5 Easy Steps to a 1031 Exchange with Excel

Understanding the 1031 Exchange: A Tax-Deferred Solution for Investors

As a savvy real estate investor, you’re likely familiar with the concept of a 1031 exchange, also known as a like-kind exchange. This powerful tax-deferral strategy allows you to swap one investment property for another, potentially saving thousands of dollars in capital gains taxes. In this article, we’ll explore the 1031 exchange process and provide a step-by-step guide on how to facilitate a successful exchange using Excel.

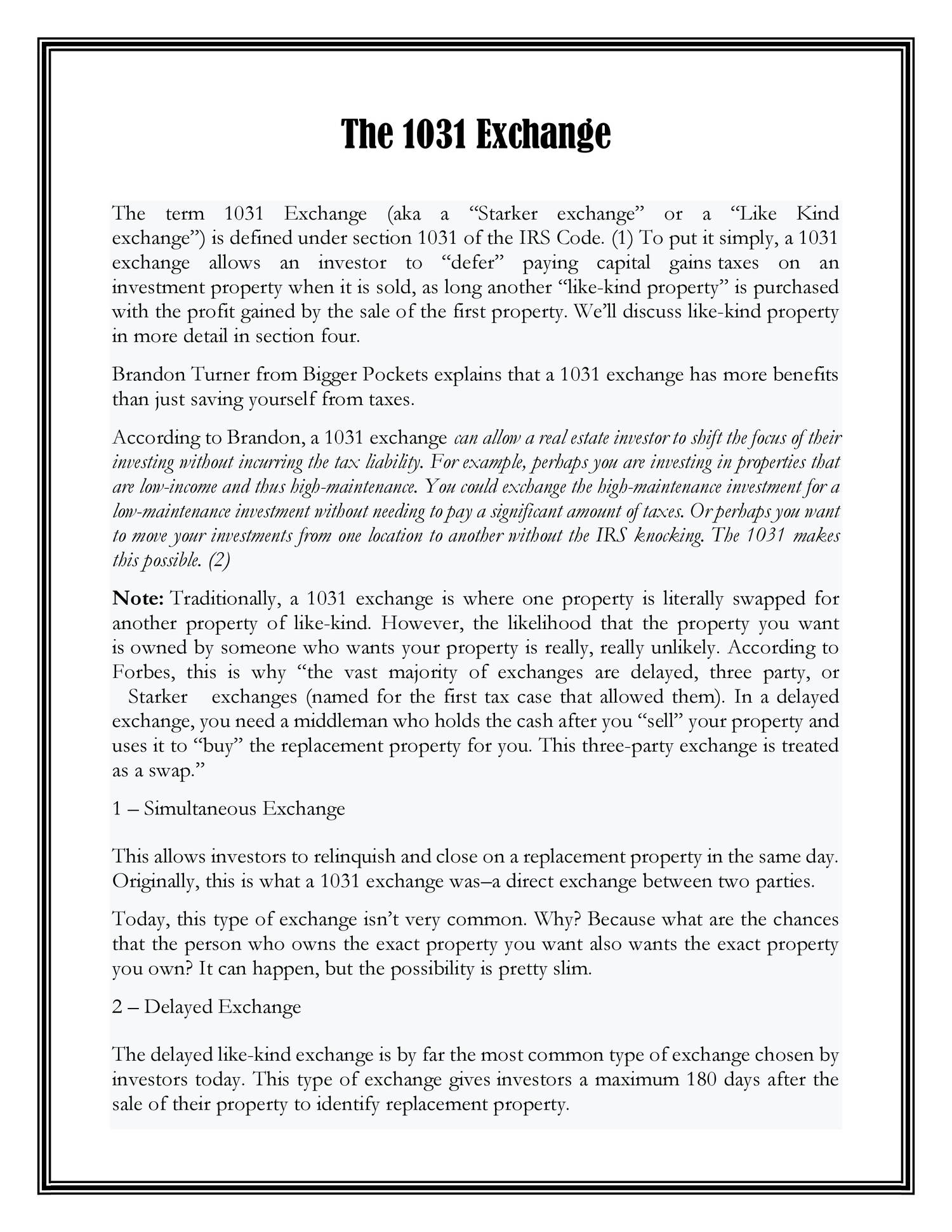

What is a 1031 Exchange?

A 1031 exchange is a tax-deferral strategy authorized by Section 1031 of the Internal Revenue Code (IRC). It enables investors to exchange one investment property for another, similar property, without recognizing capital gains or losses. This means that the investor can defer paying taxes on the gain until a later date, potentially reducing their tax liability.

Benefits of a 1031 Exchange

The benefits of a 1031 exchange are numerous:

• Tax Deferral: Defer paying capital gains taxes, potentially saving thousands of dollars. • Increased Cash Flow: By not paying taxes on the gain, you can reinvest the funds in a new property. • Diversification: Exchange one property for another, potentially diversifying your investment portfolio. • Flexibility: Exchange one property for multiple properties, or vice versa.

5 Easy Steps to a 1031 Exchange with Excel

Now that we’ve covered the basics of a 1031 exchange, let’s dive into the step-by-step process using Excel:

Step 1: Identify the Relinquished Property

💡 Note: The relinquished property is the property you're selling or "relinquishing" in the exchange.

| Property Information | Relinquished Property |

|---|---|

| Property Address | 123 Main St, Anytown, USA |

| Property Type | Commercial Office Building |

| Purchase Date | January 1, 2010 |

| Purchase Price | $1,000,000 |

| Current Value | $1,500,000 |

Step 2: Determine the Exchange Proceeds

The exchange proceeds are the funds generated from the sale of the relinquished property. These funds will be used to purchase the replacement property.

| Exchange Proceeds | Amount |

|---|---|

| Gross Sales Price | $1,500,000 |

| Closing Costs | -$50,000 |

| Net Proceeds | $1,450,000 |

Step 3: Identify the Replacement Property

📈 Note: The replacement property is the property you're acquiring in the exchange.

| Property Information | Replacement Property |

|---|---|

| Property Address | 456 Elm St, Othertown, USA |

| Property Type | Industrial Warehouse |

| Purchase Price | $1,600,000 |

Step 4: Complete the Exchange

To complete the exchange, you’ll need to:

- Sell the relinquished property

- Use the exchange proceeds to purchase the replacement property

- Ensure the replacement property is “like-kind” to the relinquished property

Step 5: Report the Exchange

You’ll need to report the exchange to the IRS using Form 8824. This form will require information about the relinquished and replacement properties, as well as the exchange proceeds.

Important Notes

📝 Note: It's essential to work with a qualified intermediary (QI) to facilitate the exchange and ensure compliance with IRS regulations.

🕒 Note: The exchange must be completed within 180 days of the sale of the relinquished property.

In conclusion, a 1031 exchange can be a powerful tax-deferral strategy for real estate investors. By following these 5 easy steps and using Excel to track the process, you can successfully facilitate a 1031 exchange and potentially save thousands of dollars in capital gains taxes.

What is the purpose of a 1031 exchange?

+A 1031 exchange allows real estate investors to defer paying capital gains taxes by exchanging one investment property for another, similar property.

What is the deadline for completing a 1031 exchange?

+The exchange must be completed within 180 days of the sale of the relinquished property.

Do I need to work with a qualified intermediary (QI) to facilitate a 1031 exchange?

+Yes, it’s essential to work with a QI to ensure compliance with IRS regulations and facilitate the exchange.

Related Terms:

- 1031 exchange worksheet pdf

- 1031 exchange calculator

- 1031 exchange calculation example

- Form 8824 worksheet

- Form 8824 instructions

- IRS Form 8824