6 Essential Facts About Social Security Lines 6a and 6b

Understanding the Importance of Social Security Lines 6a and 6b

When it comes to Social Security benefits, there are several key factors to consider, and two of the most crucial lines on your Social Security statement are Lines 6a and 6b. These lines provide vital information about your benefits, and understanding what they mean can help you make informed decisions about your retirement. Here are six essential facts about Social Security Lines 6a and 6b.

What are Social Security Lines 6a and 6b?

Lines 6a and 6b on your Social Security statement refer to your full retirement benefit and reduced retirement benefit, respectively. These lines are crucial in determining how much you’ll receive in benefits each month.

Fact #1: Full Retirement Benefit (Line 6a)

Line 6a shows your full retirement benefit amount, which is the amount you’ll receive each month if you wait until your full retirement age to start receiving benefits. Your full retirement age varies depending on your birth year, but for most people, it’s between 66 and 67 years old.

💡 Note: Your full retirement age is based on your birth year, so make sure to check the Social Security Administration's website to determine your exact full retirement age.

Fact #2: Reduced Retirement Benefit (Line 6b)

Line 6b shows your reduced retirement benefit amount, which is the amount you’ll receive each month if you start receiving benefits before your full retirement age. If you start receiving benefits at 62, your benefit amount will be reduced by 30% compared to your full retirement benefit.

Fact #3: Impact of Early Retirement on Benefits

If you start receiving benefits before your full retirement age, your benefit amount will be reduced permanently. For example, if your full retirement benefit is 2,000 per month, but you start receiving benefits at 62, your reduced benefit amount might be 1,400 per month. This reduction can have a significant impact on your retirement income, so it’s essential to consider this when deciding when to start receiving benefits.

Fact #4: Delayed Retirement Credits

On the other hand, if you delay receiving benefits beyond your full retirement age, you’ll earn delayed retirement credits, which can increase your benefit amount. For each year you delay receiving benefits, your benefit amount will increase by 8% until you reach age 70.

Fact #5: Spousal Benefits and Survivor Benefits

Lines 6a and 6b also impact spousal benefits and survivor benefits. If you’re eligible for spousal benefits, your benefit amount will be based on your spouse’s full retirement benefit (Line 6a). Similarly, if you’re eligible for survivor benefits, your benefit amount will be based on the deceased spouse’s full retirement benefit.

Fact #6: Importance of Accurate Records

Finally, it’s essential to ensure that your Social Security records are accurate and up-to-date. Any errors or discrepancies can impact your benefit amount, so make sure to review your statement carefully and report any errors to the Social Security Administration.

What is the difference between Lines 6a and 6b on my Social Security statement?

+Line 6a shows your full retirement benefit amount, while Line 6b shows your reduced retirement benefit amount.

How does early retirement impact my Social Security benefits?

+If you start receiving benefits before your full retirement age, your benefit amount will be reduced permanently.

What happens to my benefit amount if I delay receiving benefits beyond my full retirement age?

+If you delay receiving benefits beyond your full retirement age, you'll earn delayed retirement credits, which can increase your benefit amount.

In summary, understanding Social Security Lines 6a and 6b is crucial for making informed decisions about your retirement. By knowing your full retirement benefit and reduced retirement benefit amounts, you can plan your retirement income and make decisions that will impact your financial security for years to come.

Related Terms:

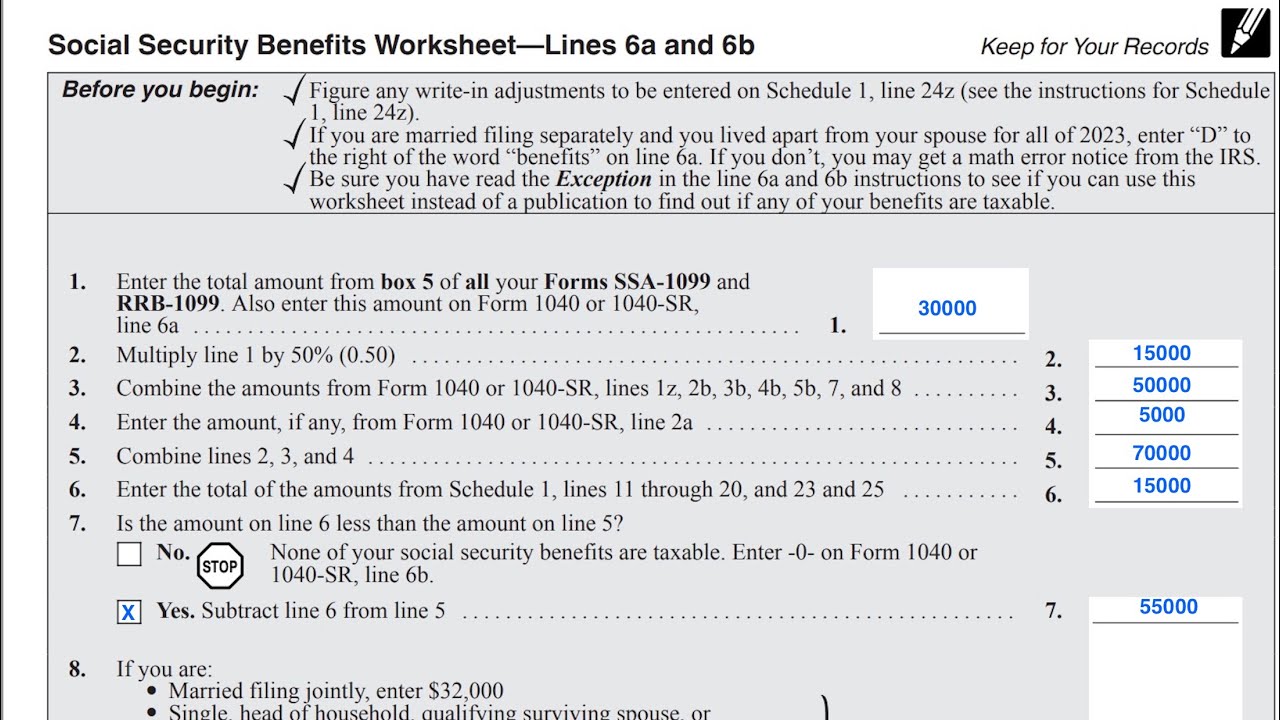

- IRS Social Security worksheet PDF

- IRS Social Security worksheet Calculator

- Publication 915

- ssa-1099 form 2023 pdf

- Taxable Social Security worksheet 2024

- Social Security tax calculator Excel