941 X Worksheet 2 Fillable Form Download

Understanding the 941 X Worksheet 2 Fillable Form

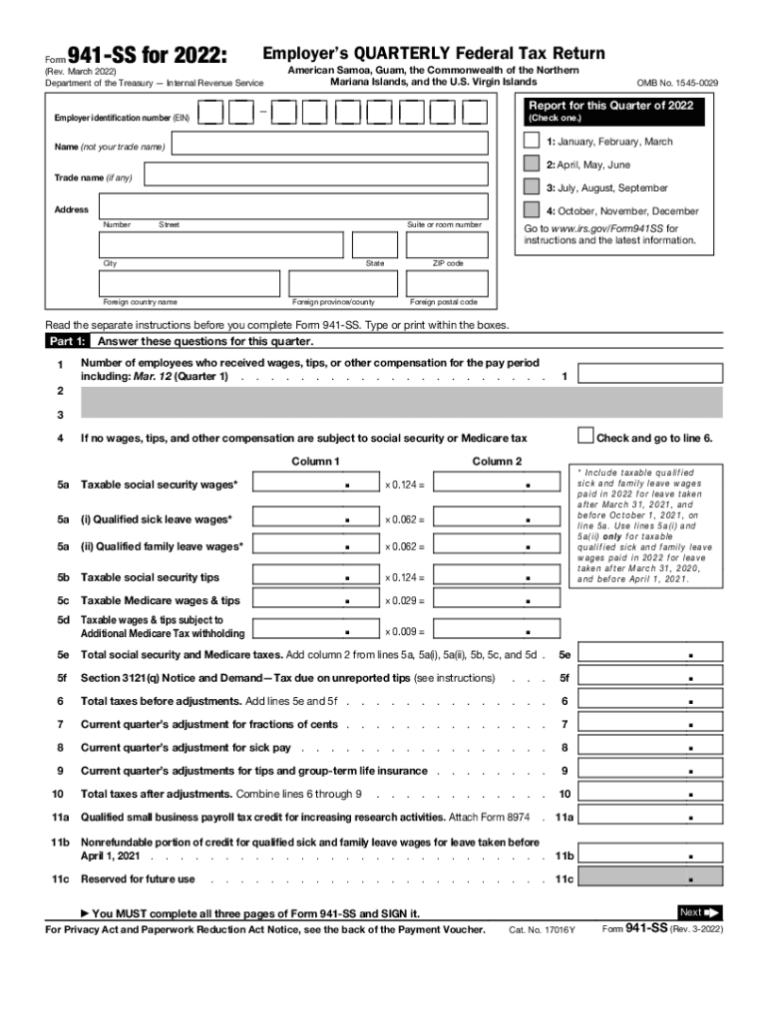

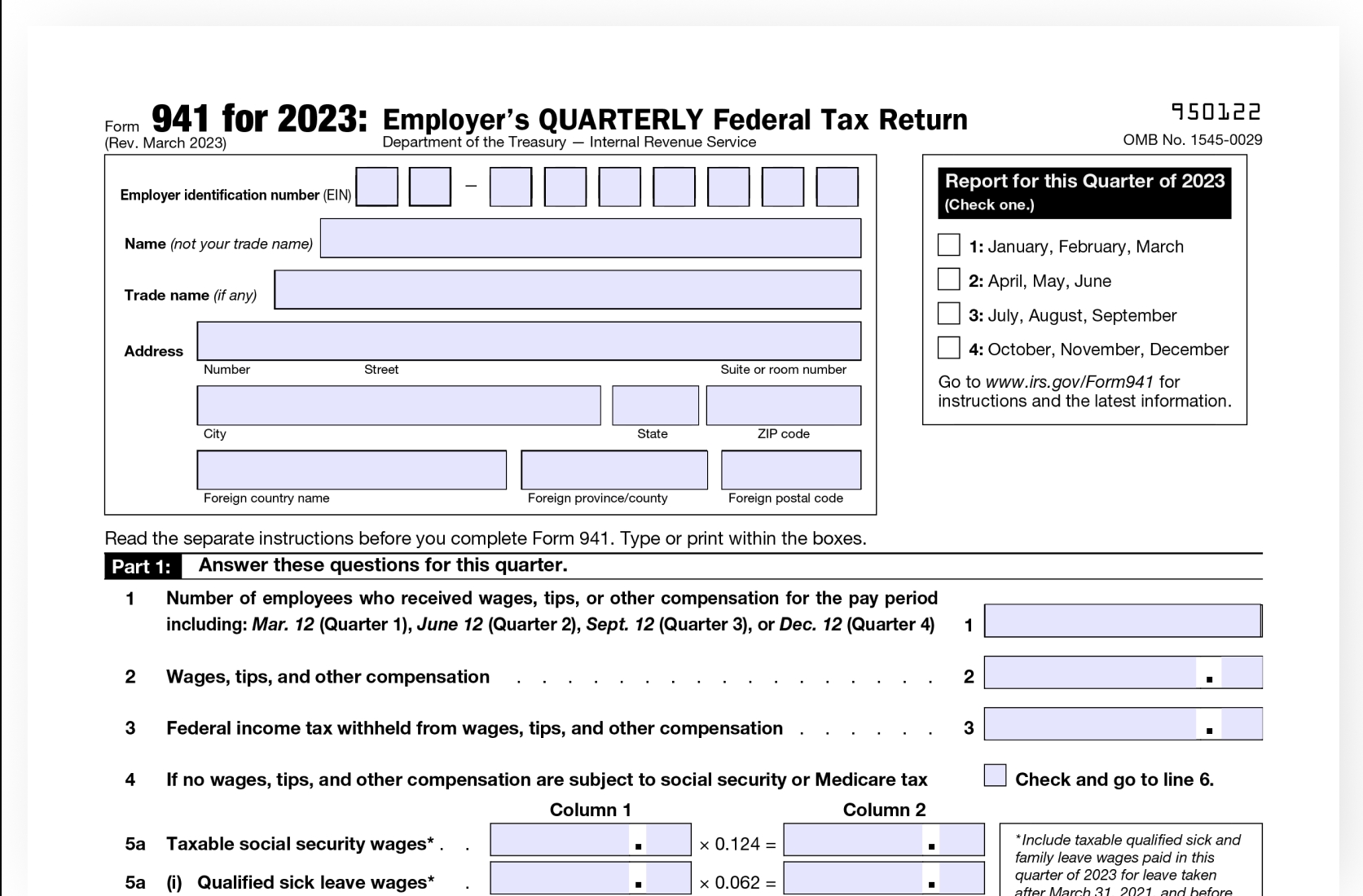

If you’re an employer, you’re required to file Form 941-X with the IRS to correct errors on a previously filed Form 941. One of the key components of this process is completing Worksheet 2, which helps you calculate the corrected employment taxes. In this article, we’ll guide you through the process of filling out Worksheet 2 and provide you with a downloadable fillable form.

What is Form 941-X?

Form 941-X is used to correct errors on a previously filed Form 941, which is the Employer’s Quarterly Federal Tax Return. This form is used to report employment taxes, including income tax withholding, Social Security tax, and Medicare tax.

What is Worksheet 2?

Worksheet 2 is a part of Form 941-X that helps you calculate the corrected employment taxes. It’s used to figure the corrected tax liability and any penalties or interest that may be due.

How to Fill Out Worksheet 2

To fill out Worksheet 2, you’ll need to have the following information:

- The original Form 941 that was filed

- The corrected Form 941 that you’re filing

- The amount of the error or correction

Here’s a step-by-step guide to filling out Worksheet 2:

- Enter the original tax liability: Enter the tax liability from the original Form 941 that was filed.

- Enter the corrected tax liability: Enter the corrected tax liability from the corrected Form 941 that you’re filing.

- Calculate the difference: Calculate the difference between the original tax liability and the corrected tax liability.

