5 Simple Ways to Track Rental Expenses

Tracking Rental Expenses: Why It Matters

As a landlord or property manager, keeping track of rental expenses is crucial for maintaining profitability and ensuring compliance with tax laws. Accurate record-keeping helps you identify areas where you can cut costs, optimize your budget, and make informed decisions about your rental properties. In this article, we’ll explore five simple ways to track rental expenses and discuss the benefits of each method.

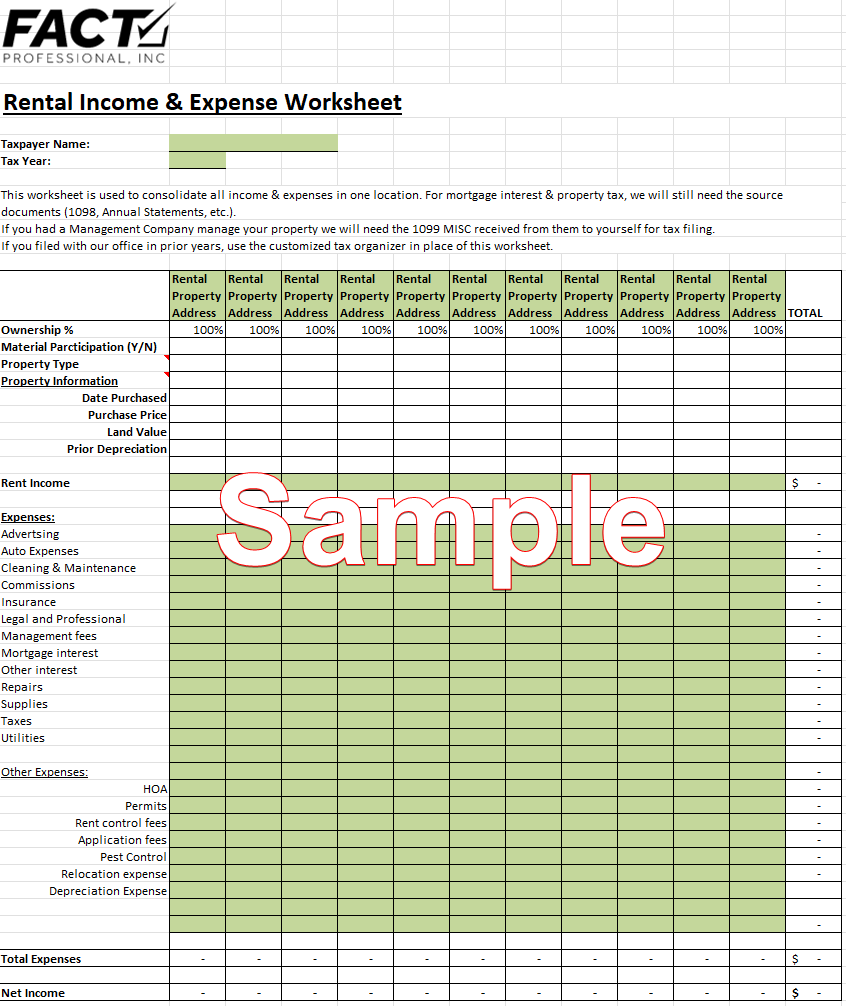

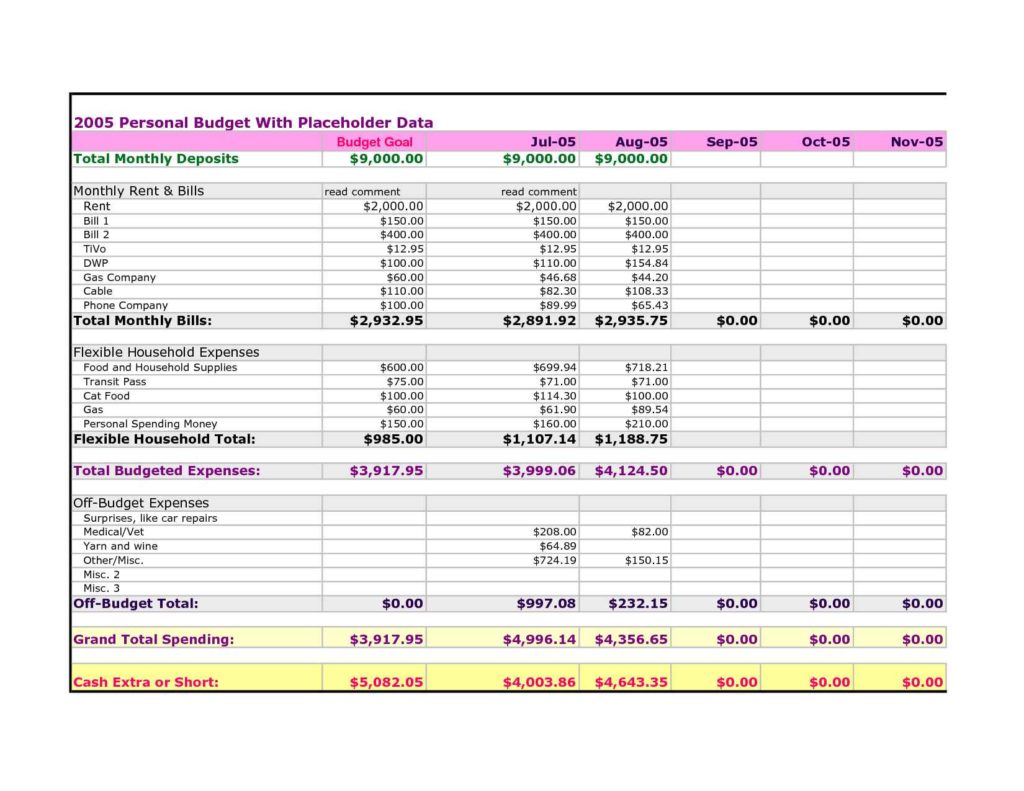

Method 1: Spreadsheets

Using spreadsheets is a popular and straightforward way to track rental expenses. You can create a table with columns for date, category, description, and amount, making it easy to categorize and total your expenses. Spreadsheets like Google Sheets or Microsoft Excel also offer formulas and functions that help with calculations and data analysis.

Benefits:

- Easy to set up and use

- Customizable to fit your specific needs

- Allows for automatic calculations and data analysis

Example:

| Date | Category | Description | Amount |

|---|---|---|---|

| 2023-02-01 | Rent | January rent payment | $1,000 |

| 2023-02-05 | Utilities | Electricity bill | $150 |

| 2023-02-10 | Maintenance | Plumbing repair | $300 |

Method 2: Accounting Software

Specialized accounting software like QuickBooks, Xero, or Zoho Books can help you track rental expenses and manage your finances more efficiently. These programs often include features like automated expense tracking, invoicing, and reporting.

Benefits:

- Streamlines financial management

- Offers advanced features like automated expense tracking and reporting

- Scalable for growing rental portfolios

Example:

Using QuickBooks, you can create a “Rental Expenses” account and categorize your expenses by type (e.g., rent, utilities, maintenance). The software will automatically generate reports and totals for you.

Method 3: Mobile Apps

Mobile apps like Expensify, Shoeboxed, or Mint allow you to track rental expenses on-the-go. These apps often include features like receipt scanning, categorization, and automatic expense tracking.

Benefits:

- Convenient for tracking expenses on-the-go

- Often includes features like receipt scanning and categorization

- Can be synced with your accounting software or spreadsheet

Example:

Using Expensify, you can snap a photo of your receipts and the app will automatically categorize and total your expenses.

Method 4: Paper-Based System

