K1 Basis Worksheet: Simplify Your Tax Filing

Simplifying Tax Filing with the K1 Basis Worksheet

As a partner in a partnership or a shareholder in an S corporation, you’re likely familiar with the complexity of tax filing. One of the most critical components of your tax return is the K1 basis worksheet. In this article, we’ll explore the K1 basis worksheet, its importance, and provide a step-by-step guide on how to simplify your tax filing.

What is a K1 Basis Worksheet?

A K1 basis worksheet is a document used to track the tax basis of your investment in a partnership or S corporation. The tax basis represents the amount of money you’ve invested in the business, plus any additional contributions or loans you’ve made. The K1 basis worksheet helps you keep track of this information and ensures you’re reporting the correct tax basis on your tax return.

Why is a K1 Basis Worksheet Important?

A K1 basis worksheet is essential for several reasons:

- Accurate Tax Reporting: The K1 basis worksheet helps you accurately report your tax basis on your tax return, which is crucial for calculating your taxable income and avoiding potential penalties.

- Deducting Losses: If the partnership or S corporation incurs losses, you may be able to deduct those losses on your tax return. The K1 basis worksheet helps you determine the amount of losses you can deduct.

- Calculating Gain or Loss on Sale: When you sell your interest in the partnership or S corporation, the K1 basis worksheet helps you calculate the gain or loss on the sale.

Step-by-Step Guide to Completing the K1 Basis Worksheet

Completing the K1 basis worksheet can be a daunting task, but by following these steps, you can simplify the process:

- Gather Required Documents: Collect the following documents:

- Your K1 statement from the partnership or S corporation

- Your tax return from the previous year

- Any additional contributions or loans made to the business

- Determine Your Beginning Basis: Start by determining your beginning basis, which is the tax basis of your investment at the beginning of the tax year.

- Calculate Contributions and Distributions: Calculate any contributions or distributions made during the tax year, including any loans or repayments.

- Calculate Income and Loss: Calculate the income or loss allocated to you from the partnership or S corporation.

- Calculate Gain or Loss on Sale: If you sold your interest in the partnership or S corporation, calculate the gain or loss on the sale.

- Calculate Your Ending Basis: Calculate your ending basis by adding any contributions and income, and subtracting any distributions and losses.

| Beginning Basis | Contributions | Distributions | Income/Loss | Gain/Loss on Sale | Ending Basis |

|---|---|---|---|---|---|

| $10,000 | $5,000 | $2,000 | $3,000 | $0 | $16,000 |

📝 Note: This is a simplified example and actual calculations may vary depending on your specific situation.

Tips for Simplifying Your Tax Filing

To simplify your tax filing, consider the following tips:

- Keep Accurate Records: Keep accurate and detailed records of your contributions, distributions, income, and losses.

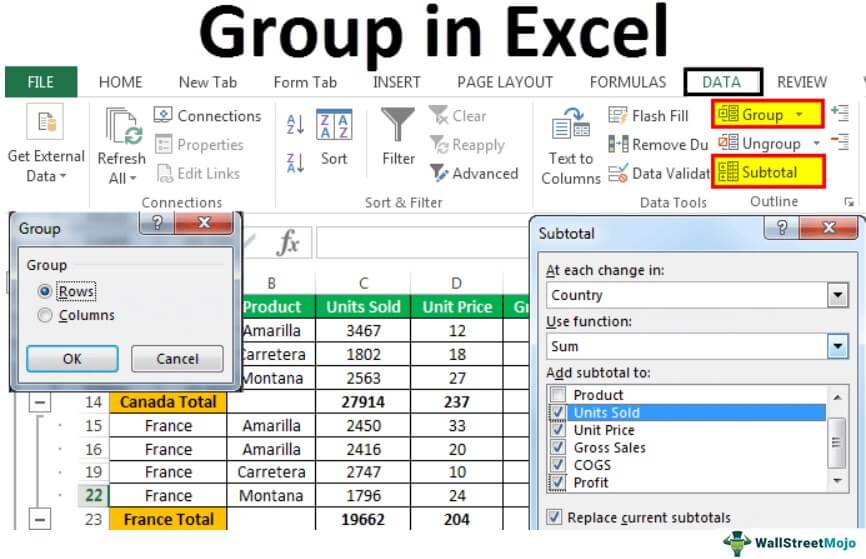

- Use Tax Preparation Software: Utilize tax preparation software to help you complete the K1 basis worksheet and calculate your tax basis.

- Consult a Tax Professional: If you’re unsure about completing the K1 basis worksheet or have complex tax situations, consider consulting a tax professional.

By following these steps and tips, you can simplify your tax filing and ensure accurate reporting of your tax basis.

The key to simplifying your tax filing is to stay organized and keep accurate records. By using the K1 basis worksheet and following the steps outlined in this article, you can ensure accurate tax reporting and avoid potential penalties. Remember to consult a tax professional if you’re unsure about any aspect of the process.

What is a K1 statement?

+A K1 statement is a document provided by the partnership or S corporation that reports your share of income, losses, and other tax-related information.

Why do I need to complete a K1 basis worksheet?

+You need to complete a K1 basis worksheet to accurately report your tax basis on your tax return and to ensure you’re deducting the correct amount of losses or gains on the sale of your interest.

Can I use tax preparation software to complete the K1 basis worksheet?

+Related Terms:

- Partner basis worksheet PDF

- Partnership basis calculation worksheet

- Partnership basis worksheet excel

- Partner basis Worksheet 1065

- 12a 1120S k1

- K1 worksheet