- Calculate the penalty: If you’re filing the corrected return after the due date, you may be subject to penalties. Calculate the penalty using the IRS’s penalty calculation rules.

- Calculate the interest: If you’re filing the corrected return after the due date, you may be subject to interest. Calculate the interest using the IRS’s interest calculation rules.

📝 Note: You can use the IRS's online calculator to help you calculate the penalty and interest.

Downloading the 941 X Worksheet 2 Fillable Form

You can download the 941 X Worksheet 2 fillable form from the IRS’s website or from other reputable sources. Make sure to use a fillable form that is compatible with your computer and software.

| Form 941-X Worksheet 2 | Download |

|---|---|

| Fillable PDF | Download from IRS |

| Fillable Excel | Download from IRS |

Conclusion

Filling out Worksheet 2 is an important part of the process of correcting errors on a previously filed Form 941. By following the steps outlined above, you can ensure that you’re calculating the corrected employment taxes correctly. Remember to download the 941 X Worksheet 2 fillable form from a reputable source and to use a calculator to help you with the penalty and interest calculations.

What is the purpose of Worksheet 2?

+Worksheet 2 is used to calculate the corrected employment taxes and any penalties or interest that may be due.

Where can I download the 941 X Worksheet 2 fillable form?

+You can download the 941 X Worksheet 2 fillable form from the IRS’s website or from other reputable sources.

What information do I need to fill out Worksheet 2?

+You’ll need the original Form 941 that was filed, the corrected Form 941 that you’re filing, and the amount of the error or correction.