5 Ways to Identify a Trial Balance Worksheet

Understanding Trial Balance Worksheets

A trial balance worksheet is a crucial tool used by accountants and bookkeepers to ensure the accuracy and balance of a company’s financial statements. It is a working document that helps identify errors and discrepancies in the accounting records, making it easier to prepare financial statements. In this article, we will explore five ways to identify a trial balance worksheet and understand its importance in the accounting process.

What is a Trial Balance Worksheet?

A trial balance worksheet is a document that lists all the general ledger accounts of a company, along with their debit and credit balances. It is typically prepared at the end of an accounting period, such as a month, quarter, or year. The worksheet is used to ensure that the debits and credits in the general ledger are equal, which is a fundamental principle of accounting.

5 Ways to Identify a Trial Balance Worksheet

Here are five ways to identify a trial balance worksheet:

1. Debit and Credit Columns

A trial balance worksheet typically has two columns: one for debit balances and one for credit balances. Each general ledger account is listed, and its debit or credit balance is entered in the corresponding column. The totals of the debit and credit columns must be equal, indicating that the accounting records are in balance.

2. List of General Ledger Accounts

A trial balance worksheet lists all the general ledger accounts of a company, including asset, liability, equity, revenue, and expense accounts. Each account is identified by its account number and name, and its debit or credit balance is entered in the corresponding column.

3. Accounting Period

A trial balance worksheet is typically prepared at the end of an accounting period, such as a month, quarter, or year. The worksheet will indicate the accounting period for which it is prepared, such as “Trial Balance as of December 31, 2022.”

4. Debit and Credit Totals

A trial balance worksheet will show the total debits and credits for each account, as well as the overall total debits and credits for the company. The totals of the debit and credit columns must be equal, indicating that the accounting records are in balance.

5. Formatting

A trial balance worksheet is typically formatted in a specific way, with the account numbers and names in one column, and the debit and credit balances in separate columns. The worksheet may also include additional columns for adjustments and totals.

📝 Note: A trial balance worksheet is not a financial statement, but rather a working document used to prepare financial statements.

Importance of Trial Balance Worksheets

Trial balance worksheets are an essential tool in the accounting process, as they help ensure the accuracy and balance of a company’s financial statements. Here are some reasons why trial balance worksheets are important:

- Error detection: Trial balance worksheets help detect errors and discrepancies in the accounting records, such as incorrect journal entries or unbalanced accounts.

- Accounting accuracy: Trial balance worksheets ensure that the accounting records are accurate and complete, which is essential for preparing reliable financial statements.

- Financial statement preparation: Trial balance worksheets provide the necessary information for preparing financial statements, such as the balance sheet and income statement.

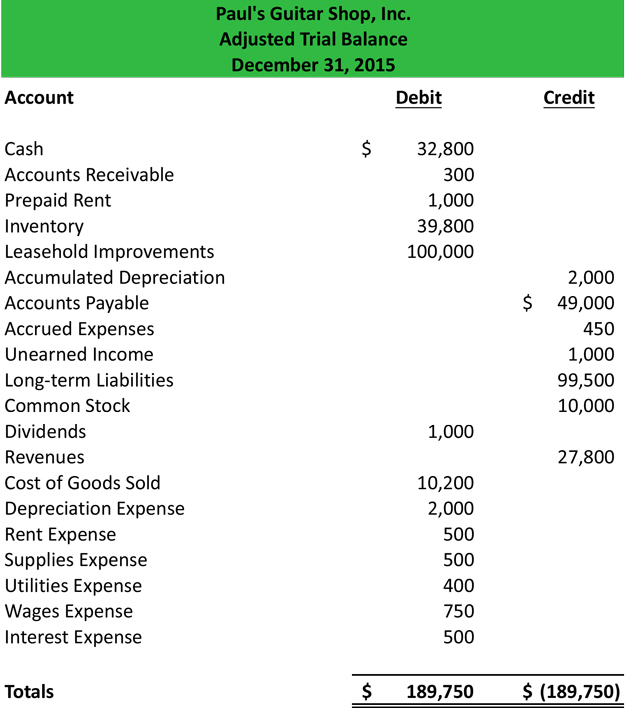

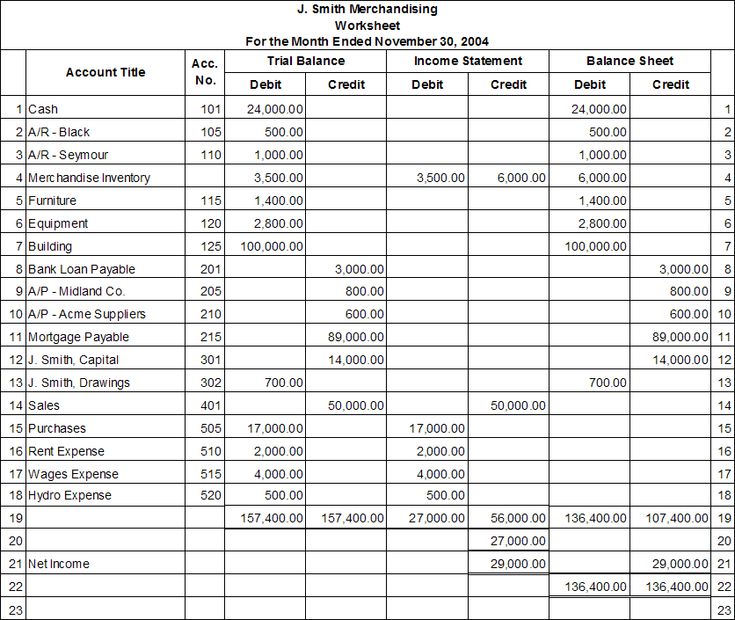

Example of a Trial Balance Worksheet

Here is an example of a trial balance worksheet:

| Account Number | Account Name | Debit Balance | Credit Balance |

|---|---|---|---|

| 1000 | Cash | $10,000 | $0 |

| 1200 | Accounts Payable | $0 | $5,000 |

| 1500 | Revenue | $0 | $20,000 |

| 2000 | Expenses | $15,000 | $0 |

| Total Debits | $25,000 | ||

| Total Credits | $25,000 | ||

In conclusion, a trial balance worksheet is an essential tool in the accounting process, used to ensure the accuracy and balance of a company’s financial statements. By identifying the five characteristics of a trial balance worksheet, accountants and bookkeepers can ensure that their financial statements are reliable and accurate.

What is the purpose of a trial balance worksheet?

+The purpose of a trial balance worksheet is to ensure the accuracy and balance of a company’s financial statements by identifying errors and discrepancies in the accounting records.

What are the five characteristics of a trial balance worksheet?

+The five characteristics of a trial balance worksheet are: debit and credit columns, list of general ledger accounts, accounting period, debit and credit totals, and formatting.

Why is a trial balance worksheet important?

+A trial balance worksheet is important because it helps detect errors and discrepancies in the accounting records, ensures accounting accuracy, and provides the necessary information for preparing financial statements.