5 Ways to Simplify 941x Worksheet 1

Understanding the 941x Worksheet 1: A Comprehensive Guide to Simplification

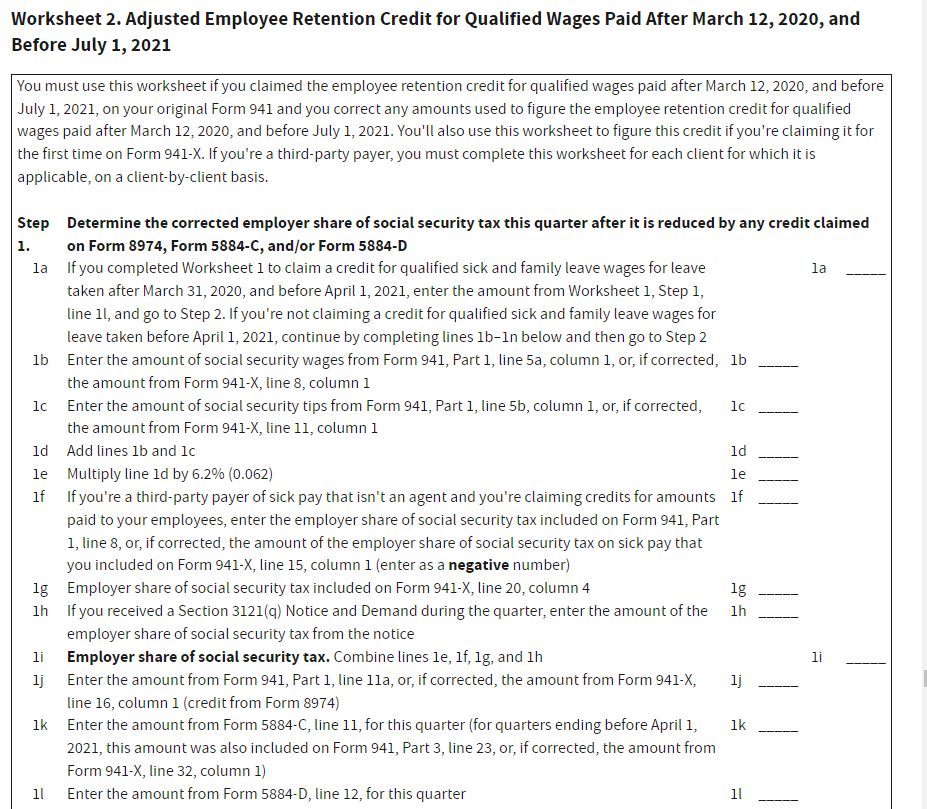

The 941x worksheet is a critical component of the employment tax return process, allowing employers to report corrections to previously filed employment tax returns. However, navigating Worksheet 1 can be daunting, especially for those without extensive experience in employment tax law. In this article, we will break down the complexities of the 941x Worksheet 1 and provide actionable tips on how to simplify the process.

What is the 941x Worksheet 1?

The 941x Worksheet 1 is a critical component of the employment tax return process. It is used to report corrections to previously filed employment tax returns, specifically Form 941. The worksheet is divided into several sections, each addressing a different aspect of the correction process.

Tip 1: Understand the Purpose of Each Section

To simplify the 941x Worksheet 1, it is essential to understand the purpose of each section. The worksheet is divided into several sections, including:

- Section 1: Corrected Amounts: This section requires employers to report the corrected amounts for various employment tax components, such as wages, tips, and taxes withheld.

- Section 2: Adjustments: This section allows employers to report adjustments to the corrected amounts, such as adjustments for overreported taxes or underreported wages.

- Section 3: Interest and Penalties: This section requires employers to calculate interest and penalties associated with the corrected amounts.

By understanding the purpose of each section, employers can ensure that they are accurately reporting corrections and avoiding common errors.

Tip 2: Use the Correct Form and Instructions

To simplify the 941x Worksheet 1, it is essential to use the correct form and instructions. The IRS provides detailed instructions for completing the worksheet, including examples and explanations. Employers should carefully review the instructions and ensure that they are using the correct form for their specific situation.

📝 Note: The IRS regularly updates the 941x Worksheet 1 and instructions. Employers should ensure that they are using the most recent version of the form and instructions.

Tip 3: Maintain Accurate Records

Maintaining accurate records is critical for simplifying the 941x Worksheet 1. Employers should keep detailed records of employment tax components, including wages, tips, and taxes withheld. This will ensure that they have accurate information to report on the worksheet.

- Tips for Maintaining Accurate Records:

- Use a payroll software to track employment tax components.

- Keep detailed records of employee wages, tips, and taxes withheld.

- Regularly review and reconcile records to ensure accuracy.

Tip 4: Use a Step-by-Step Approach

To simplify the 941x Worksheet 1, employers should use a step-by-step approach. This will ensure that they are accurately reporting corrections and avoiding common errors.

- Step-by-Step Approach:

- Review the instructions and ensure that you are using the correct form.

- Gather all necessary records and information.

- Complete Section 1: Corrected Amounts.

- Complete Section 2: Adjustments.

- Complete Section 3: Interest and Penalties.

- Review and reconcile the worksheet to ensure accuracy.

Tip 5: Seek Professional Assistance if Necessary

Finally, employers should not hesitate to seek professional assistance if necessary. The 941x Worksheet 1 can be complex, and employers may require additional guidance to ensure that they are accurately reporting corrections.

- When to Seek Professional Assistance:

- If you are unsure about how to complete the worksheet.

- If you are experiencing difficulty with the calculations.

- If you are subject to penalties or interest and require guidance on how to minimize these amounts.

What is the purpose of the 941x Worksheet 1?

+The 941x Worksheet 1 is used to report corrections to previously filed employment tax returns, specifically Form 941.

How often should I review and reconcile my employment tax records?

+Employers should regularly review and reconcile their employment tax records to ensure accuracy and avoid common errors.

Can I use payroll software to simplify the 941x Worksheet 1?

+Yes, payroll software can help simplify the 941x Worksheet 1 by providing accurate calculations and records.

In conclusion, simplifying the 941x Worksheet 1 requires a comprehensive understanding of the purpose of each section, accurate record-keeping, and a step-by-step approach. By following these tips, employers can ensure that they are accurately reporting corrections and avoiding common errors. Remember, if you are unsure about how to complete the worksheet, do not hesitate to seek professional assistance.

Related Terms:

- 941 x Worksheet 1

- form 941-x pdf

- Worksheet 1 IRS

- 941x refund status

- 940 instructions

- Worksheet 2