Simplifying 1031 Exchanges: Easy Calculation Worksheet

Understanding 1031 Exchanges: A Comprehensive Guide

For real estate investors, the 1031 exchange is a powerful tool that allows for the deferral of capital gains taxes when selling a property. However, the rules and calculations surrounding 1031 exchanges can be complex, making it difficult for investors to navigate. In this article, we will provide a detailed explanation of 1031 exchanges, including a simple calculation worksheet to help investors understand the process.

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred exchange of one investment property for another. The exchange allows investors to defer paying capital gains taxes on the sale of a property, provided that the proceeds are reinvested in a similar property within a certain time frame.

Benefits of a 1031 Exchange

The primary benefit of a 1031 exchange is the ability to defer capital gains taxes. This can provide significant tax savings, allowing investors to keep more of their profits. Additionally, 1031 exchanges can be used to:

- Increase cash flow: By deferring taxes, investors can keep more of their profits, which can be used to increase cash flow or reinvest in other properties.

- Build wealth: By continually exchanging properties and deferring taxes, investors can build wealth over time.

- Diversify portfolios: 1031 exchanges can be used to diversify investment portfolios by exchanging one property for another in a different location or asset class.

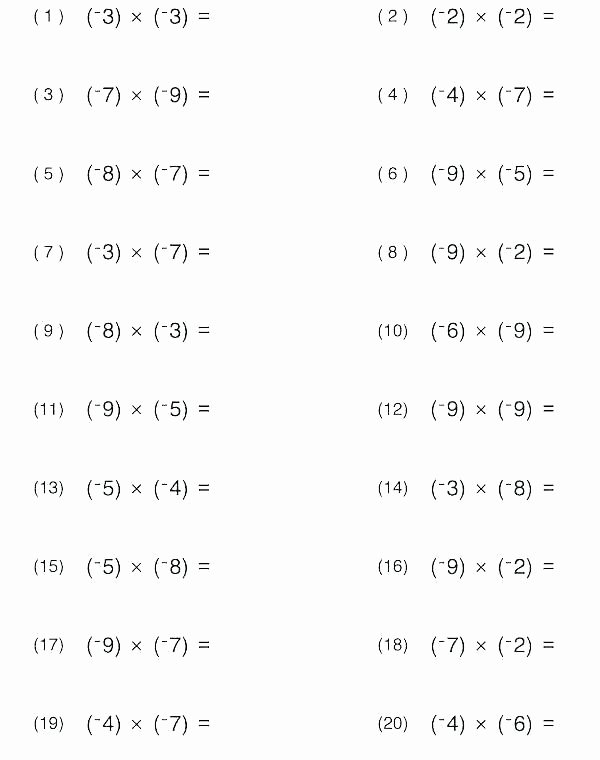

Calculating 1031 Exchanges: A Simple Worksheet

To calculate the tax implications of a 1031 exchange, investors need to understand the following:

- Gross sales price: The total amount received from the sale of the property.

- Net sales price: The gross sales price minus any commissions, fees, or other expenses.

- Capital gains tax: The tax owed on the sale of the property, calculated as the difference between the net sales price and the original purchase price.

- Exchange proceeds: The amount of money available for reinvestment in a new property.

Using the following worksheet, investors can easily calculate the tax implications of a 1031 exchange:

| Gross Sales Price | $1,000,000 |

|---|---|

| Commissions and Fees | $50,000 |

| Net Sales Price | $950,000 |

| Original Purchase Price | $500,000 |

| Capital Gains Tax | $450,000 |

| Exchange Proceeds | $950,000 |

📝 Note: This is a simplified example and actual calculations may vary depending on individual circumstances.

Timeline for a 1031 Exchange

The timeline for a 1031 exchange is critical, as investors must adhere to strict deadlines to qualify for tax-deferred treatment. The following are key deadlines to keep in mind:

- 45-day identification period: Investors have 45 days from the sale of the original property to identify potential replacement properties.

- 180-day exchange period: Investors have 180 days from the sale of the original property to complete the exchange and purchase a new property.

Common Mistakes to Avoid

To ensure a successful 1031 exchange, investors should avoid the following common mistakes:

- Missing deadlines: Failure to meet the 45-day identification period or 180-day exchange period can result in the loss of tax-deferred treatment.

- Insufficient documentation: Investors must keep accurate records of the exchange, including proof of identification and exchange proceeds.

- Incorrect property identification: Investors must ensure that the replacement property is of a like-kind nature to the original property.

📝 Note: It is recommended that investors consult with a qualified tax professional or attorney to ensure compliance with all 1031 exchange regulations.

Conclusion

A 1031 exchange can be a powerful tool for real estate investors, providing tax-deferred treatment and increased cash flow. By understanding the rules and calculations surrounding 1031 exchanges, investors can make informed decisions and maximize their returns. Using the simple calculation worksheet provided, investors can easily calculate the tax implications of a 1031 exchange and ensure a successful transaction.

What is the purpose of a 1031 exchange?

+A 1031 exchange allows real estate investors to defer paying capital gains taxes on the sale of a property, provided that the proceeds are reinvested in a similar property within a certain time frame.

What are the benefits of a 1031 exchange?

+The primary benefit of a 1031 exchange is the ability to defer capital gains taxes, which can provide significant tax savings. Additionally, 1031 exchanges can be used to increase cash flow, build wealth, and diversify investment portfolios.

What is the timeline for a 1031 exchange?

+Investors have 45 days from the sale of the original property to identify potential replacement properties, and 180 days from the sale of the original property to complete the exchange and purchase a new property.

Related Terms:

- 1031 exchange calculator

- 1031 exchange calculation example

- Like-kind exchange rules

- Form 8824 instructions

- 1031 exchange boot calculator