A paper-based system involves keeping a notebook or binder to record your rental expenses. This method is simple and low-cost, but it can be time-consuming and prone to errors.

Benefits:

- Low-cost and easy to set up

- Can be used in conjunction with other methods

- No need for technical expertise

Example:

You can use a notebook to record your rental expenses, with each page dedicated to a specific category (e.g., rent, utilities, maintenance).

Method 5: Online Invoicing Tools

Online invoicing tools like FreshBooks or Wave allow you to track rental expenses and generate invoices for your tenants. These tools often include features like automated expense tracking and payment reminders.

Benefits:

- Streamlines invoicing and payment processing

- Offers features like automated expense tracking and payment reminders

- Can be used in conjunction with other methods

Example:

Using FreshBooks, you can create a “Rental Expenses” account and generate invoices for your tenants. The software will automatically track your expenses and generate reports.

📝 Note: Regardless of the method you choose, it's essential to keep accurate and detailed records of your rental expenses. This will help you stay organized, ensure compliance with tax laws, and make informed decisions about your rental properties.

In conclusion, tracking rental expenses is crucial for maintaining profitability and ensuring compliance with tax laws. By using one or a combination of these five methods, you can simplify your financial management and make informed decisions about your rental properties. Remember to choose the method that best fits your needs and preferences, and don’t hesitate to seek professional advice if you need help getting started.

What are the benefits of using accounting software to track rental expenses?

+Accounting software offers several benefits, including streamlined financial management, automated expense tracking, and reporting. It can also help you scale your rental portfolio and ensure compliance with tax laws.

Can I use a paper-based system to track rental expenses?

+What are the benefits of using mobile apps to track rental expenses?

+Mobile apps offer several benefits, including convenience, automatic expense tracking, and categorization. They can also be synced with your accounting software or spreadsheet, making it easy to manage your finances on-the-go.

Related Terms:

- Free rental expense worksheet

- Rental property expense spreadsheet Excel

- Rental property Excel spreadsheet free

- Rental property Worksheet pdf