1031 Exchange Worksheet

Understanding the 1031 Exchange Worksheet: A Comprehensive Guide

When it comes to real estate investing, one of the most powerful tools available to investors is the 1031 exchange. This tax-deferred exchange allows investors to sell a property and reinvest the proceeds into a new property, deferring capital gains taxes. However, navigating the complex rules and regulations surrounding 1031 exchanges can be daunting. That’s where the 1031 exchange worksheet comes in – a valuable tool for investors to ensure compliance and maximize benefits.

What is a 1031 Exchange Worksheet?

A 1031 exchange worksheet is a document that outlines the steps and deadlines involved in a 1031 exchange. It provides a structured approach to tracking the exchange process, from the initial sale of the relinquished property to the acquisition of the replacement property. The worksheet helps investors and their advisors ensure that all necessary steps are taken, and deadlines are met, to qualify for tax-deferred treatment.

Benefits of Using a 1031 Exchange Worksheet

Using a 1031 exchange worksheet offers several benefits, including:

- Improved accuracy: The worksheet helps ensure that all necessary information is gathered and recorded, reducing the risk of errors or omissions.

- Enhanced organization: The worksheet provides a clear and concise format for tracking the exchange process, making it easier to manage multiple properties and deadlines.

- Increased efficiency: By following the structured approach outlined in the worksheet, investors and their advisors can streamline the exchange process, saving time and reducing stress.

- Better compliance: The worksheet helps ensure that all IRS rules and regulations are met, reducing the risk of audit or penalties.

Components of a 1031 Exchange Worksheet

A typical 1031 exchange worksheet includes the following components:

- Relinquished Property Information: This section captures details about the property being sold, including the property address, sale price, and closing date.

- Exchange Period: This section outlines the deadlines for identifying and acquiring replacement properties, including the 45-day identification period and the 180-day exchange period.

- Replacement Property Information: This section captures details about the replacement properties identified, including the property address, purchase price, and closing date.

- Exchange Funds: This section tracks the funds held by the qualified intermediary (QI) during the exchange, including the deposit of sale proceeds and the disbursement of funds for the replacement property.

How to Complete a 1031 Exchange Worksheet

To complete a 1031 exchange worksheet, follow these steps:

- Gather necessary information: Collect all relevant information about the relinquished property, including the sale price, closing date, and property address.

- Determine the exchange period: Calculate the deadlines for identifying and acquiring replacement properties, including the 45-day identification period and the 180-day exchange period.

- Identify replacement properties: List the potential replacement properties, including the property address, purchase price, and closing date.

- Track exchange funds: Monitor the funds held by the QI during the exchange, including the deposit of sale proceeds and the disbursement of funds for the replacement property.

- Review and update: Regularly review and update the worksheet to ensure accuracy and compliance with IRS regulations.

📝 Note: It is essential to consult with a qualified tax professional or attorney to ensure that the worksheet is completed accurately and in compliance with IRS regulations.

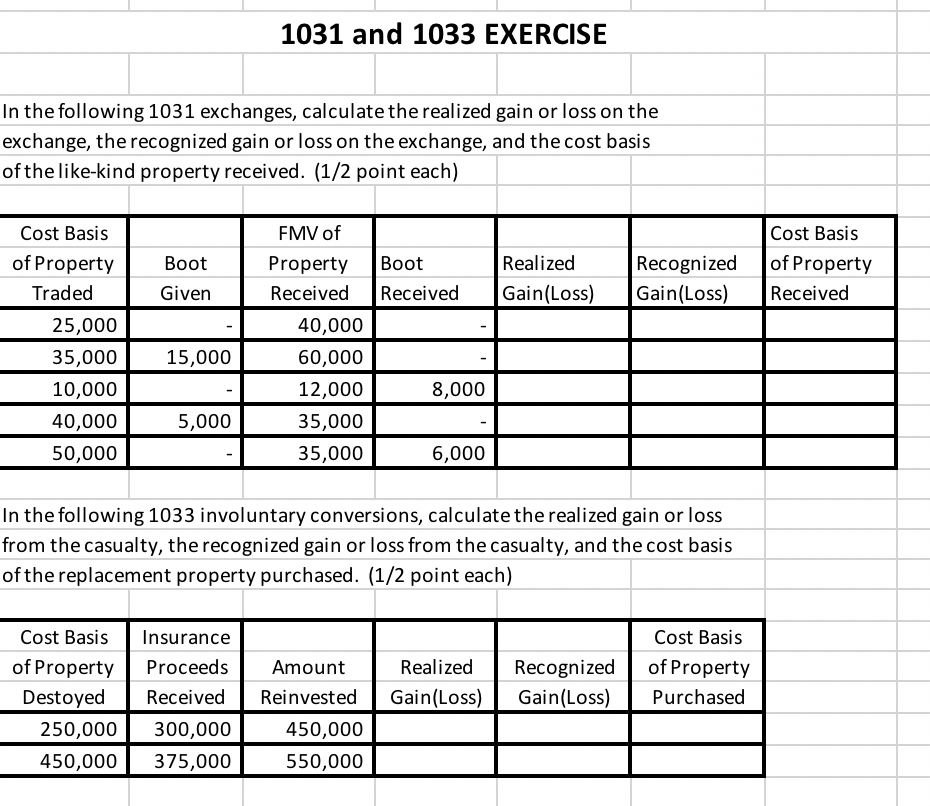

Example of a 1031 Exchange Worksheet

Here is an example of a basic 1031 exchange worksheet:

| Relinquished Property Information | Exchange Period | Replacement Property Information | Exchange Funds |

|---|---|---|---|

| Property Address: 123 Main St | 45-day identification period: 02/01/2023 - 03/17/2023 | Property Address: 456 Elm St | Sale proceeds deposited with QI: $1,000,000 |

| Sale Price: $1,500,000 | 180-day exchange period: 02/01/2023 - 08/01/2023 | Purchase Price: $1,200,000 | Funds disbursed for replacement property: $1,200,000 |

By using a 1031 exchange worksheet, investors can ensure a smooth and compliant exchange process, maximizing the benefits of this powerful tax-deferred strategy.

The key to a successful 1031 exchange is careful planning and attention to detail. By understanding the process and using a 1031 exchange worksheet, investors can navigate the complex rules and regulations surrounding 1031 exchanges with confidence. Whether you’re a seasoned real estate investor or just starting out, the 1031 exchange worksheet is an essential tool for achieving your investment goals.

What is a 1031 exchange?

+A 1031 exchange is a tax-deferred exchange that allows investors to sell a property and reinvest the proceeds into a new property, deferring capital gains taxes.

What is the purpose of a 1031 exchange worksheet?

+The 1031 exchange worksheet provides a structured approach to tracking the exchange process, ensuring accuracy, organization, and compliance with IRS regulations.

Who should use a 1031 exchange worksheet?

+Investors and their advisors should use a 1031 exchange worksheet to ensure compliance with IRS regulations and maximize the benefits of the exchange.

Related Terms:

- 1031 Exchange worksheet Excel

- 1031 exchange worksheet pdf

- 1031 exchange calculation example

- 1031 exchange calculator

- like-kind exchange worksheet excel

- Form 8824 worksheet