Realtor Tax Deductions: Maximize Your Savings This Tax Season

Realtor Tax Deductions: Maximize Your Savings This Tax Season

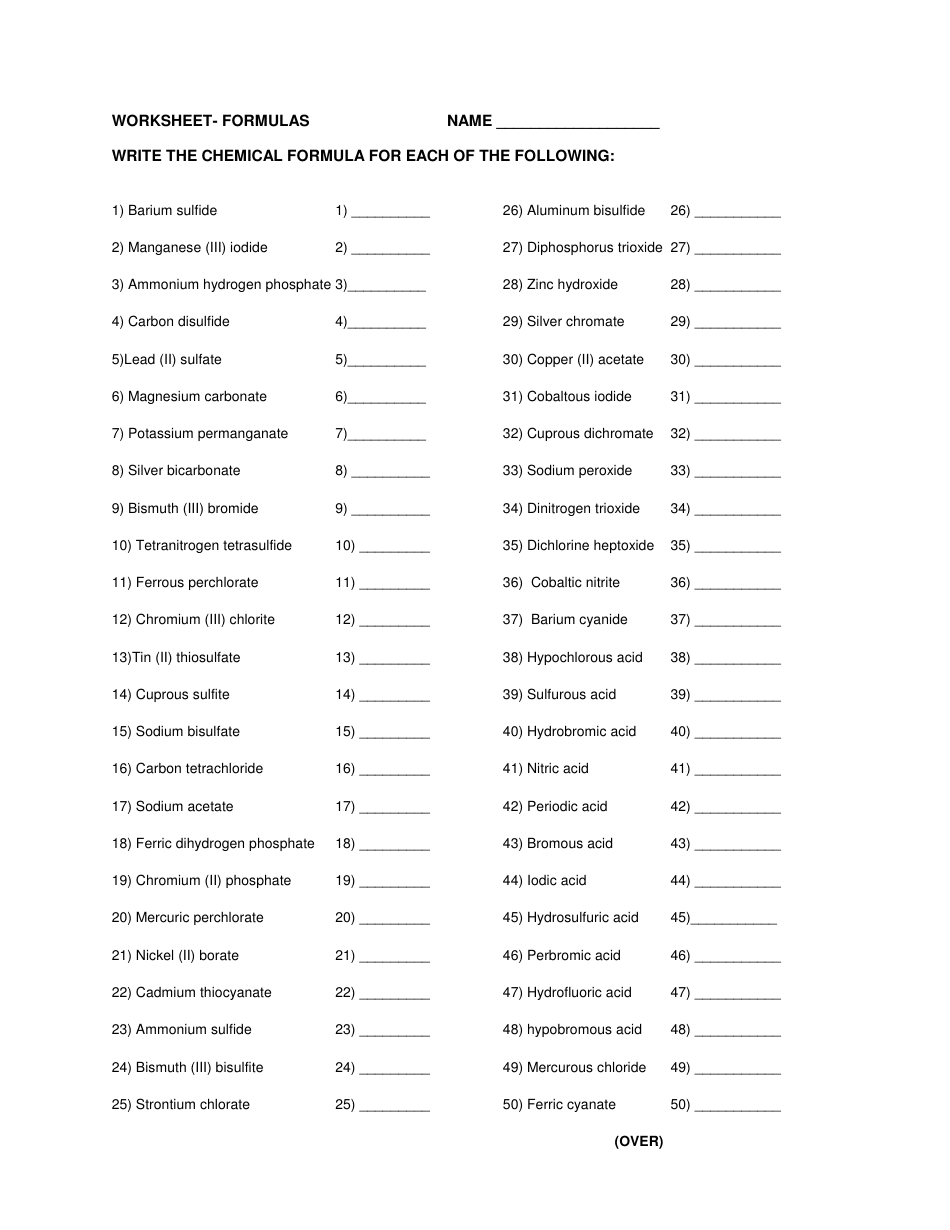

As a realtor, you’re aware of the many expenses that come with running a successful business. From marketing and advertising to association fees and continuing education, the costs can add up quickly. However, many realtors are unaware of the various tax deductions available to them. In this article, we’ll explore the top realtor tax deductions to help you maximize your savings this tax season.

Business Use of Your Home

If you use a dedicated space in your home for business, you may be eligible to deduct a portion of your rent or mortgage interest and utilities as a business expense. This is known as the home office deduction. To qualify, you’ll need to meet the following requirements:

- You must use the space regularly and exclusively for business.

- You must have a dedicated space for business, such as a home office or studio.

- You must have records to support your deduction, such as photos, measurements, and utility bills.

