Calculate Your Gross Pay with Ease

Understanding Gross Pay and Its Importance

When it comes to managing your finances, understanding your gross pay is crucial. Gross pay, also known as gross income, is the total amount of money you earn before any deductions or taxes are taken out. It’s essential to calculate your gross pay accurately to determine your take-home pay, plan your budget, and make informed financial decisions.

Factors Affecting Gross Pay

Several factors can affect your gross pay, including:

- Hourly wage or salary: Your hourly wage or salary is the primary factor in determining your gross pay.

- Number of hours worked: The number of hours you work in a pay period can significantly impact your gross pay.

- Overtime pay: Working overtime can increase your gross pay, but it may also be subject to different tax rates.

- Bonuses and commissions: Bonuses and commissions can be included in your gross pay, but they may be taxed differently than your regular income.

- Benefits and allowances: Some benefits and allowances, such as housing allowances or meal allowances, may be included in your gross pay.

How to Calculate Gross Pay

Calculating gross pay is relatively straightforward. Here’s a step-by-step guide:

- Step 1: Determine your hourly wage or salary: Check your employment contract or pay stub to find your hourly wage or salary.

- Step 2: Calculate your total hours worked: Calculate the total number of hours you worked in the pay period, including regular hours, overtime hours, and any leave taken.

- Step 3: Calculate your regular pay: Multiply your hourly wage by the total number of regular hours worked.

- Step 4: Calculate your overtime pay: Multiply your hourly wage by the total number of overtime hours worked, then multiply by the overtime rate (usually 1.5 times the regular rate).

- Step 5: Add bonuses and commissions: Add any bonuses or commissions you earned during the pay period to your regular pay and overtime pay.

- Step 6: Add benefits and allowances: Add any benefits or allowances, such as housing allowances or meal allowances, to your gross pay.

Gross Pay Calculation Example

Let’s say you work as a marketing manager with an hourly wage of 50. You work 40 regular hours and 10 overtime hours in a week. You also earn a bonus of 1,000 and a housing allowance of $500.

| Component | Amount |

|---|---|

| Regular pay (40 hours x $50/hour) | $2,000 |

| Overtime pay (10 hours x $50/hour x 1.5) | $750 |

| Bonus | $1,000 |

| Housing allowance | $500 |

| Total gross pay | $4,250 |

📝 Note: This is a simplified example and does not take into account other factors that may affect gross pay, such as taxes, deductions, and benefits.

Tips for Managing Your Gross Pay

Here are some tips for managing your gross pay effectively:

- Keep track of your hours worked: Accurately tracking your hours worked can help you ensure you’re paid correctly.

- Review your pay stub: Regularly review your pay stub to ensure you’re being paid correctly and that all deductions are accurate.

- Plan your budget: Use your gross pay to plan your budget and make informed financial decisions.

- Take advantage of benefits: Make sure you’re taking advantage of all the benefits and allowances available to you.

