5 Tips for Item Q Line 2 Tax Refund

Understanding Item Q Line 2 Tax Refund: 5 Essential Tips

As tax season approaches, many individuals are eager to claim their tax refunds. However, navigating the complexities of tax returns can be overwhelming, especially when it comes to specific lines like Item Q Line 2. In this article, we will break down the essential tips you need to know about Item Q Line 2 tax refund, ensuring you maximize your return and avoid any potential issues.

Tip 1: Understand What Item Q Line 2 Represents

Item Q Line 2 refers to the “Qualified Education Expenses” deduction on your tax return. This line is specifically designed for individuals who have incurred expenses related to higher education, such as tuition fees, course materials, and other qualified education expenses. It’s essential to understand that this line is only applicable to those who have completed Form 8917, which is the Tuition and Fees Deduction form.

📝 Note: Ensure you keep receipts and records of all qualified education expenses, as these will be required to support your claim.

Tip 2: Know the Eligibility Criteria

To be eligible for the Item Q Line 2 deduction, you must meet specific criteria:

- You or your dependent must be enrolled in a qualified education program.

- You must have paid qualified education expenses during the tax year.

- You must have a valid Form 1098-T, which is the Tuition Statement form, from the educational institution.

- You must complete Form 8917 and attach it to your tax return.

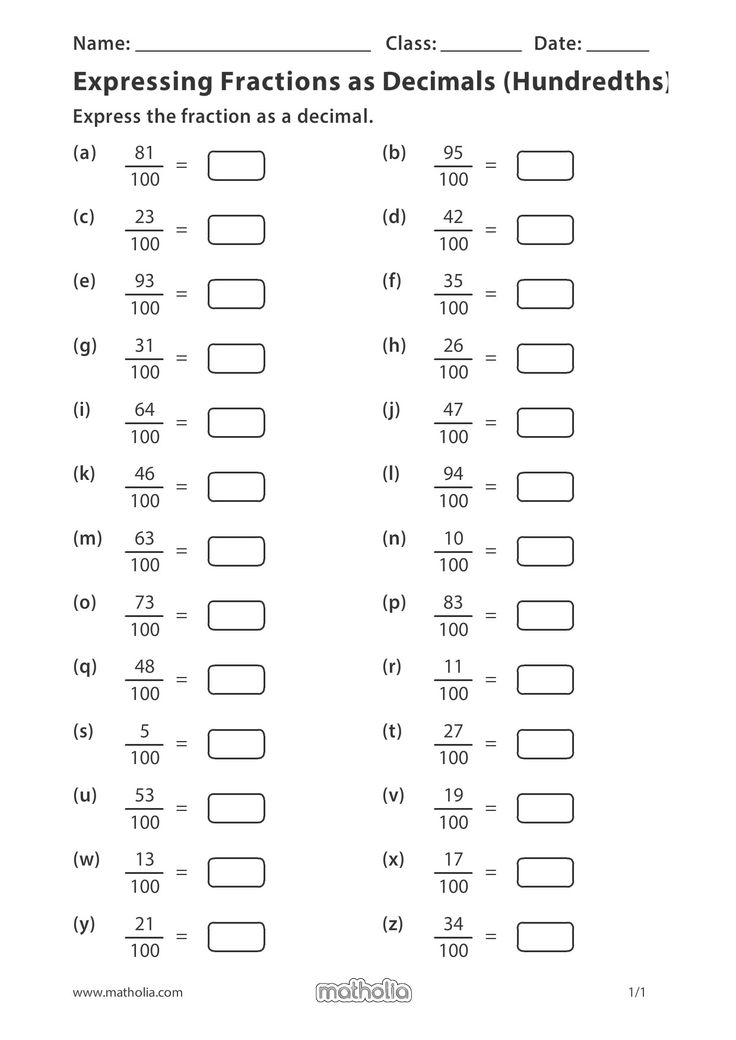

Tip 3: Calculate Your Qualified Education Expenses

Calculating your qualified education expenses requires attention to detail. You can claim expenses related to:

- Tuition fees

- Course materials (e.g., textbooks, online resources)

- Fees for enrollment and registration

- Other qualified education expenses (e.g., computer equipment, software)

However, you cannot claim expenses for:

- Room and board

- Transportation

- Personal expenses

- Expenses not related to your education

| Qualified Education Expenses | Non-Qualified Education Expenses |

|---|---|

| Tuition fees | Room and board |

| Course materials | Transportation |

| Fees for enrollment and registration | Personal expenses |

| Other qualified education expenses | Expenses not related to education |

Tip 4: Complete Form 8917 Correctly

To claim the Item Q Line 2 deduction, you must complete Form 8917 accurately. Ensure you:

- Complete Part I: Qualified Education Expenses

- Calculate your total qualified education expenses

- Complete Part II: Adjusted Qualified Education Expenses

- Calculate your adjusted qualified education expenses

📝 Note: Attach Form 8917 to your tax return (Form 1040) and keep a copy for your records.

Tip 5: Review and Verify Your Return

Before submitting your tax return, review and verify your Item Q Line 2 deduction. Ensure you have:

- Completed Form 8917 correctly

- Attached all required documentation (e.g., Form 1098-T)

- Claimed the correct amount of qualified education expenses

- Followed all eligibility criteria

By following these 5 essential tips, you can ensure you maximize your Item Q Line 2 tax refund and avoid any potential issues during tax season.

What is the purpose of Form 8917?

+Form 8917 is used to claim the Tuition and Fees Deduction, which is reported on Item Q Line 2 of your tax return.

Can I claim expenses for room and board on Item Q Line 2?

+No, room and board expenses are not qualified education expenses and cannot be claimed on Item Q Line 2.

What documentation do I need to support my Item Q Line 2 deduction?

+You will need to keep receipts and records of all qualified education expenses, as well as a valid Form 1098-T from the educational institution.

Related Terms:

- Item Q Line 2 answers

- Schedule 1 state tax refund