You can calculate the deduction using the simplified option, which is 5 per square foot of home office space, up to a maximum of 1,500. Alternatively, you can use the actual expenses method, which requires you to calculate the actual expenses related to your home office.

Travel Expenses

As a realtor, you likely spend a significant amount of time on the road, showing properties to clients and attending industry events. You can deduct the following travel expenses:

- Transportation costs, such as gas, tolls, and parking fees

- Meals and lodging expenses while traveling for business

- Airfare and other transportation costs to attend industry events or conferences

To qualify for the travel expense deduction, you’ll need to keep accurate records, including:

- Dates and locations of travel

- Purpose of travel

- Receipts and invoices for expenses

Marketing and Advertising Expenses

Marketing and advertising are essential for any realtor looking to attract new clients and grow their business. You can deduct the following marketing and advertising expenses:

- Website design and maintenance costs

- Social media advertising expenses

- Print and online advertising expenses

- Direct mail marketing expenses

To qualify for the marketing and advertising expense deduction, you’ll need to keep accurate records, including:

- Receipts and invoices for expenses

- Proof of advertising placement, such as screenshots or tear sheets

Continuing Education Expenses

As a realtor, you’re required to complete continuing education courses to maintain your license. You can deduct the following continuing education expenses:

- Course registration fees

- Travel expenses related to attending courses or conferences

- Materials and supplies related to courses, such as textbooks and software

To qualify for the continuing education expense deduction, you’ll need to keep accurate records, including:

- Course registration documents

- Receipts and invoices for expenses

- Proof of course completion, such as certificates or transcripts

Association Fees and Membership Dues

As a realtor, you likely belong to one or more professional associations, such as the National Association of Realtors (NAR). You can deduct the following association fees and membership dues:

- Annual membership fees

- Conference registration fees

- Committee or committee chair fees

To qualify for the association fee and membership dues deduction, you’ll need to keep accurate records, including:

- Receipts and invoices for expenses

- Proof of membership, such as membership cards or certificates

Insurance Premiums

As a realtor, you likely carry liability insurance and errors and omissions (E&O) insurance to protect yourself and your business. You can deduct the following insurance premiums:

- Liability insurance premiums

- E&O insurance premiums

- Other business-related insurance premiums

To qualify for the insurance premium deduction, you’ll need to keep accurate records, including:

- Receipts and invoices for expenses

- Proof of insurance coverage, such as policy documents or certificates

📝 Note: Keep accurate records of all expenses, including receipts, invoices, and bank statements. This will help you support your deductions in case of an audit.

Vehicle Expenses

As a realtor, you likely use your vehicle for business purposes, such as showing properties to clients. You can deduct the following vehicle expenses:

- Gasoline and oil expenses

- Maintenance and repair expenses

- Registration and licensing fees

To qualify for the vehicle expense deduction, you’ll need to keep accurate records, including:

- Log of business miles driven

- Receipts and invoices for expenses

- Proof of vehicle ownership, such as title or registration documents

Depreciation and Amortization

As a realtor, you may have purchased assets for your business, such as a computer or camera. You can deduct the depreciation and amortization of these assets over time.

To qualify for the depreciation and amortization deduction, you’ll need to keep accurate records, including:

- Receipts and invoices for asset purchases

- Proof of asset ownership, such as title or registration documents

- Records of depreciation and amortization calculations

📝 Note: Consult with a tax professional to ensure you're taking advantage of all available depreciation and amortization deductions.

As a realtor, it’s essential to stay organized and keep accurate records of all expenses. By taking advantage of the top realtor tax deductions, you can maximize your savings this tax season.

In summary, don’t miss out on the following realtor tax deductions:

- Business use of your home

- Travel expenses

- Marketing and advertising expenses

- Continuing education expenses

- Association fees and membership dues

- Insurance premiums

- Vehicle expenses

- Depreciation and amortization

By staying informed and keeping accurate records, you can save thousands of dollars on your taxes and grow your business.

What is the home office deduction, and how do I qualify?

+The home office deduction is a tax deduction that allows you to deduct a portion of your rent or mortgage interest and utilities as a business expense. To qualify, you must use a dedicated space in your home regularly and exclusively for business.

Can I deduct my vehicle expenses as a realtor?

+Yes, you can deduct your vehicle expenses as a realtor. You can deduct the business use percentage of your gasoline and oil expenses, maintenance and repair expenses, and registration and licensing fees.

What is depreciation and amortization, and how do I qualify for the deduction?

+Depreciation and amortization are tax deductions that allow you to deduct the value of assets over time. To qualify for the deduction, you’ll need to keep accurate records of asset purchases, ownership, and depreciation and amortization calculations.