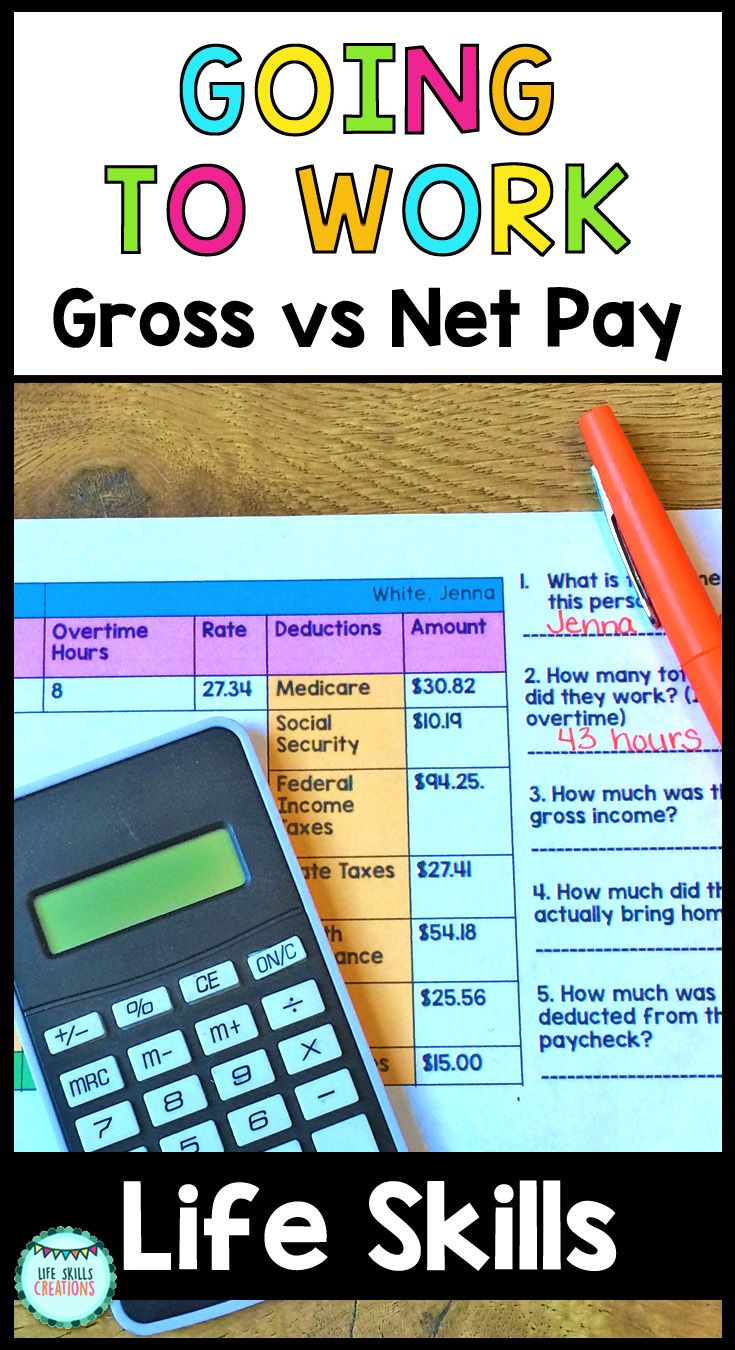

What is the difference between gross pay and net pay?

+Gross pay is the total amount of money you earn before any deductions or taxes are taken out, while net pay is the amount of money you take home after all deductions and taxes have been taken out.

How do I calculate my gross pay if I'm paid a salary?

+If you're paid a salary, you can calculate your gross pay by dividing your annual salary by the number of pay periods in a year.

What are some common deductions that affect gross pay?

+Common deductions that affect gross pay include taxes, health insurance premiums, retirement contributions, and other benefits.

In conclusion, understanding and calculating your gross pay is essential for managing your finances effectively. By following the steps outlined in this article, you can accurately calculate your gross pay and make informed financial decisions.

Related Terms:

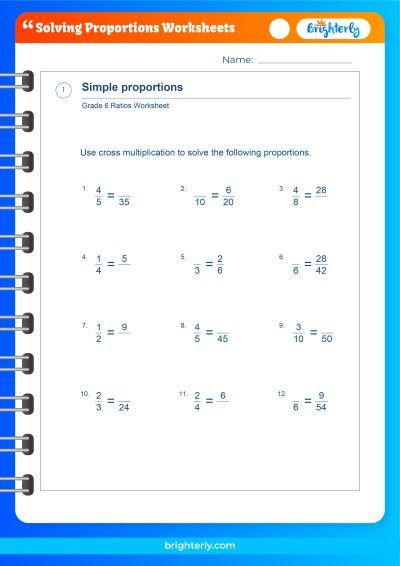

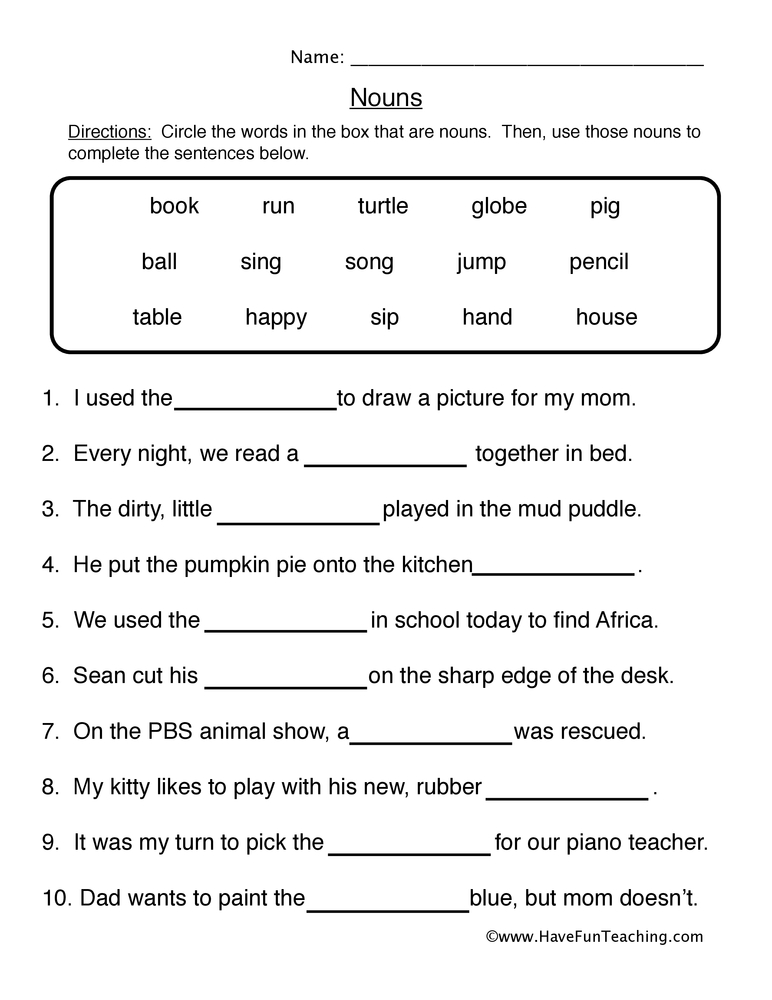

- Calculating gross pay Worksheet answers

- Gross pay Worksheet pdf

- Calculating hourly wages Worksheet

- Calculating net pay worksheet

- Calculating overtime pay Worksheet PDF