step 4: Calculate Gross Pay

Now, add the employee’s earnings, overtime pay, bonuses, and commissions to calculate the gross pay.

Gross Pay = Earnings + Overtime Pay + Bonuses + Commissions

Example:

Gross Pay = 4,000 (earnings) + 300 (overtime pay) + 1,000 (bonus) = 5,300

Step 5: Verify and Record Gross Pay

The final step is to verify and record the gross pay. Make sure to:

- Verify calculations: Double-check calculations to ensure accuracy.

- Record gross pay: Record the gross pay in the employee’s payroll records.

📝 Note: Make sure to keep accurate records of gross pay for tax purposes and to ensure compliance with labor laws.

By following these 5 steps, you can accurately calculate an employee’s gross pay. Remember to include all earnings, overtime pay, bonuses, and commissions, and verify calculations to ensure accuracy.

Gross pay is just one aspect of an employee’s compensation package. Understanding the different components of compensation and how to calculate them accurately is crucial for both employers and employees.

What is gross pay?

+

Gross pay is the total amount of money an employee earns before any deductions or taxes are taken out.

What is included in gross pay?

+

Gross pay includes earnings, overtime pay, bonuses, and commissions.

Why is it important to calculate gross pay accurately?

+

Calculating gross pay accurately is crucial for both employers and employees, as it affects the overall compensation package and tax obligations.

Related Terms:

- Calculator